Coffee prices today (June 20) in the domestic market increased by 500 VND/kg. Accordingly, the lowest transaction price in the localities is 67,200 VND/kg, continuing to be recorded in Dak Nong province.

Update domestic coffee prices

According to a survey at 6:55, today's coffee price increased by 500 VND/kg.

According to records, localities are purchasing coffee at prices ranging from 66,600 - 67,200 VND/kg.

Of which, Lam Dong province has the lowest price of 66,500 VND/kg. Next is Gia Lai province with the price of 66,700 VND/kg.

At the same time of survey, Dak Lak province had a purchase price of 67,000 VND/kg.

Dak Nong recorded a transaction price of 67,200 VND/kg - the highest among the surveyed localities.

| Market | Medium | Change |

| Dak Lak | 67,000 | +500 |

| Lam Dong | 66,500 | +500 |

| Gia Lai | 66,700 | +500 |

| Dak Nong | 67,200 | +500 |

| USD/VND exchange rate | 23,320 | -40 |

Unit: VND/kg

Exchange rate according to Vietcombank

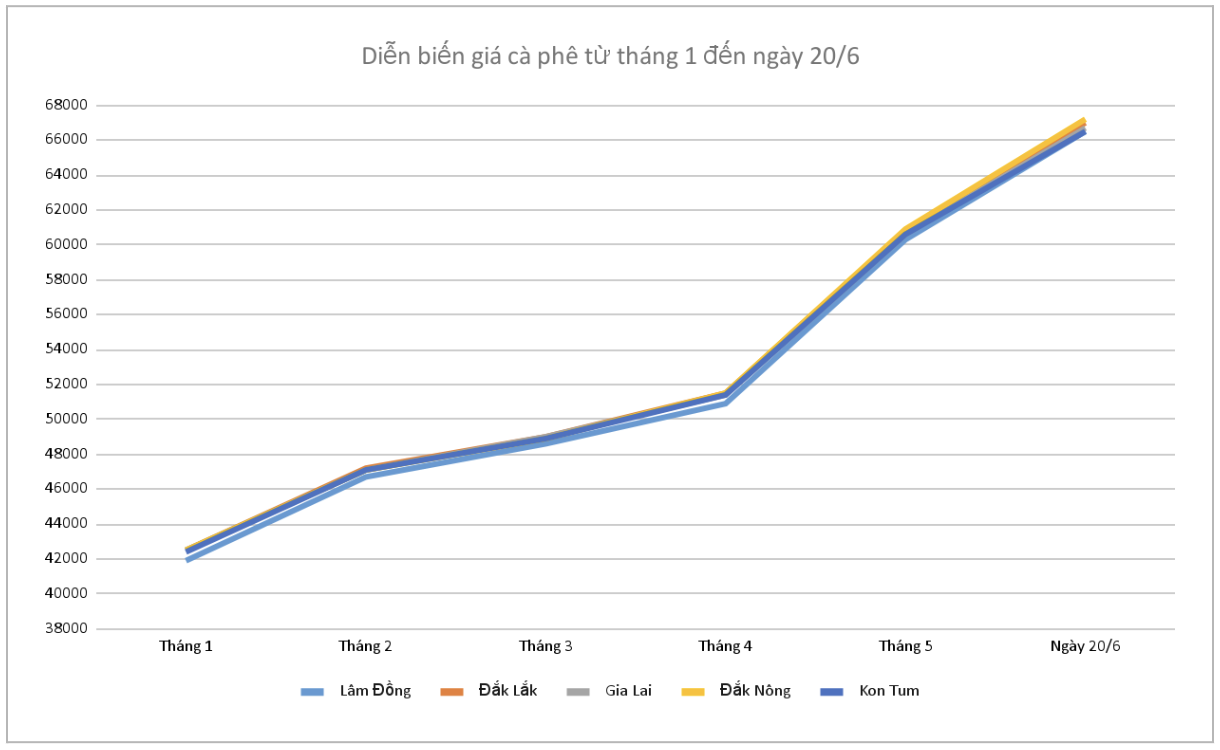

Coffee price developments from January to June 20. (Synthesis: Anh Thu )

Update world coffee prices

According to records, coffee prices on the world market fluctuated in opposite directions. Specifically, the online price of robusta coffee in London for delivery in July 2023 was recorded at 2,833 USD/ton after increasing by 1.32% (equivalent to 37 USD).

The price of Arabica coffee for July 2023 delivery in New York was at 184.9 US cents/pound after decreasing 1.12% (equivalent to 2.1 US cents) at the time of survey at 7:00 a.m. (Vietnam time).

Photo: Anh Thu

The rally in robusta prices will continue as Vietnam’s supply dries up. We estimate Vietnam’s robusta inventories to be around 80,000 tonnes.

Accordingly, the output for the 2022-2023 crop year is about 1.5 million tons, plus 100,000 tons of backlog from the previous crop year, for a total supply of 1.6 million tons.

Vietnam exported 1.27 million tons, consumed domestically about 250,000 tons, totaling 1.52 million tons. Thus, the remaining inventory is only about 80,000 tons.

Meanwhile, the average monthly export demand is over 100,000 tons and Vietnam still has 4 months left until the end of the crop year.

According to a survey of some businesses, we found that the majority of goods are in the hands of FDI enterprises.

Brazil, the world’s second-largest producer of robusta, began harvesting in May. The recent sharp rise in robusta prices may encourage Brazilians to export more of the bean in the coming months. However, it should be noted that shortages are occurring everywhere.

Bloomberg estimates that Vietnam’s coffee output this year will be the lowest in four years. Brazil’s output is expected to fall by 5%. Indonesia’s robusta output could fall by as much as 20% due to unfavorable weather.

In addition, the supply of Brazilian robusta coffee cannot meet the demand. Because, unlike Vietnamese products, Brazilian robusta beans can only be used in instant coffee processing and cannot be roasted or blended with Arabica beans.

According to data from the International Coffee Organization (ICO), Brazil's robusta coffee exports in the 7 months of the 2022-2023 crop year (from October 2022 to April 2023) also decreased sharply by 36%.

For arabica beans, the downward trend may continue in the coming time due to economic difficulties, reducing demand for coffee with higher prices compared to robusta beans.

Source

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

Comment (0)