ANTD.VN - On October 21, 2024, the ASEAN Capital Markets Forum (ACMF) successfully held its 41st Chairman's Meeting in Vientiane, Lao PDR, chaired by the Lao Securities Commission Office (LSCO).

This is the annual ACMF Chairman's Meeting with the participation of representatives of capital market regulators of ten ASEAN member countries to jointly promote the common goal of establishing deep, liquid and integrated ASEAN capital markets.

|

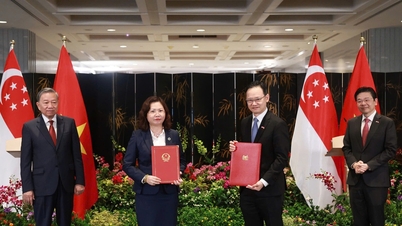

Chairwoman of the State Securities Commission Vu Thi Chan Phuong speaks at the Forum |

Speaking at the Conference, Chairwoman of the State Securities Commission Vu Thi Chan Phuong shared about the journey of developing Vietnam's capital market. Vietnam's capital market is still young, starting with a few listed companies, but over the past 20 years the market has grown significantly, playing an important role in the economy.

“This development did not happen overnight. We have worked hard to build an open, transparent and fair market. By following international standards, we have built trust from both domestic and foreign investors,” the Chairman of the State Securities Commission emphasized.

The Chairman of the State Securities Commission also assessed that technology is changing rapidly, to catch up and seize opportunities, Vietnam will continue to modernize the market, focusing on areas such as digital finance, bonds and derivatives. Sustainable development will also continue to be a top priority when expanding the green financial market.

“By working together through the ACMF, we can build stronger and more connected markets in the ASEAN region and become leaders in sustainable finance,” the SSC Chairman believes.

|

Conference Overview |

At the Conference, the ACMF adopted the ASEAN Transition Finance Guidelines (ATFG) Version 2, which provides additional guidance and clarification on different types and applications of transition finance, helps to unify terminology and promote better understanding among market participants on what constitutes a fair, equitable, credible and orderly transition to a low-carbon economy.

At the same time, ATFG Version 2 provides guidance on a reference transformation roadmap – thereby supporting companies in the ASEAN region to develop their own transformation plans, while helping investors and financial institutions understand and evaluate the same.

The Senior Leaders of the 10 ASEAN SSCs noted the progress made in relation to the ASEAN Voluntary Carbon Market Study and the ongoing development of the ASEAN Sustainable Finance Taxonomy, as well as the progress made in relation to the ASEAN Collective Investment Scheme (CIS) initiative on (a) Harmonisation of disclosure standards and (b) amendments to the Memorandum of Understanding and Standards to meet the CIS requirements.

In addition, delegates at the ACMF Presidents’ Meeting acknowledged the promising developments of each member on standards for sustainability reporting, as well as appreciated the continued dialogue and cooperation with the International Sustainability Standards Board (ISSB), recognizing the efforts and commitment of ISSB to achieve interoperability between sustainability reporting standards and support the adoption of IFRS sustainability reporting standards in the ASEAN region.

Also at this Meeting, the ACMF approved the final assessment results of the ACMF Action Plan 2021-2025 with targets achieved without any initiatives being delayed or at risk and 85% of overall initiatives completed or on track.

In particular, the development of the ASEAN Taxonomy on Sustainable Finance, the ASEAN CIS Digital Repository and the ASEAN Sustainable and Responsible Funds Standard (SFRS) are important initiatives recently undertaken...

Aiming to further advance the sustainability, financial inclusion and resilience objectives of the ACMF in the region and after extensive consultation with domestic and international stakeholders, the Meeting adopted Five Strategic Drives related to the ongoing development of the ACMF Action Plan 2026–2030.

Specifically: (1) Building a more sustainable and resilient ACMF; (2) Building a sustainable and resilient ASEAN community; (3) Promoting financial inclusion and empowerment; (4) Strengthening regional integration and global positioning; and (5) Promoting digitalization.

The conference concluded with the handover of the ACMF Chairmanship from the Lao Securities Commission Office (LSCO), ACMF Chairman 2024, to the Securities Commission of Malaysia (SCM) in 2025, with the Philippine Securities and Exchange Commission (PSEC) as Vice Chairman.

Source: https://www.anninhthudo.vn/dien-dan-thi-truong-von-asean-huong-toi-ben-vung-linh-hoat-va-ket-noi-post593207.antd

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)