| Robusta and Arabica coffee prices both increased, why? Export coffee prices increased, Robusta reached 4,200 USD/ton |

At the end of the most recent trading session, the price of Robusta coffee in London for July 2024 delivery increased by 93 USD/ton, at 4,270 USD/ton, and for September 2024 delivery increased by 89 USD/ton, at 4,131 USD/ton.

Arabica coffee prices for July 2024 delivery increased by 3.55 cents/lb to 233 cents/lb, and for September 2024 delivery increased by 3.65 cents/lb to 231.95 cents/lb.

Coffee prices on both exchanges increased simultaneously. The weak USD helped Arabica recover. Concerns that excessive drought in Vietnam and Brazil recently damaged coffee plants and limited global production pushed prices up.

After many consecutive strong increases, on May 30, green coffee beans in our country were purchased at 121,000-122,200 VND/kg.

In the world market, coffee prices also maintained their upward trend. Currently, Robusta coffee prices on the London floor have skyrocketed by 228 USD/ton, reaching 4,120 USD/ton. September delivery also increased by 219 USD, reaching 4,025 USD/ton and November delivery increased by 206 USD, reaching 3,915 USD/ton.

Arabica coffee prices on the New York floor also increased sharply. Specifically, July futures increased by 279.4 USD to 5,090 USD/ton, September futures increased by 273.9 USD to 5,070 USD/ton, and December futures increased by 271.7 USD to 5,030 USD/ton.

The market is focusing on assessing the prospects for coffee production in some key countries. In Brazil, farmers are gradually entering the harvest season which lasts from May to September every year. However, some early forecasts warn that La Nina could return, replacing El Nino, from July with heavy rains that will hinder the harvest in Brazil.

Meanwhile, the Central Highlands region - the main coffee capital of Vietnam - is entering the rainy season, ending a severe drought, more favorable for coffee production. However, our country's coffee inventory is assessed to be almost depleted.

The Ministry of Agriculture and Rural Development forecasts that Vietnam's coffee output in the 2023/24 crop year could fall 20% to 1.472 million tonnes, marking the lowest output crop in four years.

Early morning of May 31, in the US market, the US Dollar Index (DXY) measuring the fluctuations of the greenback against 6 key currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.37%, to 104.74.

The US dollar fell in the last trading session, after revised data showed that US gross domestic product grew at a slower pace than expected in the first quarter.

After reaching a historic peak of VND134,000/kg at the end of April this year, the price of green coffee in our country suddenly dropped dramatically in early May. However, by the second half of May, the decline had stopped and coffee prices began to recover. These days, coffee prices are back on track, heading towards the historic peak set at the end of April.

|

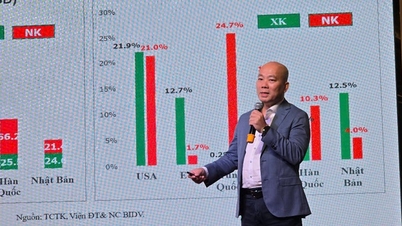

| By the end of May 2024, Vietnam will export about 833 thousand tons of coffee, earning 2.9 billion USD. |

The latest report from the Ministry of Agriculture and Rural Development shows that by the end of May 2024, our country exported about 833 thousand tons of coffee, earning 2.9 billion USD. Compared to the same period last year, the volume of exported coffee decreased by 3.9%, but the value increased sharply by 44.1% due to the increase and stability of coffee prices.

Hedge funds are currently increasing their net long positions, with forecasts that Robusta supply from Vietnam will continue to be scarce in the coming time. This pushes up domestic coffee prices in Vietnam, as demand from global roasters for Robusta remains very high.

In the first 7 months of the 2023-2024 crop year (from October 2023 to April 2024), Vietnam exported more than 1.1 million tons of green coffee, down 1.5% compared to the same period in the 2022-2023 crop year. With this result, Vietnam has exported about 65-70% of the total expected output of about 1.6-1.7 million tons of the current crop year.

Currently, Vietnam is still the world's largest supplier of Robusta coffee. However, in recent months, coffee exports have tended to decrease.

The US Department of Agriculture (USDA) forecasts that Brazil's Arabica coffee production in the 2023-2024 crop year will increase by 12.8% compared to the previous crop year, reaching 44.9 million bags thanks to higher yields and increased planting area. Colombia's Arabica coffee production is also expected to increase by 7.5%, reaching 11.5 million bags... Meanwhile, global Robusta coffee production is forecast to decrease by 3.3%, to 74.1 million bags.

Coffee trader Volcafe estimates a global robusta deficit of 4.6 million bags in 2024-25, which, while lower than the 9 million-bag deficit in 2023-24, would be the fourth consecutive year of robusta deficit.

The Vietnam Coffee and Cocoa Association estimates that our country's coffee output in the 2023-2024 crop year will decrease by 10% compared to the previous crop, to about 1.6 million tons (equivalent to 26 million 60kg bags).

Hedge funds are currently increasing their net long positions, with forecasts that Robusta supply from Vietnam will continue to be scarce in the coming time. This pushes up domestic coffee prices in Vietnam, as demand from global roasters for Robusta remains very high.

Source: https://congthuong.vn/gia-ca-phe-xuat-khau-tang-vot-robusta-huong-toi-dinh-lich-su-323417.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)