Ms. Anh's company owes social insurance (SI) to employees from June 2022 until now, affecting the rights of employees. Ms. Anh is planning to have a baby so she wants to quit her job to find a new one.

Ms. Anh wondered: "If I now report my resignation and apply for a job at a new company, continue to participate in social insurance at the next company, and after 12 months of participation, if I get pregnant, will I be entitled to maternity insurance? If I am entitled to maternity insurance, do I need to provide any additional documents or papers at the old company?"

Maternity benefits greatly support female workers during childbirth (Illustration: Son Nguyen).

According to Vietnam Social Security, the conditions for enjoying maternity benefits are stipulated in Clause 2 and Clause 3, Article 31 of the 2014 Law on Social Insurance.

Based on the above regulations, female employees giving birth must pay social insurance for at least 6 months within 12 months before giving birth to be eligible for maternity benefits.

In case you have paid social insurance for 12 months or more but have to take time off work to rest during pregnancy as prescribed by a competent medical examination and treatment facility, you must pay social insurance for 3 months or more within the 12 months before giving birth.

According to Vietnam Social Security, if Ms. Anh participates in social insurance at the new company, if she meets the conditions for maternity benefits according to the above regulations, the company will prepare a request for maternity benefits. When the application is submitted, the Social Security agency will review and resolve it.

In case Ms. Anh has paid social insurance at her new company for less than 6 months or more in the 12 months before giving birth, she can request her old company to be responsible for paying social insurance for the period of social insurance debt. After that, the social insurance agency will add it to the social insurance payment period at the new company to resolve the maternity regime for Ms. Anh.

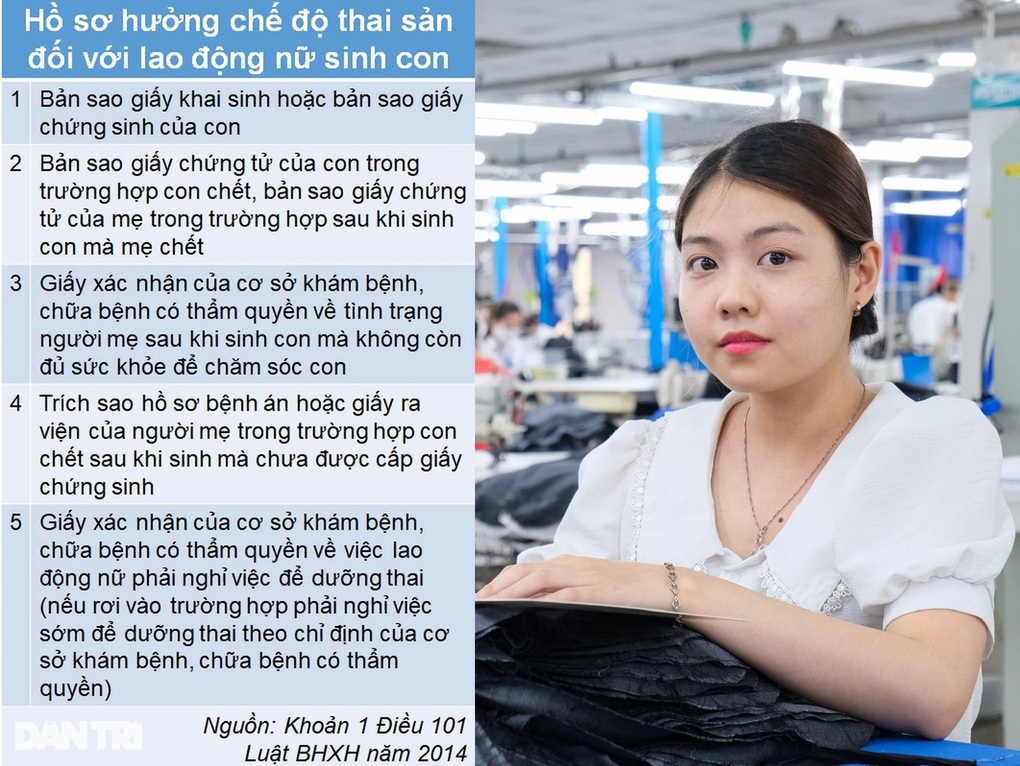

Regarding maternity benefits for female employees giving birth, Vietnam Social Security said it is regulated in detail in Clause 1, Article 101 of the 2014 Law on Social Insurance.

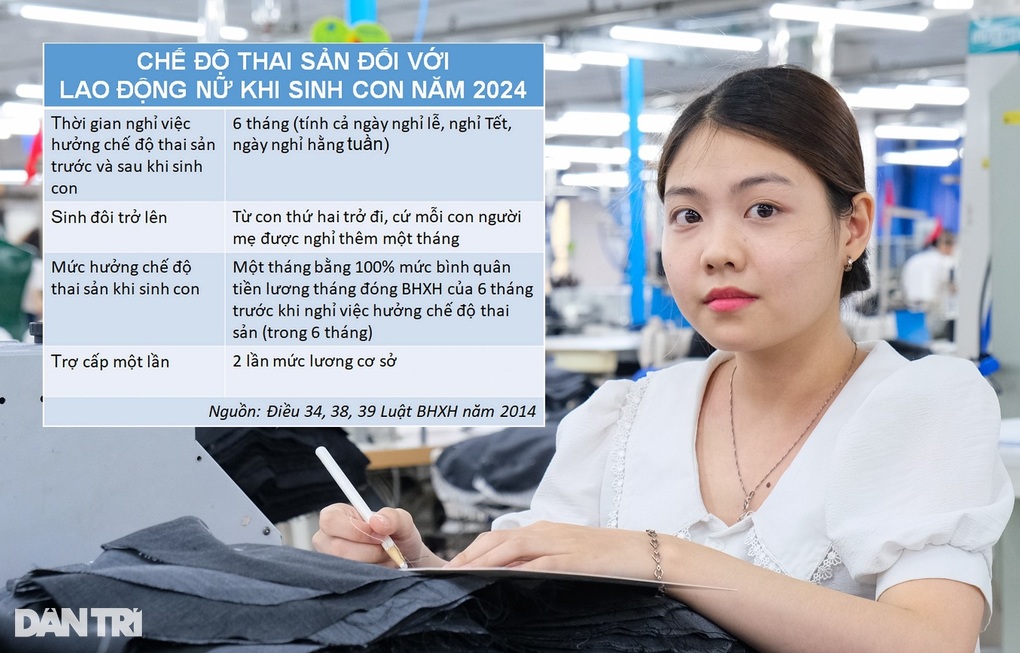

Maternity benefits for female employees giving birth include 4 items: Leave for prenatal check-ups, one-time allowance upon childbirth, maternity allowance during childbirth, and postnatal care allowance.

Source: https://dantri.com.vn/an-sinh/cong-ty-cu-no-tien-bhxh-thi-co-duoc-huong-che-do-thai-san-khong-20240917143422864.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference to promote public investment growth momentum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/7d1fac1aef9d4002a09ee8fa7e0fc5c5)

Comment (0)