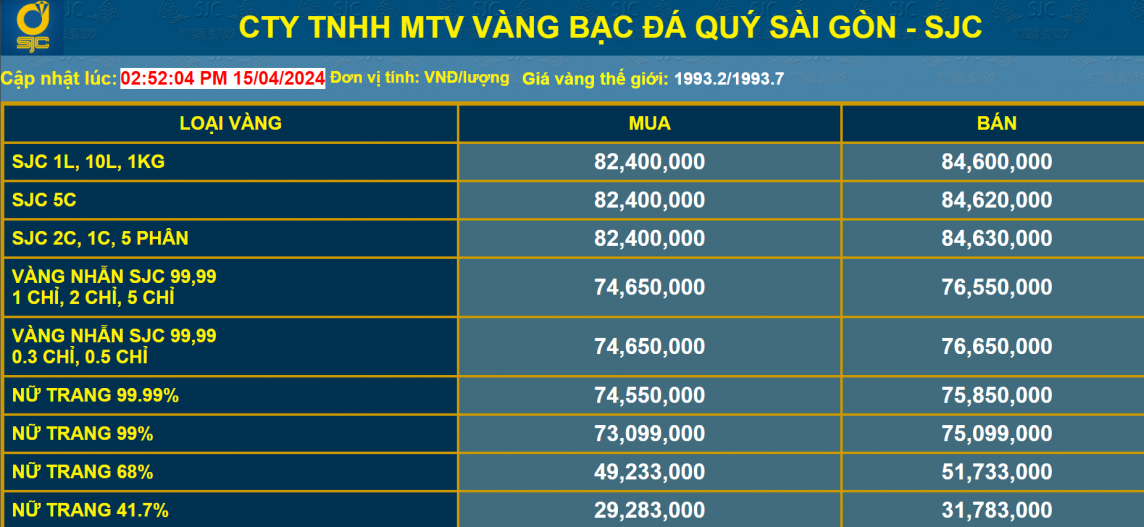

At 3 PM on April 15, 2024, the price of SJC gold in Vietnam increased sharply compared to the early morning of the same day. Saigon Jewelry Company Limited (SJC) listed the price of SJC gold at 82.4 million VND/ounce for buying and 84.6 million VND/ounce for selling. Compared to the early morning of the same day, the price of SJC gold at this company was adjusted up by 1.8 million VND/ounce for buying and 1.48 million VND/ounce for selling.

At its peak, at 11:19 AM on the same day, the price of SJC gold at this establishment surged dramatically, reaching 83.3 million VND/ounce for buying and 85.5 million VND/ounce for selling.

|

| Gold prices listed at Saigon Jewelry Company Limited (SJC). Screenshot taken at 3:00 PM on April 15, 2024. |

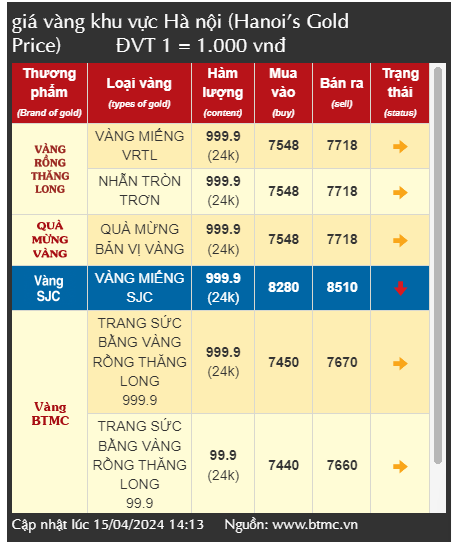

At 3 PM, Bao Tin Minh Chau listed the price of SJC gold at 82.8 million VND/ounce for buying and 85.1 million VND/ounce for selling. Compared to the early morning of the same day, the price of SJC gold was adjusted upwards by 1.7 million VND/ounce for buying and 2 million VND/ounce for selling by this unit.

The difference between the buying and selling price of gold bars at this establishment is currently 2.3 million VND per tael.

|

| Gold prices listed at Bao Tin Minh Chau. Screenshot taken at 3:00 PM on April 15, 2024. |

Domestic gold prices rose in line with world gold prices, but due to scarce supply and a surge in demand, domestic gold prices still lagged significantly behind international prices, especially for SJC gold bars and recently, gold rings. At the same time, world gold prices surged to $2,361 per ounce, up $17 per ounce compared to yesterday morning. Converted using the current exchange rate, the world gold price is approximately 71 million VND per tael (1 tael = 37 grams) excluding taxes and fees.

