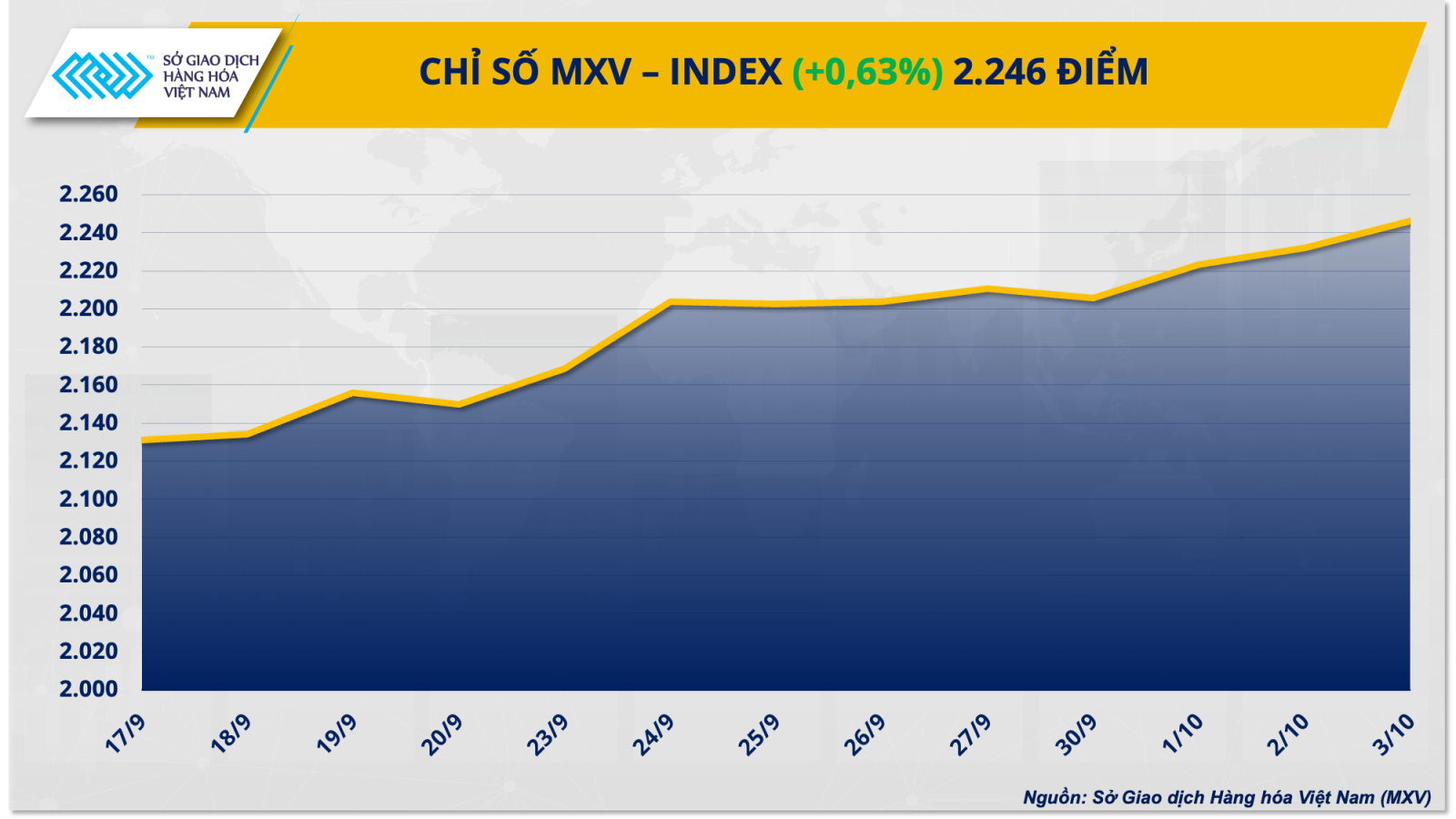

At the end of yesterday's trading session (October 3), the energy market was bright green, in which oil prices jumped more than 5% and were heading towards the $80/barrel mark amid concerns that widespread conflicts could disrupt global crude oil flows. On the other hand, agricultural product prices turned to decline due to profit-taking pressure from the market. Closing, the MXV-Index increased by 0.63% to 2,246 points.

