On the evening of August 22, politician Bart De Wever, leader of the nationalist N-VA (New Flemish Alliance) party and the person tasked with forming a new government in Belgium, officially submitted a request to King Philippe to resign from this task.

|

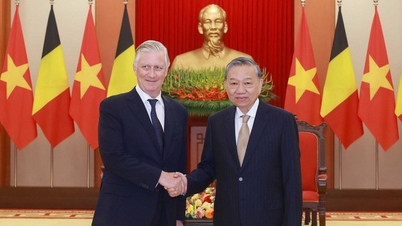

| King Philippe (left) and Bart De Wever, leader of the nationalist N-VA party, during a meeting on August 22. (Source: Belga) |

According to Belga news agency, King Philippe has accepted Bart De Wever's resignation and will continue to meet with leaders of Belgian parties to find a solution. However, the goal of forming a new government in a short time is not easy.

The decision was made by Mr. Bart De Wever after weeks of failed coalition talks, pushing the country to the brink of a new political crisis.

Bart De Wever was tasked with forming the Arizona coalition between five parties: N-VA, the liberal Reform Movement (MR), the Christian Democrats of Flanders (CD&V), the center-left socialist Vooruit and the centrist Les Engagés.

The main reason for this breakdown was deep disagreements between the parties over the tax reform plan.

Specifically, MR and Vooruit could not find common ground on tax increases, especially capital taxes. MR argued that the current proposals were too burdensome for businesses and citizens, while Vooruit wanted to expand the scope of taxation to obtain greater revenue.

The Belgian government originally planned to reduce tax rates by 2029, but the initial phase was too burdensome with many new taxes. Specifically, the reform package is expected to raise taxes on food by up to 2 billion euros due to the policy of increasing the value-added tax (VAT) from 6% to 9%, applicable to items such as meat, bread and eggs.

In addition, excise taxes on gasoline will increase. Most notably, the proposal to increase capital gains tax - the most controversial issue in the negotiations.

MR wants to tax only stock transactions, while Vooruit wants to expand the scope of the tax – including the sale of businesses – to create a larger capital tax.

The new tax package, which could amount to €5.5bn, will have a significant impact on small and medium-sized businesses, MR stressed. The measure includes plans to tax “comprehensive benefits” schemes currently enjoyed by employers.

The failure to reach an agreement on tax reform has brought the negotiations to a standstill. This failure not only affects the future of the new government but also raises many questions about Belgium's political stability in the future.

Source: https://baoquocte.vn/bi-dam-phan-lap-chinh-phu-bat-thanh-nguoi-duoc-chon-mat-gui-vang-bo-cuoc-khung-hoang-chinh-tri-chuc-cho-bung-phat-283587.html

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)