Over the past week, from April 8-14, 2024, domestic SJC gold prices fluctuated upwards several times. At one point, SJC gold prices reached 85 million VND/ounce, and gold rings surpassed 78.25 million VND/ounce. If calculated from the early morning of April 8, 2024, the SJC gold price at Saigon Jewelry Company Limited (SJC) was listed at 79.5 million VND/ounce for buying and 81.92 million VND/ounce for selling. By 3 PM on April 15, 2024, the SJC gold price at this company had been adjusted upwards by 2.9 million VND/ounce for buying and 2.68 million VND/ounce for selling.

A notable highlight of the past week was the Prime Minister's conclusion on April 11, 2024, following a meeting on solutions for managing the gold market in the coming period, amidst the volatile fluctuations in gold prices. Specifically, the Prime Minister requested the State Bank of Vietnam to take the lead and coordinate with relevant agencies to strictly implement the regulations in Decree No. 24/2012/ND-CP, including immediately addressing the significant difference between domestic and international gold prices, ensuring the stability of the gold market.

Shortly thereafter, on April 12, 2024, the Deputy Governor of the State Bank of Vietnam stated that, to stabilize the market, the State Bank had prepared intervention plans and carried out inspections of gold trading activities of enterprises and credit institutions nationwide in 2022, 2023, etc. Accordingly, the State Bank of Vietnam would immediately increase the supply of gold bars to reduce the price difference between domestic and international markets. For the jewelry and handicraft market, such as gold rings, the State Bank of Vietnam would continue to create conditions to ensure sufficient raw materials for production activities to export gold jewelry and handicrafts. The State Bank of Vietnam would also conduct inspections, audits, and supervision according to its assigned functions, duties, and powers; and strictly handle acts of gold smuggling across borders, profiteering, speculation, and manipulation of gold prices.

|

| Many experts are warning investors and the public to be cautious about the rising price of gold. (Illustrative image) |

In recent days, not only SJC gold but also 9999 gold rings have seen a sharp increase, causing many who bought gold on the God of Wealth Day this year at around 66 million VND/ounce to make a substantial profit, and many have already cashed in. "When the price of 9999 gold rings increased sharply, I went to sell my gold to take profit. In total, I made a profit of 7 million VND per ounce. Seeing that gold prices still have a high upward trend, I decided to buy more gold, although not a large amount," shared Ms. Hoang Yen (Tay Ho, Hanoi ), adding that many others share her investment mindset at this time. While in previous days people mainly bought gold rings, now many are buying SJC gold bars as well.

In contrast to Ms. Yen, Mr. Nguyen Nam (Dong Da District, Hanoi) expressed caution regarding the unusual market developments and the continuous fluctuations in gold prices in recent days. " With the global and domestic gold prices constantly fluctuating, rising and falling erratically, I'm hesitant about whether or not to invest at this time. In recent days, the Government and the State Bank have issued directives, and authorities nationwide have been inspecting gold shops. I think this will strongly impact future gold price fluctuations. If I invest and the price drops when liquidity decreases, I will certainly lose money ," Mr. Nam expressed his concern.

According to statistics from Bao Tin Minh Chau, despite gold prices reaching historical highs, on the morning of April 15, 2024, the number of customers buying gold still exceeded the number of customers selling. "This morning, the ratio of customers buying to selling was 55% buying gold and 45% selling," Bao Tin Minh Chau reported, advising investors and the public to carefully consider their options before trading and to regularly monitor gold market information on official channels to make informed decisions and avoid losses.

In this context, many experts warn investors and the public to be cautious about the rising price of gold. If investing at this time, a specific, comprehensive, and detailed plan is needed to be able to respond promptly to the hourly and minute-by-minute fluctuations of the domestic and international gold markets. Investors and the public should absolutely not borrow money to invest in gold, because when the price of gold falls, investors will face both the pressure of losses and economic stress.

The upward trend in gold prices is likely to continue, but a short-term correction is possible due to intervention from the Government and the State Bank. Therefore, at this time, investors and the public should exercise extreme caution in gold transactions, some experts advise.

Source

![[Photo] Prime Minister Pham Minh Chinh receives the Governor of Tochigi Province (Japan)](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765892133176_dsc-8082-6425-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives Lao Minister of Education and Sports Thongsalith Mangnormek](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765876834721_dsc-7519-jpg.webp&w=3840&q=75)

![[Image] Leaked images ahead of the 2025 Community Action Awards gala.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765882828720_ndo_br_thiet-ke-chua-co-ten-45-png.webp&w=3840&q=75)

![[Live] 2025 Community Action Awards Gala](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765899631650_ndo_tr_z7334013144784-9f9fe10a6d63584c85aff40f2957c250-jpg.webp&w=3840&q=75)

![[Video] Independence and self-reliance linked with international integration through 40 years of reform](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/16/1765899635777_1-1-8054-png.webp)

Comment (0)