Vietnam’s cashew exports are expected to hit a record $4 billion this year. However, alarm bells have also been raised for the industry as the largest source of raw materials, Cambodia, is growing rapidly.

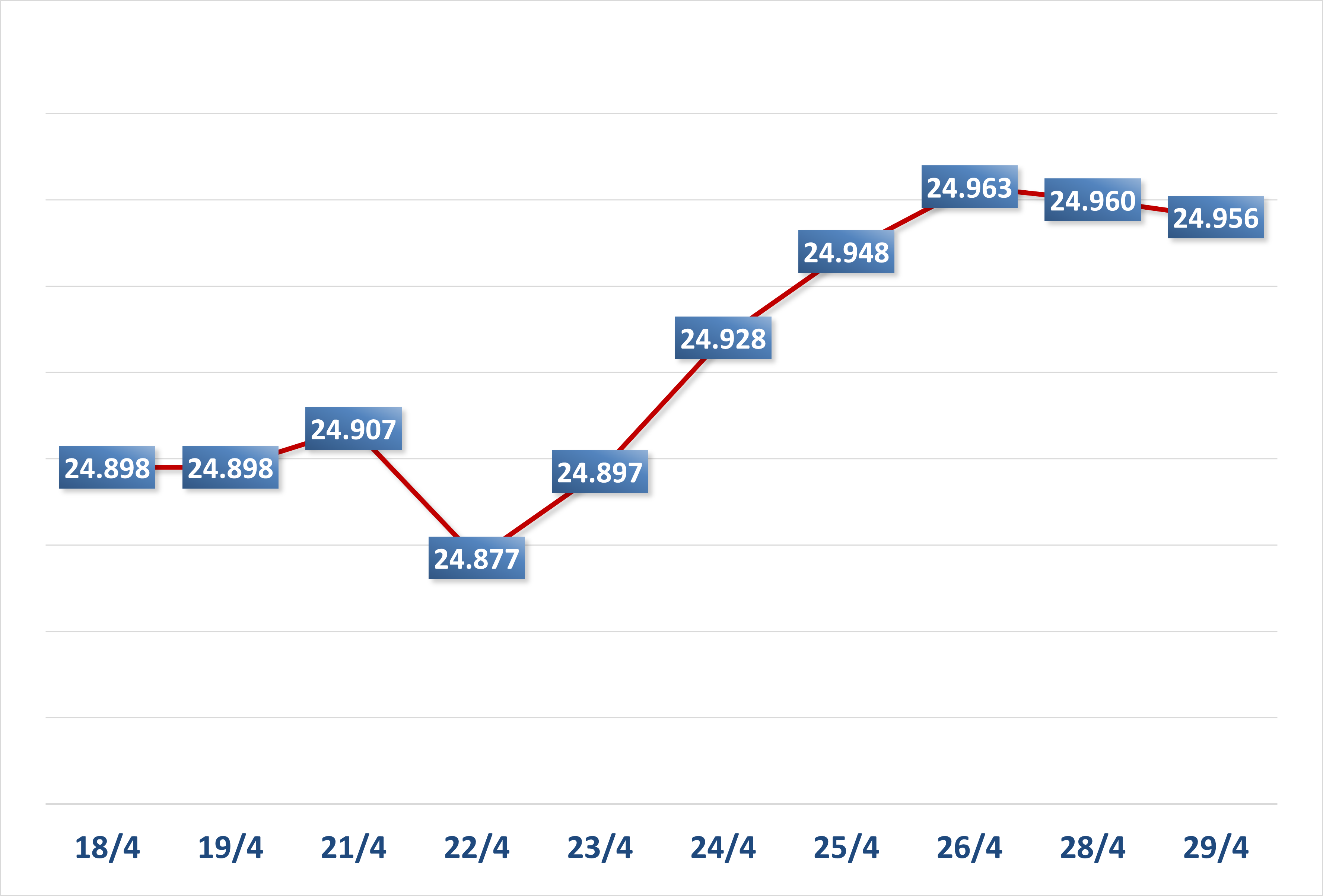

Preliminary statistics from the General Department of Customs show that in the first 10 months of this year, Vietnam exported more than 609,000 tons of cashew nuts, reaching a turnover of nearly 3.58 billion USD. Compared to the same period last year, cashew exports increased by 17.9% in volume and 21.4% in value.

