According to MXV, Arabica coffee prices increased by 3.23% and Robusta coffee prices were 2.62% higher than the reference price thanks to support from the decrease in the USD/BRL exchange rate.

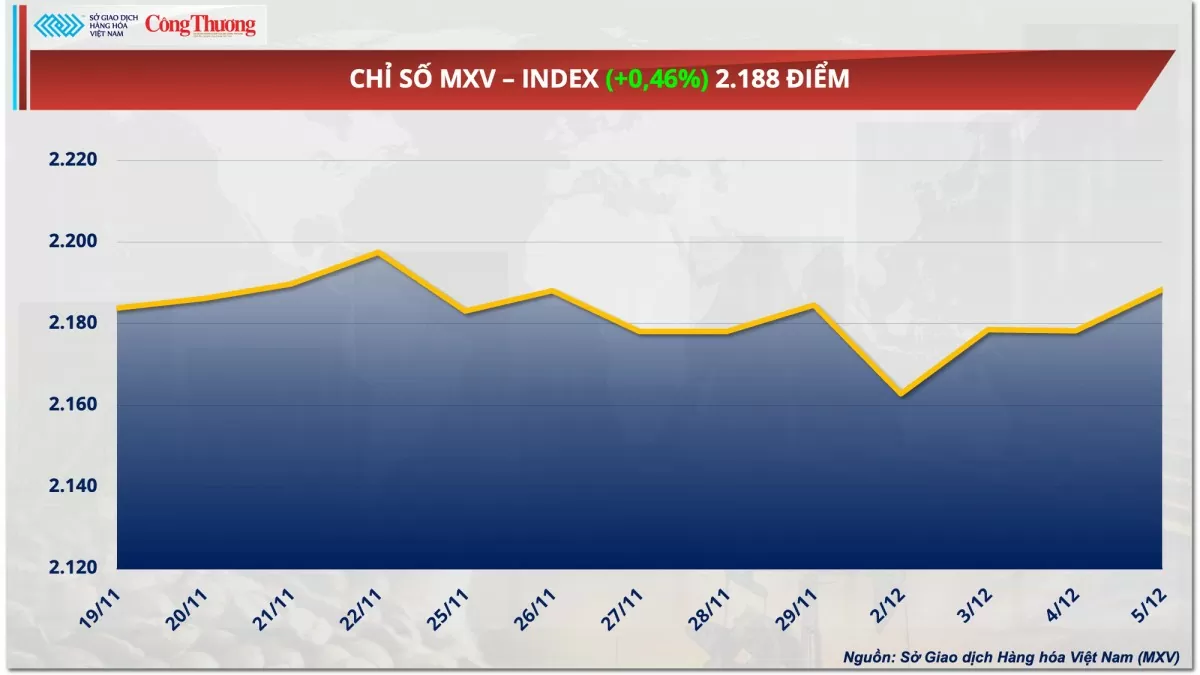

According to the Vietnam Commodity Exchange (MXV), the world raw material market was divided in yesterday's trading session (December 5). However, the dominant buying force pushed the MXV-Index up 0.46% to 2,188 points. Notably, the prices of Arabica and Robusta coffee continued to increase for the second consecutive session. At the same time, green also covered the price list of agricultural products when 6 out of 7 items increased simultaneously.

