| Coffee export prices recover despite improved supply Coffee inventories on the floor increase, helping coffee export prices reverse and decrease |

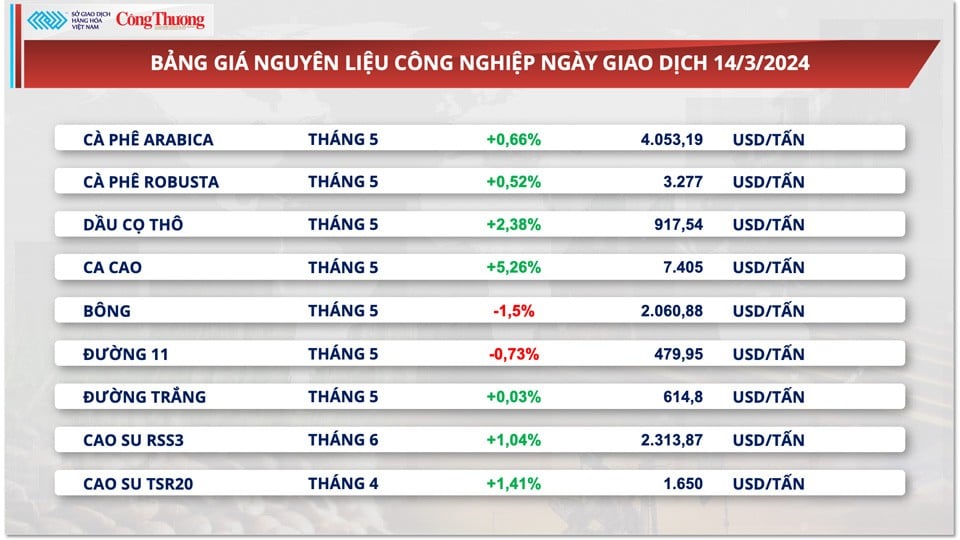

At the end of the trading session on March 14, the prices of both coffee products increased, in which Arabica prices recovered 0.66% and Robusta increased 0.52%. Positive supply prospects and a stronger USD were not enough to maintain pressure on coffee prices.

The increase in certified Arabica inventories continues to strengthen the market supply. At the end of the session on March 13, the certified Arabica inventories on the ICE-US increased by 7,380 bags, bringing the total number of certified coffees to 458,107 bags.

|

| Arabica prices rebounded 0.66% and Robusta increased by 0.52% |

Meanwhile, the Dollar Index rose 0.55% yesterday as data on weekly unemployment claims fell, causing money to flow from markets such as stocks and commodities to safe-haven assets. This contributed to increasing pressure on coffee prices.

For Robusta, inventory on the ICE-EU Exchange has improved for 4 consecutive sessions, which is a factor limiting the recovery of trading session prices. At the end of the session on March 12, Robusta inventory on the ICE Exchange increased by 760 tons, reaching 25,470 tons.

Robusta coffee prices on the Intercontinental European Exchange (ICE-EU) have been breaking records for more than two months in 2024. According to MXV, Robusta coffee prices hit a 30-year high on March 7, closing at $3,381 per tonne.

In the domestic market, prices have also continuously reached new peaks, even increasing at a rate "more dizzying" than world coffee prices. According to data from giacaphe.com, the price of green coffee beans in Vietnam reached its highest level in history after surpassing VND92,000/kg on March 8. The new record price increased by 35% compared to the beginning of the year and was nearly twice as high as the price of about VND48,000/kg in the same period last year.

According to data from the General Department of Customs, cumulative coffee exports from November 2023 to the end of February 2024 were 9% higher than the same period last year and 22% higher than the average of the last 5 years.

Coffee output in Vietnam in the 23/24 crop year is forecast to remain low due to adverse weather conditions. The Vietnam Coffee and Cocoa Association (VICOFA) forecasts that coffee output in the 23/24 crop year will decrease by 10% compared to the previous crop year, to about 1.6 million tons, the lowest level in the last four crop years.

The US Department of Agriculture (USDA) estimates that Vietnam's coffee inventory at the end of the 22/23 crop year is 339,000 bags and is expected to be only 359,000 bags at the end of the 23/24 crop year, the third lowest level in the past 17 crop years.

|

| Export coffee prices improve across the board |

According to data from the International Coffee Organization (ICO), world coffee demand has been shifting from Arabica to Robusta recently.

This is reflected in the steady increase in Robusta's share of total global coffee exports over the past three years, from 33.8% in the first four months of the 2020-21 crop year to 39.1% in the same period of the 2022-23 crop year and 39.3% in the 2023-24 crop year.

According to the ICO, in just the first 4 months of the 2023-2024 crop year (from October 2023 to January 2024), 16.1 million bags of Robusta coffee were exported worldwide, an increase of 14.7% over the same period last crop year.

However, supplies of this bitter-tasting coffee are expected to tighten in the coming period, as the ICO forecasts that global Robusta coffee production in the current crop year will fall by 2.1% to 75.8 million bags.

Certified Robusta coffee stocks on the London Coffee Exchange fell to 0.4 million 60-kg bags at the end of February, the lowest level in 10 years.

The US Department of Agriculture (USDA) also made similar comments when it forecast that global Robusta coffee production in the 2023-2024 crop year will decrease for the second consecutive year to 74.1 million bags compared to 76.6 million bags in the previous crop year and the lowest level in the last four crop years. Mainly due to a sharp decline in Indonesia's output due to adverse weather.

According to the USDA, Vietnam is the world's largest producer and exporter of Robusta coffee. On average, Vietnam's annual coffee export volume is about 1.6 million tons (equivalent to 26-27 million 60kg bags), more than twice the total Robusta coffee export volume of the two countries behind, Brazil and Indonesia, with about 11 million bags.

Vietnam Commodity Exchange said that Vietnam will still be the focus market for Robusta coffee in the first half of 2024, before Brazil starts its new crop. Moreover, the supply situation and prospects for the new crop in our country are not very optimistic, which is likely to push Robusta prices to continue to stay high in the first quarter of 2024.

Source

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

Comment (0)