The Prime Minister assigned 'KPI' to build social housing, the Ministry of Finance continues to study the proposal to tax second homes, the "popular" price of apartments in Hanoi is about 4 billion VND... are the latest real estate news.

|

| Imposing a tax on second properties is one of many measures to help the market develop transparently and sustainably. (Source: Thanh Nien) |

Prime Minister assigns 'KPI' to build social housing

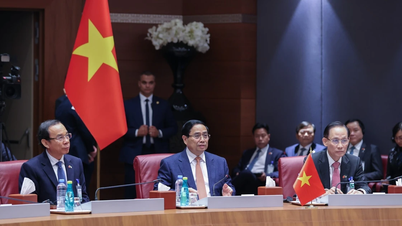

Prime Minister Pham Minh Chinh has just signed a decision assigning targets for completing social housing in 2025 and the following years until 2030 for localities to add to their socio -economic development targets.

According to the Prime Minister's decision, the social housing target that localities must complete in the 2025-2030 period is 995,445 apartments.

Of which, in 2025 there will be 100,275 apartments, in 2026 there will be 116,347 apartments, in 2027 there will be 148,343 apartments, in 2028 there will be 172,402 apartments; in 2029 there will be 186,917 apartments and in 2030 there will be 271,161 apartments.

The locality assigned the largest target for social housing is Ho Chi Minh City with 69,700 units. Next is Hanoi with 56,200 units, Hai Phong 33,500 units, Da Nang 12,800 units, Can Tho 9,100 units.

The targets for social housing are also specified for each year. This year, Hanoi must complete 4,670 units; Ho Chi Minh City 2,874 units. By 2030, these two cities must complete the largest number of social housing in 5 years: more than 14,200 units and more than 19,200 units, respectively.

According to the Ministry of Construction, by the end of 2024, 645 social housing projects had been implemented nationwide with a scale of more than 581,200 units. Of these, 96 projects were completed with more than 57,600 units, 135 projects had started construction equivalent to more than 115,600 units and 414 projects had been approved for investment in principle with nearly 408,000 units.

In early 2023, the Prime Minister issued Decision 338 approving the Project "Investing in the construction of at least 1 million social housing apartments for low-income earners and industrial park workers in the 2021-2030 period".

The project aims to develop social housing and worker housing at prices suitable to the affordability of middle- and low-income households in urban areas and of workers and laborers in industrial parks and export processing zones.

The State encourages economic sectors to develop housing to create conditions for everyone to have accommodation according to market mechanisms, meeting all people's needs, and at the same time has policies to support housing for social policy beneficiaries, low-income people and the poor who have housing difficulties in order to contribute to political stability, ensure social security and develop urban and rural areas in a civilized and modern direction.

Ministry of Finance continues to study the proposal to tax second real estate

Responding to the petition of Dong Nai province voters on the proposal to levy a second real estate tax, the Ministry of Finance said it is continuing to research and synthesize international experience, identifying difficulties and shortcomings in the implementation of tax policies related to real estate in the past to report to competent authorities at the appropriate time, ensuring compliance with Vietnam's socio-economic conditions and international practices.

Accordingly, voters believe that imposing a tax on second-hand real estate is one of many measures to help the real estate market develop transparently and sustainably, and should not become a barrier to real estate development and risk creating social disagreement. Therefore, voters recommend that the Government should study comprehensive solutions to limit speculation, minimize adverse impacts on the real estate market, and at the same time create consensus from the people.

In response to voters' petitions, the Ministry of Finance affirmed that current laws clearly stipulate real estate, including land, houses and construction works attached to land, other related assets, and assets recognized by law.

To manage real estate ownership and use, the State has applied many fees at different stages, the stage of establishing ownership and use rights (land use fees, land rent in case of one-time or annual payment, registration fee); the stage of use (non-agricultural land use tax, agricultural land use tax, periodic land rent); the transfer stage (personal income tax, corporate income tax, value added tax).

However, the Ministry of Finance also said that revenues during the real estate use phase are not currently applied to housing - a difference compared to other types of assets.

The Ministry of Finance said it is conducting research based on major policies of the Party and State. Specifically, Resolution No. 18-NQ/TW dated June 16, 2022 of the 13th Party Central Committee emphasized the innovation and improvement of land management policies to create momentum to turn Vietnam into a high-income developed country. At the same time, plans of the National Assembly Standing Committee (Plan No. 81/KH-UBTVQH15) and the Prime Minister (Decision No. 2114/QD-TTg) also aim to promote a transparent, stable and sustainable real estate market.

The Ministry of Finance is continuing to research and synthesize international experience, identify difficulties and shortcomings in the implementation of tax policies related to real estate in the past time to report to competent authorities at the appropriate time, ensuring consistency with Vietnam's socio-economic conditions, international practices as well as the consistency of the tax policy system related to real estate and placed in the overall reform of the tax policy system in the period of 2021 - 2030.

Hanoi apartment price "popular" around 4 billion VND

A survey by market research company Qandme released on February 25 shows that household income in Ho Chi Minh City and Hanoi is much higher than in other provinces and cities. The percentage of households with income of 40 million VND or more in Ho Chi Minh City and Hanoi is 4%, while in other places it is 1%, and in rural areas it is 0.6%.

Income from 25 million VND/household or more accounts for 45%, while in other provinces and cities it is 20%.

Income from 30 million VND/month or more accounts for 30%, in other provinces and cities it is 8%.

The income gap between urban and rural areas is huge. Only 0.7% of households in Ho Chi Minh City and Hanoi have an income of less than 10 million VND per month, compared with 2.2% in rural areas.

