Foreign exchange rates, USD/VND exchange rate today, January 15, recorded the USD cooling down after the market received statistics showing that US inflation data was lower than expected.

Foreign exchange rate update table - USD exchange rate Agribank today

| 1. Agribank - Updated: January 15, 2025 08:30 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,200 | 25,220 | 25,560 |

| EUR | EUR | 25,493 | 25,595 | 26,681 |

| GBP | GBP | 30,400 | 30,522 | 31,496 |

| HKD | HKD | 3,196 | 3,209 | 3,316 |

| CHF | CHF | 27,171 | 27,280 | 28,141 |

| JPY | JPY | 157.49 | 158.12 | 165 |

| AUD | AUD | 15,385 | 15,447 | 15,962 |

| SGD | SGD | 18,208 | 18,281 | 18,800 |

| THB | THB | 713 | 716 | 746 |

| CAD | CAD | 17,335 | 17,405 | 17,912 |

| NZD | NZD | 13,977 | 14,472 | |

| KRW | KRW | 16.58 | 18.28 | |

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 7:00 a.m. on January 15, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 24,343 VND, up 2 VND.

The reference USD exchange rate at the State Bank of Vietnam is listed at: 23,400 VND - 25,450 VND.

USD exchange rates at commercial banks are as follows:

Vietcombank: 25,170 - 25,560 VND.

Vietinbank: 25,065 - 25,560 VND.

|

| Foreign exchange rates, USD/VND exchange rate today, January 15: EUR continues to decline. (Source: Forbes) |

Exchange rate developments in the world market

The US Dollar Index (DXY) measuring the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.12% to 109.52.

The dollar cooled after the market received statistics showing lower-than-expected US inflation data. In recent trading sessions, the DXY index surged to its highest level in more than two years, peaking at 110.17 before retreating slightly.

Data showed that the US Producer Price Index (PPI) rose 3.3% year-on-year in December 2024, compared with a 3.4% gain expected by economists polled by Reuters .

The more important event is the inauguration of US President-elect Donald Trump this month, after which the market will consider the impact of Mr. Trump’s tariff policies, said Uto Shinohara, senior investment strategist at Mesirow Currency Management in Chicago.

His plans for high import tariffs, tax cuts and immigration restrictions could boost inflation, adding to expectations of a less aggressive rate-cutting cycle.

The euro fell 0.4% to $1.0208. Earlier in the session, the common European currency hit its lowest level against the dollar since November 2022.

The pound fell 0.24 percent to $1.2167, after sliding to a 14-month low earlier in the session.

The pound has been under pressure from concerns about rising borrowing costs and growing uncertainty about Britain's finances.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-151-eur-noi-dai-da-giam-300876.html

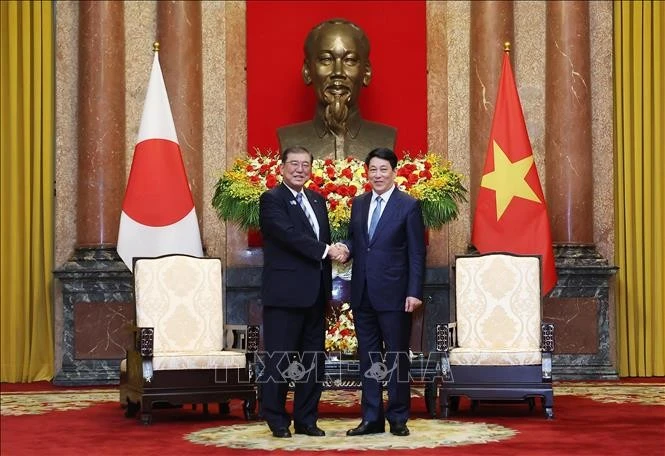

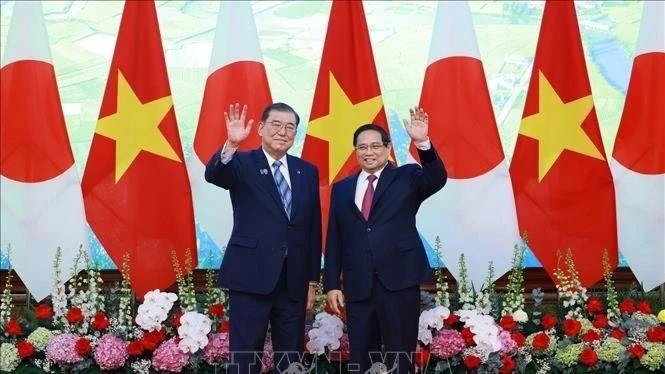

![[Photo] President Luong Cuong receives Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/44f0532bb01040b1a1fdb333e7eafb77)

![[Photo] Ho Chi Minh City: full of flags and flowers before the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ab41c3d5013141489dee6471f4a02b96)

![[Photo] General Secretary To Lam receives Secretary General of the Mozambique Liberation Front Party](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/360d46b787c547bbaa5472c490ddeded)

![[Photo] President Luong Cuong offers incense to commemorate Uncle Ho at House 67](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/162df748c87348e1821cc4c83745a888)

Comment (0)