Despite the sharp increase in housing and land prices, Vietnam’s income tax and property tax rates are much lower than those of other countries in the region. In addition, anti-speculation taxes have not been enacted.

Vietnam real estate prices increase faster than the US, Australia, Japan

Despite the sharp increase in housing and land prices, Vietnam’s income tax and property tax rates are much lower than those of other countries in the region. In addition, anti-speculation taxes have not been enacted.

At Batdongsan's Vietnam Real Estate Conference 2024, when sharing about macroeconomic factors, Dr. Can Van Luc, Chief Economist of BIDV, always expressed optimism about the positive prospects of the economy. However, when it comes to the story of real estate prices, that enthusiasm is no longer there.

|

| Mr. Can Van Luc also feels fed up with the current situation of rising housing prices. Photo: Thanh Vu |

“Housing prices are increasing so fast! From 2019 until now, prices have increased by 50-70%, mainly in the apartment segment. Part of the reason for the high prices is the lack of supply. I think the market is hiding some abnormalities. Real estate businesses need to consider and calculate the price of the product, so that it is reasonable and sustainable,” Dr. Can Van Luc raised the issue.

To reinforce the above statement, the expert said that by the end of September 2024, housing credit increased by only 4.6%, despite the continuous decrease in loan interest rates. This slow growth reflects the cautious psychology of home buyers, before the "price storm" period of the real estate market.

