Russian oil prices are higher than the ceiling price of the West, Suez Canal revenue has dropped sharply, the US and China have exchanged concerns about bilateral trade, the largest IPO in Japan in 6 years... are the outstanding world economic news of the past week.

|

| Russia's Urals oil price for October 2024 delivery rises back above $65/barrel at export ports in the Baltic and Black Seas, $5 per barrel higher than the price ceiling imposed by the West. (Source: The Moscow Times) |

World economy

Bad news for the Suez Canal

An Egyptian official revealed on October 6 that Suez Canal revenue has dropped by 60%, while the number of ships passing through the vital waterway connecting Asia with Europe has dropped by 49% since the beginning of 2024, as tensions continue to rise in the Red Sea.

In a statement, Suez Canal Authority (SCA) Chairman Osama Rabie said that “the current situation and unprecedented challenges in the Red Sea region” have prompted shipping lines to seek alternative shipping routes away from the Suez Canal.

According to the SCA, Egypt's Suez Canal revenue has decreased from $9.4 billion in the 2022/2023 fiscal year to $7.2 billion in the 2023/2024 fiscal year. The fiscal year in Egypt begins on July 1 of each year and ends on June 30 of the following year.

Since the conflict in the Gaza Strip erupted last October, Yemen’s Houthi forces have repeatedly attacked ships passing through the Red Sea and the Gulf of Aden, which is linked to Israel, disrupting shipping traffic in the Red Sea. Many shipping companies have been forced to divert away from the Egyptian canal and take the more distant but safer route around the Cape of Good Hope at the southern tip of Africa.

America

*According to a report released by the US Department of Commerce on October 8, the country's trade deficit in August 2024 decreased sharply thanks to a record increase in exports and a decrease in imports. This development may lead to an upward adjustment of the forecast for the US economic growth rate in the third quarter of 2024.

Specifically, the US trade deficit in August 2024 decreased by 10.8% to $70.4 billion, the lowest level since March 2024, down from $78.9 billion in the previous month. After adjusting for inflation, the goods trade deficit decreased by 8.9% to $88.6 billion.

The sharp decline in the trade deficit in August 2024 is a factor that will likely support the increase in the US economic growth estimate in the third quarter of 2024. The world's largest economy grew 3.0% in the second quarter of 2024.

China

* Chinese Commerce Minister Wang Wentao and his US counterpart Gina Raimondo on October 8 exchanged concerns about bilateral trade, in which the Chinese side called on the US to soon lift sanctions against Chinese businesses.

The phone call between Mr. Wang and Ms. Gina Raimondo was described by China as "frank, in-depth and pragmatic".

China's Ministry of Commerce said Mr. Wang Wentao "focused on expressing serious concerns about the US semiconductor policy toward China and restrictions on China's connected cars."

Meanwhile, China called on the US to properly assess the specific concerns of Chinese companies, lift sanctions on them as soon as possible, and improve the business environment for them in the US.

* China's recent National Day holiday boosted consumption through a combination of travel demand and promotional programs, showing the strong economic vitality of the world's second-largest economy.

According to China's Ministry of Transport, more than 2 billion cross-regional trips were made across the country during the seven-day holiday (October 1-7), up 4.1% on average compared to 2023.

The tourism boom not only boosted the development of tourism-related industries but also boosted consumer spending in various industries, underscoring the resilience of China's domestic market during and after the holiday.

* The strong and surprising growth of China's stock market in recent days has put nine of its businessmen on the list of the world's richest people.

As of the end of October 8, a total of 55 Chinese entrepreneurs were on the Bloomberg Billionaires Index, a list of the world’s 500 richest people. Compared to 46 billionaires on September 23, the increase in the number of Chinese billionaires today shows the “strength” of the wave of rising stock prices on the country’s stock exchanges, triggered by a series of economic, financial and market support measures by the government.

Europe

* On October 8, the European Union (EU) said it would file a lawsuit with the World Trade Organization (WTO) to protest China's imposition of anti-dumping measures on brandy imported from the bloc.

Beijing's move is believed to be a response to the European Commission (EC) after the agency imposed additional import duties on electric vehicles produced in the Northeast Asian country.

China's Ministry of Commerce has released a detailed list of the tariffs each company will have to pay, ranging from 30.6% for Martell to 39% for Jas Hennessy and 38.1% for Remy Martin.