|

| MXV-Index |

Coffee prices increased for two consecutive sessions

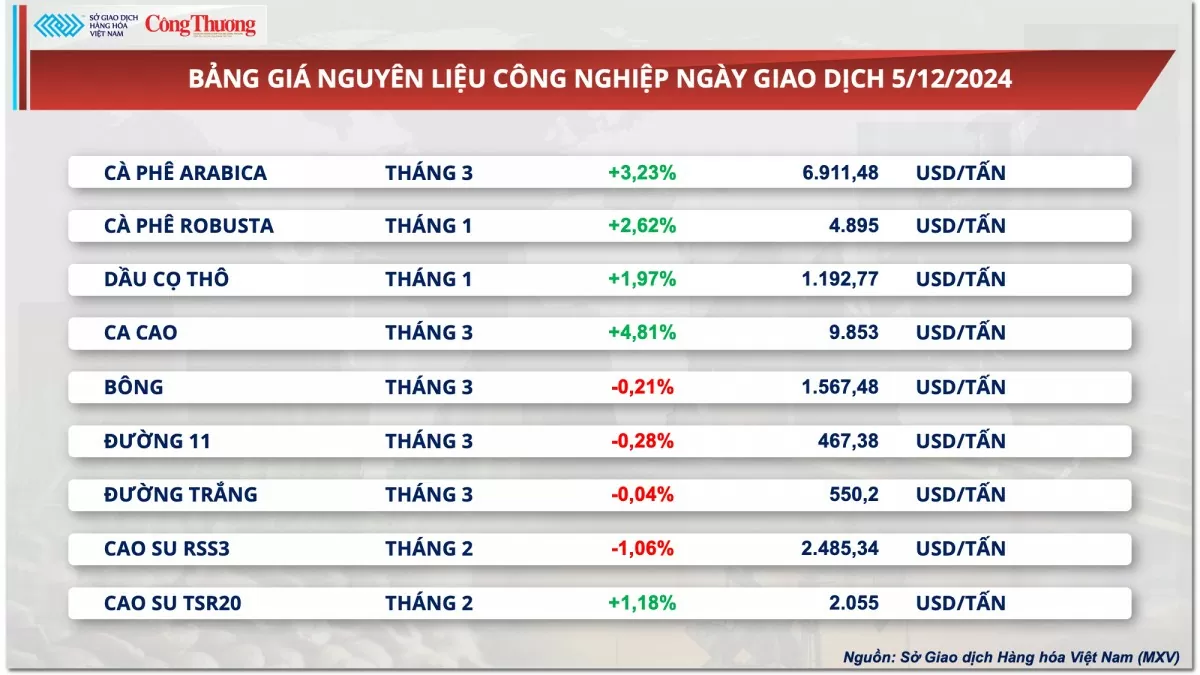

At the end of yesterday's trading session, green dominated the price list of industrial raw materials. In particular, the prices of two coffee products both increased sharply. Specifically, the price of Arabica coffee increased by 3.23% and the price of Robusta coffee was 2.62% higher than the reference price thanks to the support from the decrease in the USD/BRL exchange rate.

Yesterday, the Dollar Index fell 0.57%, causing the USD exchange rate to be 0.49% lower than the previous session. The narrowing of the exchange rate makes Brazilian farmers reluctant to increase coffee sales because they benefit less from the currency difference. Meanwhile, this encourages speculators to continue buying.

|

| Industrial raw material price list |

In addition, according to Barchart, rain is hindering coffee harvesting activities in Vietnam. This is also one of the important reasons that continued to support prices in yesterday's session.

However, yesterday, the market continued to receive positive signals about the coffee supply in Colombia. This information also contributed to limiting the sharp increase in coffee prices. The Colombian Coffee Federation (FNC) estimated the country's coffee output in 2024 at 13.6 million 60kg bags, up 20% compared to 2023 and 600,000 bags higher than previously predicted thanks to disease control and adaptation to climate change. At the same time, the FNC also reported that in November, the country produced 1.76 million 60kg bags of washed Arabica coffee, up 37% compared to the same period in 2023. Along with that, the amount of coffee exported in November increased by 8% compared to the same period last year, to 1.19 million bags.

In the domestic market, coffee prices in the Central Highlands and Southeast this morning (December 6) were recorded at 116,000 - 117,200 VND/kg, an increase of 3,000 VND/kg compared to December 5. However, compared to the same period last year, coffee prices have now doubled.

In another notable development on the industrial raw material price chart, cocoa prices hit a nearly six-month high after rising 4.81% in yesterday's session. The prospect of a more negative cocoa supply in Ivory Coast in the coming period has fueled continued buying pressure in the market. Cooperatives, buyers and intermediaries said most of the main harvest was completed in November and the shortage is expected to last until February or March. Meanwhile, multinational exporters are concerned about the risk of contract defaults as they expect supplies from farmers to fall in the coming months after adverse weather hit their crops.

In addition, analysts also assessed that the amount of cocoa arriving at Ivory Coast from October 1 to December 1 increased by 34%, which is not too likely when this growth is based on the very low base of 2023 when production and exports have seriously decreased. Meanwhile, analysts pointed out that if comparing the amount of cocoa arriving at the port in the past with normal years like 2022, it recorded a decrease of up to 15%.