The Middle East “fire pan” “heats up” the world oil market

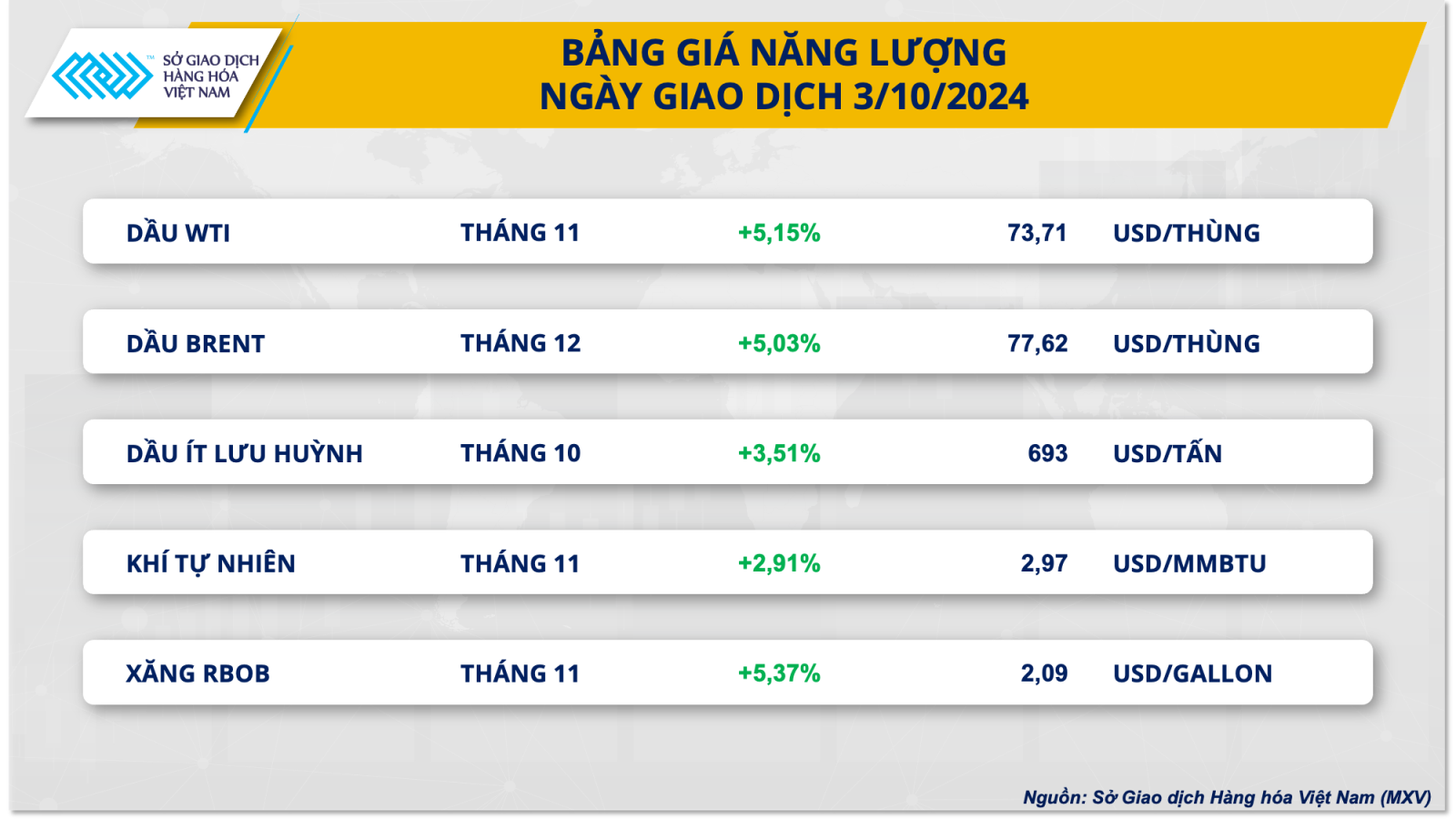

At the end of yesterday's trading session, world oil prices recorded a strong increase due to concerns that the conflict in the Middle East could continue to escalate after Iran's attack. At the end of the session, WTI crude oil prices increased by 5.15% to 73.71 USD/barrel, Brent crude oil prices increased by 5.03% to 77.62 USD/barrel.

Iran’s surprise attack on Israel early on October 2 has further raised tensions in the region. Market concerns are growing that Israel could target Iranian oil infrastructure in retaliation. The Pentagon said it was discussing with Israeli officials a possible response to Iran’s missile attack but declined to provide details and left open the possibility of strikes on Iran’s crude oil infrastructure.

Iran is a member of the Organization of the Petroleum Exporting Countries (OPEC) and produces about 3.2 million barrels per day, equivalent to 3% of global output. If the war between the two countries spreads, it will not only affect Iran's supply but also the flow of about 20 million barrels per day through the Strait of Hormuz, which is under Iran's control.

Analysts warn that such an escalation could prompt Iran to block the Strait of Hormuz or even attack the infrastructure of countries with close ties to the US in the region, as it did in 2019. Even so, Gulf Arab states have sought to reassure Iran of their neutrality in the conflict amid concerns that further violence could threaten regional oil facilities.

In another development, the Houthi forces continued to issue warnings to Western commercial ships passing through Bab El Mandeb. The Houthis have carried out nearly 100 attacks on ships crossing the Red Sea since November 2023 and said they would not stop unless Israel ended its military operations.

Meanwhile, supply pressure from OPEC as unrest disrupted Libyan supplies and Iraq implemented a pledge to cut production to offset overshooting plans, also supported the price rally. The Organization of the Petroleum Exporting Countries (OPEC) pumped 26.14 million barrels per day last month, down 390,000 barrels per day from a month earlier when it was at its lowest level this year.