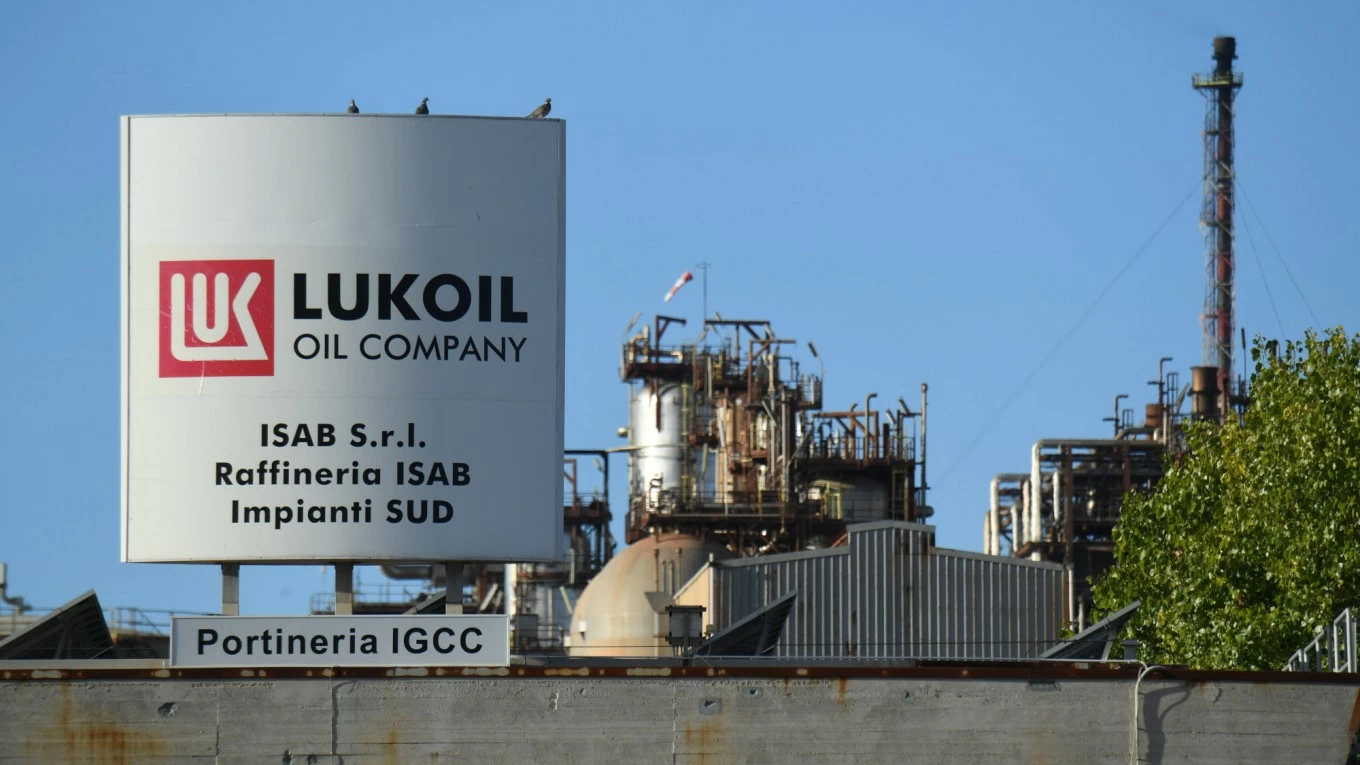

* According to Reuters , the price of Russia's Urals oil for October 2024 delivery has risen back above $65/barrel at export ports in the Baltic and Black Seas, $5/barrel higher than the price ceiling imposed by the West.

Traders said the steep discount to India and rising shipping costs have limited the upside for Urals, although the cap is small. Since the start of the year, prices for Russia’s Urals have mostly been above $60 a barrel, Reuters calculations based on oil trader data show. Prices hit $65 a barrel in late August.

* Europe's heavy industry is likely to return to cutting gas use by 2025, analysts say, amid a tightening gas market and rising prices.

The International Energy Agency (IEA) has just released a report showing that global gas demand this year is increasing sharply compared to the past two years and is expected to reach a record high in 2024 and 2025.

In its annual global gas security assessment, the IEA said that industrial gas demand in Europe is recovering as prices stabilize. However, consumption is expected to decline in the coming years as companies continue to struggle with higher energy costs compared to other regions and weak economic growth.