The average export price of cashew nuts in the past 10 months reached 5,867 USD/ton, up 2.9% over the same period last year.

Vietnam’s cashew industry has continued to maintain its position as the world’s number one cashew nut exporter for nearly two decades. It is forecasted that Vietnam’s cashew nut exports will set a historic record this year, earning $4 billion.

However, this strength of our country is heavily dependent on imported raw materials. Statistics show that Vietnamese enterprises have spent nearly 2.9 billion USD to import about 2.31 million tons of raw cashew nuts in the past 10 months, down 8.5% in volume and 1.1% in value.

The average import price of this item is 1,256 USD/ton, up 8.6% over the same period in 2023.

Currently, the main source of cashew nuts for Vietnam comes from Cambodia and Africa. Of which, the import value of cashew nuts from Cambodia is up to 1.06 billion USD, the import from Ivory Coast is 679 million USD, from Ghana and Tanzania is nearly 302 million USD and 90 million USD respectively...

Accordingly, the alarm was also raised for Vietnam's strong industry when the main source of raw materials, Cambodia, is developing rapidly.

The Vietnam Trade Office in Cambodia recently reported that this neighboring country is rapidly developing cashew cultivation in a sustainable manner.

Specifically, the cashew growing area in Cambodia in 2024 will increase to 580,117 hectares, ranking third in the world in terms of cashew cultivation area.

Notably, Cambodia also launched a cashew growing areas document to ensure that all stakeholders have access to accurate information and maps of growing areas, facilitating effective and sustainable management of agricultural land resources.

According to Mr. Uon Silot - President of the Cashew Nut Association of Cambodia - this cashew growing area map is very important for development partners, organizations and companies in the industry, motivating them to re-evaluate and adjust their strategies based on clear data to build effective plans for the development of the cashew industry in this country.

Not only that, a cashew processing factory with a capacity of 12,000 tons/year for export in Cambodia is also preparing to operate from December. Accordingly, the first batch of processed cashew nuts will be packaged and exported to the Chinese market.

The leader of the Cambodian Cashew Association said that so far, the main market for Cambodia's large M23 cashew nuts is China. Meanwhile, businesses in this country cannot export directly to China but through Vietnam, which buys nearly 90% of Cambodia's raw cashew nuts.

However, after the above factory is in stable operation, Cambodia will export processed cashew nuts directly to Chinese provinces. Next, Cambodian cashew nuts will target the Middle East and European markets...

With rapid growth in both cultivation and export, the leader of the Cambodian Cashew Association hopes that in the next 5 to 6 years, they can become the world's largest cashew nut producer.

Cambodia's push to process cashew nuts for export has shaken Vietnam's No. 1 position. Because, when boosting processing, this country will reduce its raw cashew exports. Meanwhile, the Vietnamese cashew industry imports millions of tons of raw cashew nuts from Cambodia for processing each year. By the end of October this year, our country had imported 815,200 tons of raw cashew nuts from this neighboring country.

According to a report by the Vietnam Cashew Association (VINACAS), the cashew growing area in Vietnam is limited to 300,000 hectares, the domestic supply of raw cashews only ensures 10-12% of the export processing needs of Vietnamese enterprises, 88-90% depends on imported raw cashews.

VINACAS warns that in addition to Cambodia, many countries in Africa are also promoting deep processing of cashew nuts. The Vietnamese cashew industry is facing the risk of a shortage of raw materials for processing.

In addition, there are many shortcomings in the import of raw materials from African countries. According to processing enterprises, if not resolved, this strong industry of our country may face the risk of "fading away".