Soybean prices rise on positive demand outlook

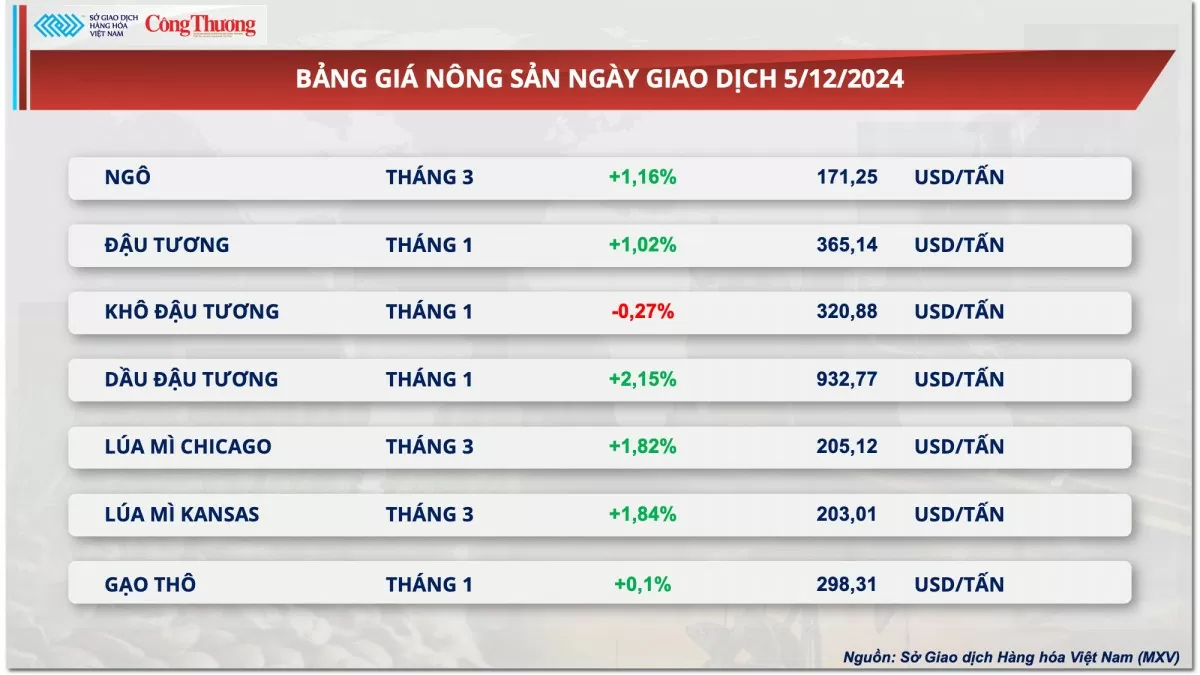

According to MXV, soybean prices recorded a 1% increase at the close of yesterday's trading session, following the general trend of most agricultural products. In addition to expectations of high demand, the prospect of lower exports from Brazil is also a factor that helps support prices.

|

| Agricultural product price list |

In its weekly Export Sales report, the USDA reported soybean sales of 2.3 million tonnes for the reporting week, down slightly from the previous week but up 17% from the four-week average. In its Daily Export Sales report, the agency also announced a sale of 136,000 tonnes of soybeans for delivery in the 2024-25 marketing year to China. This shows that demand for US soybeans is relatively positive, boosting buying pressure in the market.

In addition, according to data released by the National Association of Cereal Exporters (ANEC), Brazil is expected to export only 1.24 million tons of soybeans in December, much lower than the 3.79 million tons in the same period in 2023. Total soybean exports in 2024 are forecast to reach 97.1 million tons, down from the 98 million tons forecast in early November. If confirmed, Brazil's soybean exports would fall 4% from the record 101.3 million tons achieved in 2023. Lower exports from Brazil indicate that competitive pressure on US soybeans is easing, contributing to price support.

Soybean meal prices eased slightly, pressured by rising soy oil prices. ANEC said Brazil’s soymeal exports in December were forecast at 1.44 million tonnes, down more than 500,000 tonnes from a year earlier. Still, thanks to large shipments throughout the year, Brazil’s total soymeal exports in 2024 are expected to reach a record 22.4 million tonnes, slightly above the previous record of 22.35 million tonnes in 2023. Easing supplies from Brazil are also weighing on prices.

In the domestic market, on December 4, the offer price of South American soybean meal to the South continued to decrease. The offer price of soybean meal futures for delivery in January 2025 was at 55 USD/ton, while the offer price for delivery in February 2025 fluctuated around 52 - 54 USD/ton. In the North, the offer price was about 5 USD/ton higher than in the South.