The data were collected through nationwide interviews, revealing clear disparities influenced by economic growth, employment opportunities and industrial concentration.

The income picture shows the rich-poor divide by region. Ho Chi Minh City has the highest income, followed by Hanoi and Da Nang. According to survey data, 15.5% of households in Ho Chi Minh City have an income of 35 to 39.9 million VND per month, compared to 11% in Hanoi and only 1.8% in Da Nang. In addition, 5.8% of households in Ho Chi Minh City have an income of 40 million VND or more, while the rate in Hanoi is 1.8% and in Da Nang is only 0.5%.

Although families in Ho Chi Minh City and Hanoi have the highest income in the country, life is not easy for those who do not own a house or are buying a house on installments. The dream of settling down and saving to buy a house is very difficult because house prices have increased at a dizzying rate in the past decade.

Currently in Hanoi, the "popular" price of an apartment is about 4 billion VND. Therefore, the richest 2% of households in Hanoi with 40 million VND/month, if they do not eat or spend anything, will need more than 8 years to be able to buy one.

According to Savills, the average household income in Hanoi is around 250 million VND/year. Therefore, it takes about 16 years without spending money to buy an apartment at a “popular” price.

In fact, costs in Ho Chi Minh City and Hanoi are often much higher than in other provinces and cities.

Suppose the household income is in the highest group and is 40 million VND/month. The savings rate may vary depending on the spending of each family. Suppose the savings are high, with about 50% of income, or 20 million VND/month. They need nearly 17 years to be able to buy an apartment.

However, that does not take into account the high inflation rate and the rapid increase in real estate prices. Saving money to buy a house and realize the dream of settling down is difficult.

The usual solution is to take out a bank loan and pay it back in installments. But if you have to take out a bank loan, the interest will increase the cost of buying a house and extend the repayment period. The time can be up to several decades if there is no breakthrough in income.

For the group of households with the most common income in Ho Chi Minh City and Hanoi of 20-24.9 million VND/month (accounting for 35% of the total number of households), the time to accumulate to be able to buy a house or take out a home loan will be double that of the first group, possibly up to 40-50 years.

Can Tho: Focus on rectifying and handling price manipulation, speculation and inspecting real estate projects

Implementing the direction of the Prime Minister in Official Dispatch No. 03/CD-TTg dated January 15, 2025 on focusing on rectifying and handling price manipulation, real estate speculation and inspecting and examining real estate investment and construction projects, through considering the proposal of the Department of Construction in Official Dispatch No. 440/SXD-QLN dated February 11, 2025, the Chairman of the People's Committee of Can Tho City:

Assign the Department of Construction, Department of Agriculture and Environment, Department of Finance, People's Committees of districts and towns, based on their functions, tasks and authority, to focus on strictly and effectively implementing the tasks and solutions to rectify and handle price manipulation, real estate speculation and inspect and examine real estate construction investment projects as directed by the Prime Minister in Official Dispatch No. 03/CD-TTg and the direction of the Chairman of the City People's Committee in this Official Dispatch, ensuring compliance with regulations.

The Chairman of the People's Committee of Can Tho City assigned the Department of Construction to preside over and coordinate with the Can Tho City Real Estate Association to strengthen the propaganda and dissemination of laws and new policies related to the fields of land, housing, and real estate business to organizations, enterprises/investors of real estate projects to implement in accordance with regulations. Announce information on housing and the real estate market, notify real estate eligible for business; housing development programs and plans; urban and rural planning, urban development programs, ensuring compliance with regulations, timeliness, transparency, preventing fraud and deception in real estate business.

At the same time, the Department of Construction shall preside over and coordinate with the Departments, branches and sectors of Can Tho city, the People's Committees of districts and related units to closely monitor and control the examination and issuance of real estate brokerage practice certificates in Can Tho city, ensuring compliance with current legal regulations; the operations of real estate trading floors and real estate brokerage enterprises must be transparent and professional; prevent and limit the lack of control that can cause market instability.

The People's Committee of Can Tho City assigned the Department of Agriculture and Environment to preside over and coordinate with the Departments, branches, sectors of Can Tho City, the People's Committees of districts and related units to announce information on planning and land use plans in accordance with regulations, promptly, transparently, and prevent fraud and deception in real estate business. Proactively and promptly resolve administrative procedures under the authority related to housing and real estate projects (such as changing land use purposes, determining land prices, calculating land use fees, etc.).

Assign the Department of Finance to proactively and promptly resolve administrative procedures under its authority related to housing and real estate projects (such as investment policy approval, project appraisal, etc.).

The People's Committees of districts and towns shall strengthen inspection and examination, proactively prevent, rectify and strictly handle violations by enterprises/investors of real estate projects, real estate trading floors, real estate brokerage service enterprises, land use rights auction enterprises in the area; focusing on the legality, conditions, information disclosure... of real estate put into business with speculative phenomena, abnormal price increases, not allowing profiteering and market disruption. In cases beyond the authority, the report shall propose the Department of Construction to synthesize and advise the People's Committee of Can Tho city to consider and handle in accordance with regulations.

Source: https://baoquocte.vn/bat-dong-san-giac-mo-so-huu-nha-ha-noi-va-tphmc-van-xa-voi-chan-chinh-xu-ly-viec-thao-tung-gia-dau-co-305974.html

![[Photo] The Standing Committee of the Organizing Subcommittee serving the 14th National Party Congress meets on information and propaganda work for the Congress.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/19/1763531906775_tieu-ban-phuc-vu-dh-19-11-9302-614-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and his wife meet the Vietnamese community in Algeria](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/19/1763510299099_1763510015166-jpg.webp)

Comment (0)