|

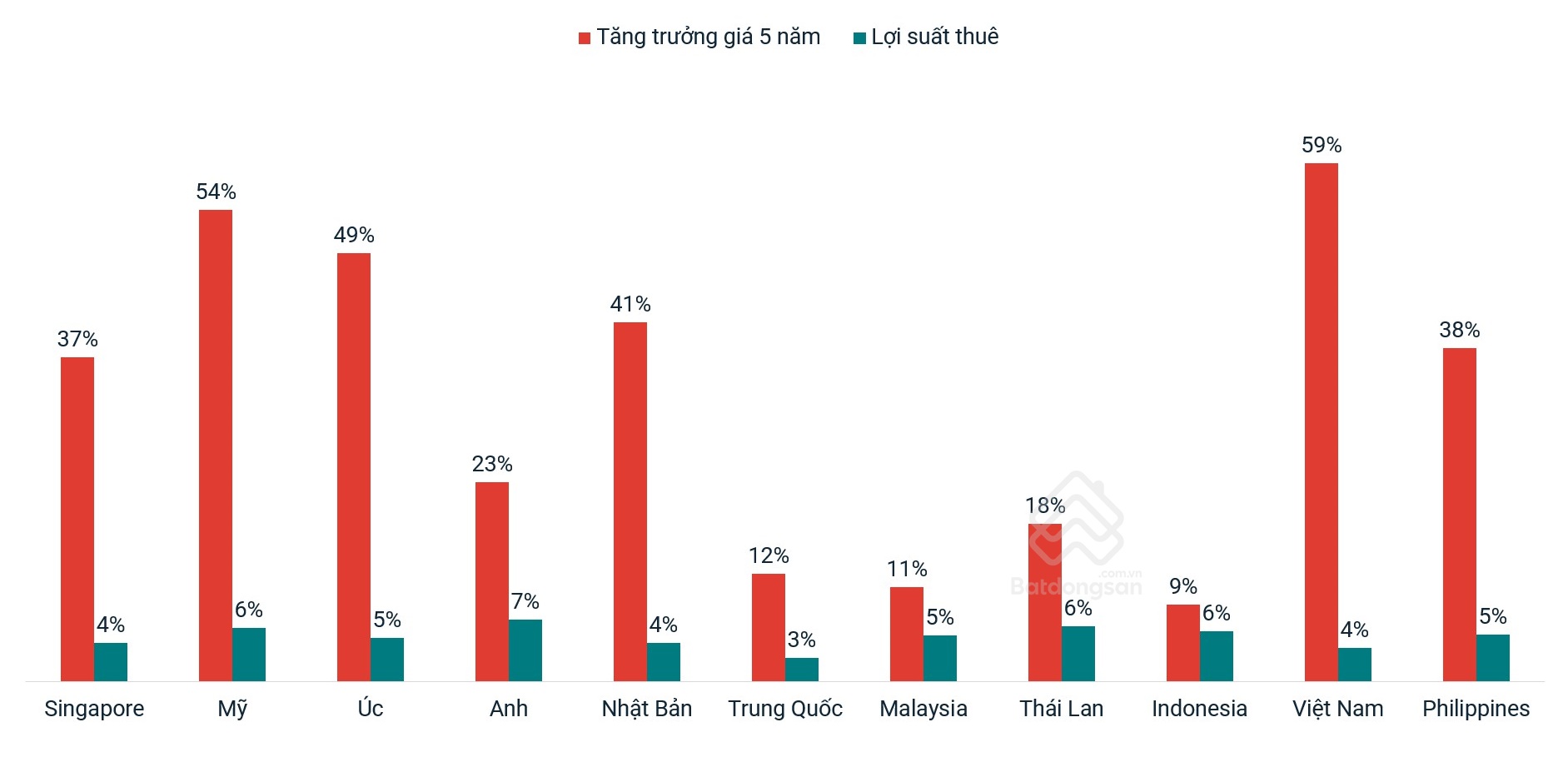

| Real estate price growth and rental yields across countries. |

According to Global Property Guide, Vietnam’s real estate prices are growing at the fastest rate in the world. With prices increasing by 59% after 5 years, the figure is even higher than the US (54%), Australia (49%), Japan (41%), Singapore (37%). In fact, Vietnam’s growth rate is 3-6 times higher than that of other Southeast Asian countries such as Indonesia (9%), Malaysia (11%), and Thailand (18%).

In addition to the data numbers, the most popular topics on the internet are also revolving around housing prices. Accordingly, the most searched keywords are “young people find it difficult to buy a house”, “real estate tax”, “high real estate prices” and “crazy real estate prices”.

In order to “cool down” housing prices, ministries and agencies are continuously proposing anti-speculation policies. For the Ministry of Construction, it is a policy to tax people who own many houses and lands and collect taxes on abandoned real estate. Meanwhile, the Ministry of Finance proposes a tax focusing on the ownership period.