* Germany's Federal Statistical Office (Destatis) announced on October 7 that industrial orders in the country in August 2024 decreased more than expected, increasing the risk that Europe's largest economy could fall into recession by the end of this year.

According to Destatis, new orders fell by 5.8% in August 2024 compared to July 2024. This figure represents a reversal after a 3.9% increase recorded in July 2024. Excluding large orders that can vary from month to month, the number of orders in August 2024 fell by 3.4%.

Japan and Korea

* Tokyo Metro has set the initial public offering (IPO) price at 1,100 to 1,200 yen per share, compared with an initial estimate of 1,100 yen per share, according to a filing with the regulator on October 7.

At the top end, Metro Tokyo, one of two subway operators in Japan's capital, will raise 349 billion yen ($2.35 billion), marking Japan's biggest IPO in six years .

* Real wages in Japan fell 0.6 percent year-on-year in August 2024, marking the first decline in three months, as wage growth failed to keep pace with inflation, official government data showed.

The decline in real wages also reflects the gradual reduction of summer bonuses in June and July 2024.

* According to statistics released by the Korea Electricity Exchange on October 9, Korea's peak electricity demand hit a new record in September 2024 as the scorching heat of summer extended into autumn.

Accordingly, Korea's peak electricity demand in September 2024 averaged 78 GW, up 6% year-on-year, marking the highest level in September history. This figure was only slightly lower than the 80.5 GW recorded in July during the peak of the summer heat wave.

The increase was due to increased electricity consumption for air conditioning due to the heat wave that lasted throughout September. The average temperature across South Korea in September was 24.7 degrees Celsius, 4.2 degrees higher than the normal average, marking the highest temperature recorded since 1973.

ASEAN and emerging economies

* On October 7, the Director General of Bilateral Affairs of the Cuban Ministry of Foreign Affairs, Carlos Miguel Pereira, announced that the Caribbean island nation has officially applied to join the BRICS group of emerging economies as a partner country.

Earlier, Cuban Foreign Minister Bruno Rodríguez Parrilla affirmed the country's determination to strengthen relations with BRICS.

* According to Indonesian Deputy Finance Minister Thomas Djiwandono, the ASEAN region has demonstrated its economic resilience as the region's growth contributed 3.6% to the world's GDP.

Speaking at the ASEAN Treasury Forum on October 3 in Bali, Mr. Thomas Djiwandono said that ASEAN's economic growth this year is expected to reach 4.5%, the highest in the world, while global economic growth is expected to reach 3.2%.

In fact, the ASEAN economy has overcome many crises over the years, demonstrating its resilience. Based on statistical data, 17% of foreign direct investment (FDI) was poured into ASEAN in 2022, making ASEAN one of the highest FDI recipients compared to other developing regions.

Going forward, Thomas said, ASEAN countries need to continue to strengthen regional resilience and connectivity to achieve long-term economic development.

* According to Mr. Apurva Sanghi, chief economist of the World Bank (WB) in Malaysia, the WB has raised its economic growth forecast for Malaysia to 4.9% in 2024 from the initial forecast of 4.3% given in April.

All domestic and external factors support the latest growth forecast, Mr Sanghi said, adding that the global economy is performing much better than expected six months ago.

Meanwhile, in Malaysia, positive economic momentum, increased political stability and an increasingly favorable policy environment are driving and mobilizing more investments.

* Thai authorities are implementing measures to strengthen screening of imported goods to prevent smuggling of poor quality products and protect the country's industries.

Specifically, Industry Minister Akanat Promphan said that the Ministry has worked with various sectors, instructing the Thai Industrial Standards Institute (TISI) to coordinate with the Customs Department to close the EXEMPT 5 import channel from October 1 to prevent smuggling of poor quality goods.

Items imported through EXEMPT 5 are TISI controlled goods, not for sale and imported in limited quantities. They are exempt from licensing or certification due to their small quantity, making this channel a loophole for the import of poor quality goods.

Source: https://baoquocte.vn/kinh-te-the-gioi-noi-bat-4-1010-dau-nga-phot-lo-gia-tran-cua-phuong-tay-doanh-thu-kenh-dao-suez-lao-doc-tang-truong-asean-cao-nhat-toan-cau-289498.html

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Steering Committee for key projects in the transport sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/0f4a774f29ce4699b015316413a1d09e)

![[Photo] General Secretary To Lam holds a brief meeting with Russian President Vladimir Putin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/bfaa3ffbc920467893367c80b68984c6)

Comment (0)