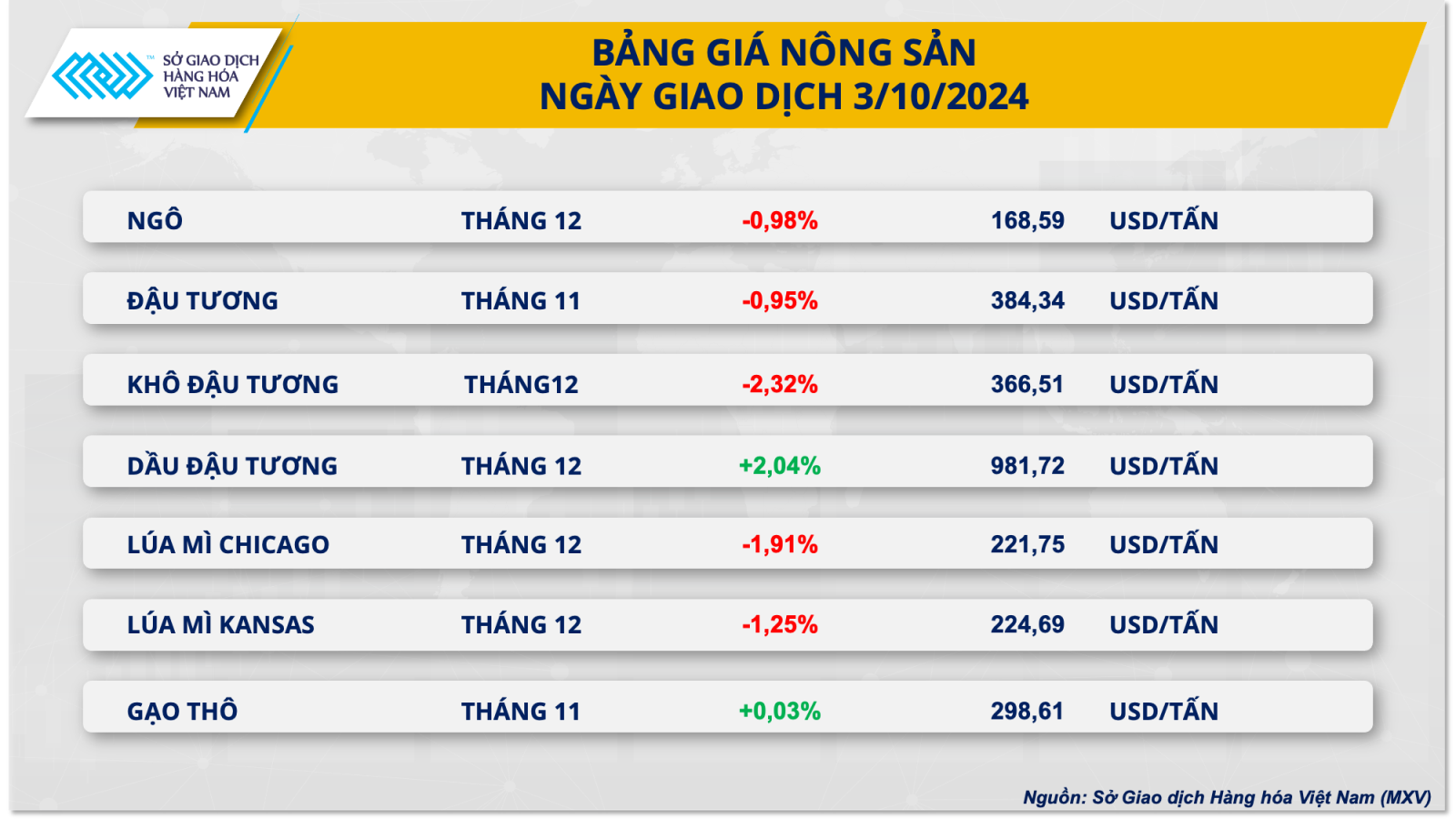

Corn prices break 4 consecutive session increase streak

Going against the grain market yesterday, the agricultural market was dominated by red. December corn futures fell nearly 1% yesterday, ending a four-session winning streak. In addition to the ongoing harvest, the market was also under pressure from technical selling pressure after corn rebounded strongly this week.

According to data from the Ministry of Agriculture of Ukraine, Ukraine's cumulative grain exports from the start of the 2024-2025 crop year to October 2 reached 10.65 million tons, up sharply from 6.68 million tons in the same period last year. In October alone, Ukraine exported 197,000 tons of grain, compared to just 7,000 tons in the same period last year. The increased exports from Ukraine have erased concerns that shipments from the Black Sea could be disrupted due to geopolitical conflicts, putting pressure on prices.

On the other hand, in the USDA’s weekly Export Sales report, the USDA reported that US corn sales for the week ending September 26 reached 1.68 million tonnes, a jump of nearly 215% from the previous week. This figure was also higher than market expectations, indicating that demand for US corn is high despite some transportation difficulties. This factor has restrained the price decline yesterday.

Wheat’s three-day winning streak came to a halt yesterday. The market was under pressure from the opening bell and ended down more than 11 cents.

The East Coast dockworkers strike entered its third day, with President Biden saying there had been progress in talks between labor and employers. Employers said they were open to new negotiations after the president publicly pushed for higher wages. However, there has been no new information on the negotiations. The dockworkers’ strike will likely impact U.S. grain exports to some extent, which could spur selling in the wheat market.

Source: https://baohaiduong.vn/gia-dau-tiep-tuc-nong-gia-nong-san-dong-loat-giam-truoc-ap-luc-chot-loi-394801.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)