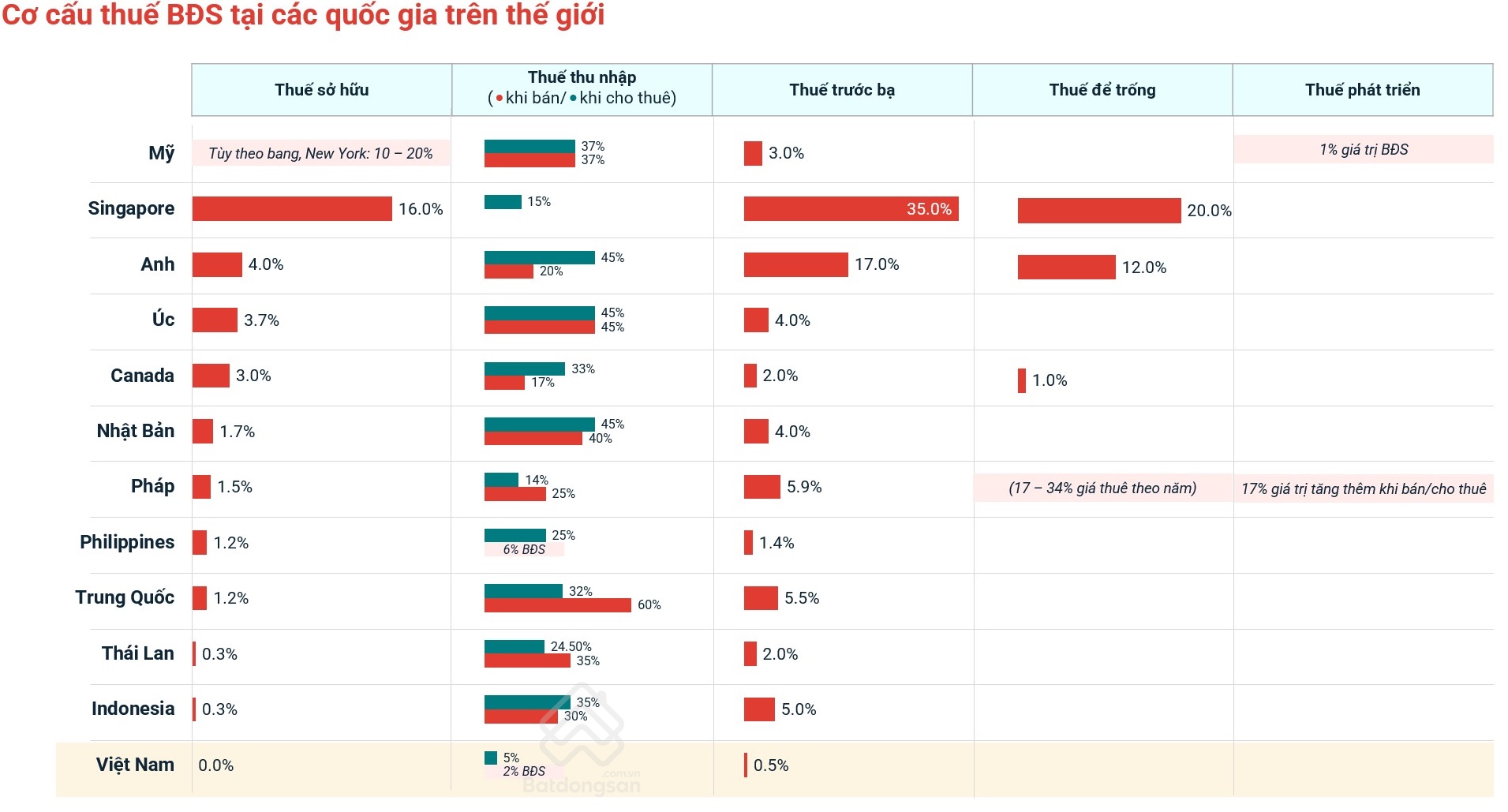

According to Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan, each country has its own income tax policies to control the situation of real estate "surfing". For example, in Japan, the tax rate for houses and land owned for less than 5 years is up to 39.6%. If it is 5 years or more, the tax rate will be reduced to 20.3%.

|

| Real estate tax structure in countries around the world. |

In China, this country focuses on taxing land, to avoid waste, leaving land vacant and to encourage people to develop, do business and produce on that land. Specifically, when trading land, the seller can pay up to 30 - 60% of the tax. Meanwhile, for other real estate, the tax rate is only about 20%.

In France, the tax is based on the ownership period, along with the value of the property. For houses and land held for 6 years or less, the income tax rate that the seller has to pay will be from 19 - 25%. On the contrary, for real estate owned for 22 years or more, the tax rate will be reduced to 0%. At the same time, houses worth from 1.3 - 3 million Euros will "bear" an additional 0.25% tax. For the super luxury segment, over 3 million Euros, the additional tax rate will be 0.5%.

Looking back at the Vietnamese market, the current tax rate is much lower than other countries, even when compared to countries in the region. Specifically, in Vietnam, income tax on real estate sales is only 2%; registration tax is 0.5%. Meanwhile, in Thailand, these figures are 35% and 2% respectively; in the Philippines, 6% and 1.4%; in Indonesia, 30% and 5%; in China, 60% and 5.5%.

“Referring to some prominent countries in the world, it can be seen that real estate tax is used as a policy to manage the market and optimize revenue. However, before applying, many theoretical and operational challenges need to be considered appropriately. For example, in Singapore, this island nation imposes very high taxes on speculative activities but real estate prices still increase sharply,” commented Mr. Nguyen Quoc Anh.

In a survey by Batdongsan with 118 investors in 2023, more than 80% of respondents said that they only hold real estate for less than 1 year, then will sell it. Real estate "surfing" is part of the reason why prices are constantly pushed up. The introduction of anti-speculation policies will be an effective solution to help the real estate market become healthy and stable, contributing to realizing the dream of settling down for millions of people.

Source: https://baodautu.vn/batdongsan/gia-bat-dong-san-viet-nam-tang-nhanh-hon-ca-my-uc-nhat-ban-d231568.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)