To implement the application of the global minimum tax from January 1, 2024, at the end of 2023, National Assembly Chairman Vuong Dinh Hue signed Resolution No. 107/2023/QH15 of the National Assembly on the application of additional corporate income tax according to regulations against global tax base erosion.

However, according to jurists, in addition to this extremely important legal document, it is still necessary to issue more legal documents and urgently implement many other actions.

Affirming that the impacts of the application of global minimum tax on foreign-invested enterprises are “not small and urgent”, the European Chamber of Commerce in Vietnam (EuroCham) has proposed that the Vietnamese Government cooperate with other developing countries to negotiate restrictive and exceptional conditions to protect tax incentives for foreign investors in specific sectors, based on the level of labor use, technology transfer for economic modernization and development... or maintain the transition period, extend registration for investment in developing countries.

EuroCham recommends that Vietnam negotiate with countries where foreign investors reside and are established to sign bilateral agreements on non-application of global base erosion regulations for specific investment projects, and consider supporting investors based on costs, instead of tax rates as at present, and apply them together with other business support policies.

Regarding this issue, Minister of Planning and Investment Nguyen Chi Dung said that currently, in addition to tax incentives, the 2020 Investment Law also stipulates many other investment support policies such as support for the development of technical infrastructure systems, social infrastructure inside and outside the investment project fence; support for training, human resource development; credit support; support for access to production and business premises; support for science, technology, technology transfer; support for market development, information provision; support for research and development...

In the context of having to come up with specific policies to compensate affected businesses, competent authorities can focus on developing detailed regulations to apply these forms.

Investment support policies when applying global minimum tax need to be selective, consistent with the orientation of attracting investment and developing industries and fields, focusing on prioritizing projects with advanced technology, new technology, high technology, clean technology, modern management, high added value, spillover effects, connecting global production and supply chains.

Of course, these policies need to ensure minimal impact on the state budget; not violate international treaties to which Vietnam is a member; and be feasible and easy to implement.

Notably, Vietnam is not only concerned with the interests of existing businesses that are affected by the global minimum tax policy, but also must pay attention to attracting more investment from new investors.

Therefore, the requirement to legalize and design new policies is extremely urgent to maintain the competitiveness of the business environment, avoid disadvantages for taxable enterprises operating in Vietnam, and avoid disputes between foreign investors and state agencies in investment activities.

ANH THU

Source

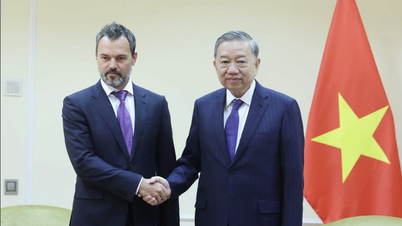

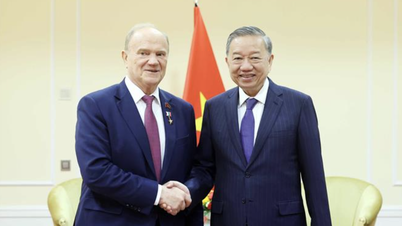

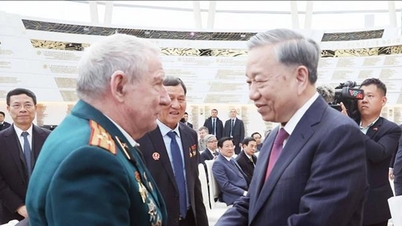

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)