Source: https://vietnamnet.vn/doi-thu-tang-than-toc-bao-dong-the-manh-top-1-the-gioi-cua-viet-nam-2341619.html

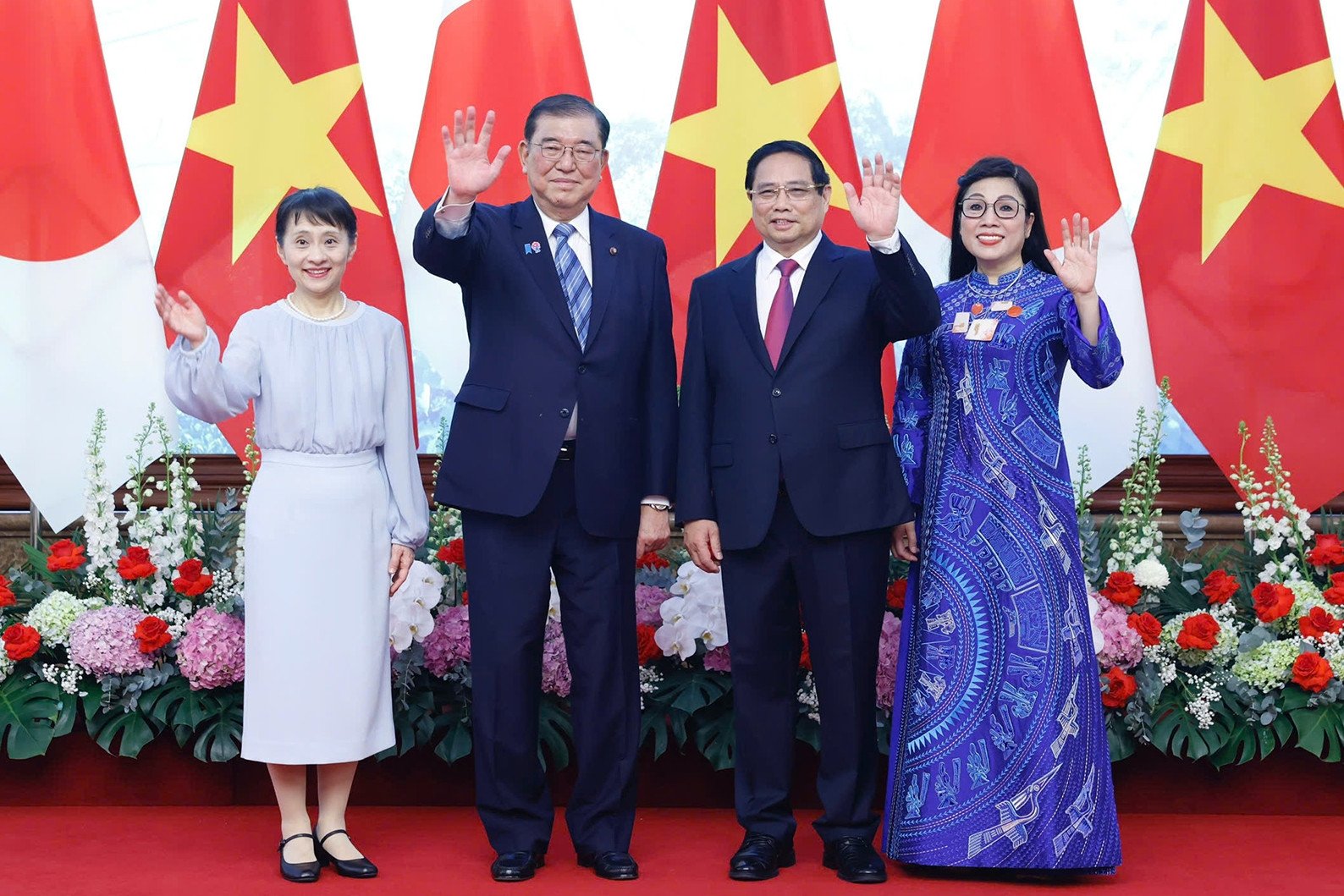

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

![[Photo] A long line of young people in front of Nhan Dan Newspaper, recalling memories of the day the country was reunified](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/4709cea2becb4f13aaa0b2abb476bcea)

![[Photo] Signing ceremony of cooperation and document exchange between Vietnam and Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/e069929395524fa081768b99bac43467)

Comment (0)