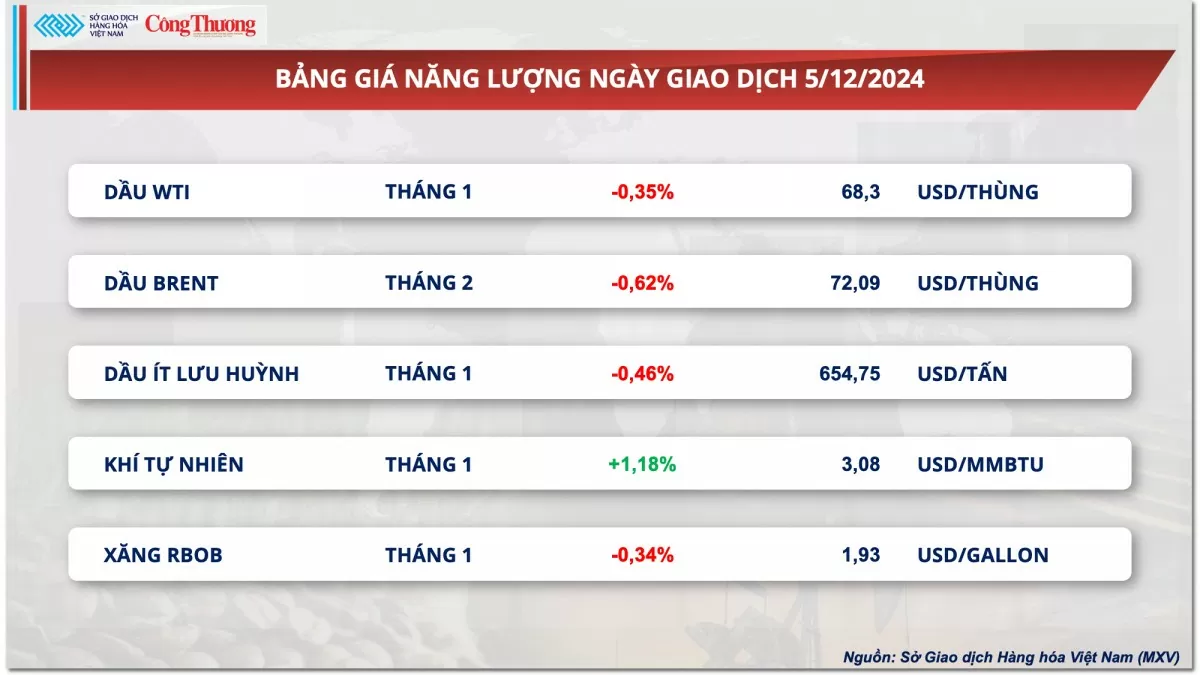

Prices of some other goods

|

| Energy price list |

|

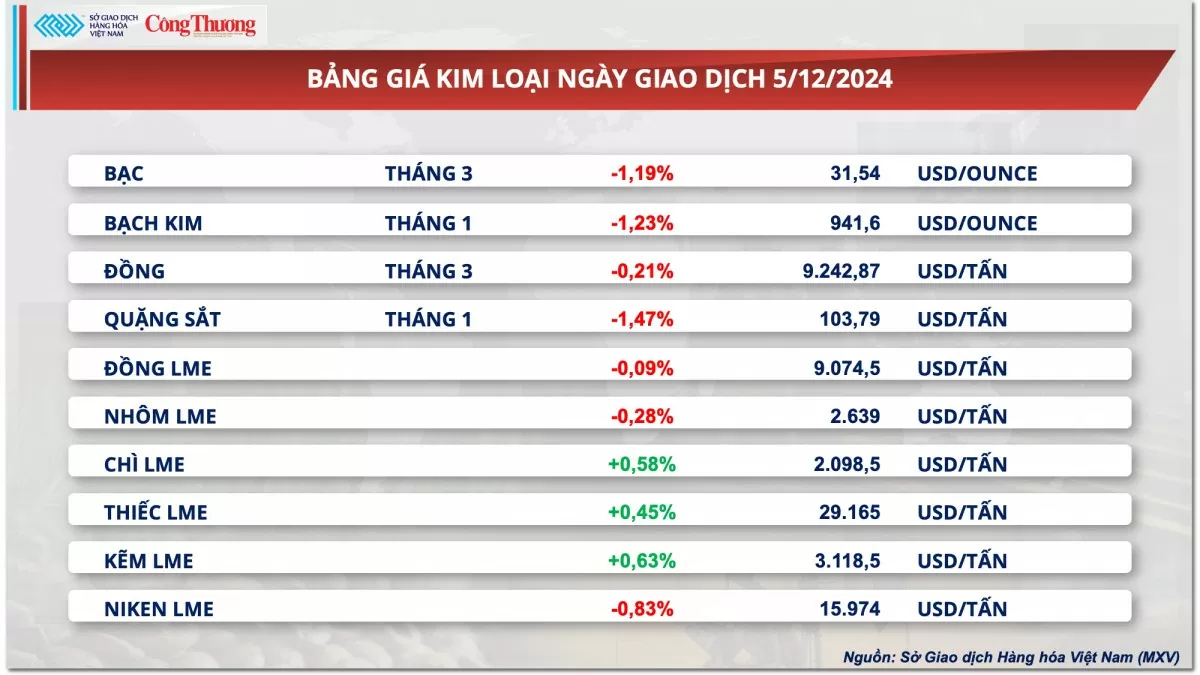

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-612-gia-ca-phe-tang-hai-phien-lien-tiep-362798.html

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)