Health tech is a “rising star” in fundraising

Health tech startups are leading in attracting investment capital in 2023, surpassing industries such as finance, retail or education.

The information was published in the “Vietnam Technology and Innovation Investment Report 2024”, issued by the National Innovation Center (NIC) and Do Ventures Investment Fund.

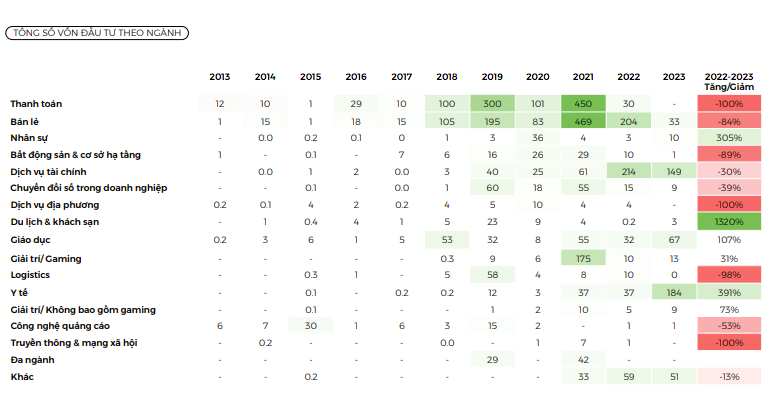

According to this report, in 2023, Vietnamese health technology (healthtech) startups raised up to 184 million USD, an increase of 391% compared to the previous year. This is also the field that attracted the most investment capital, surpassing the "champion" of 2022, financial technology (fintech).

|

| Capital poured into startups in the healthcare sector will be the largest source of capital in 2023. |

Many health tech startups have successfully raised tens of millions of dollars in 2023, while the global and regional fundraising market faces a gloomy situation.

The most typical is the deal to raise more than 51 million USD in the series B round of wholesale drug startup Buymed. Through the electronic portal thuocsi.vn, pharmaceutical manufacturing and distribution companies will be connected with about 35,000 pharmacies and clinics in 63 provinces and cities nationwide. Thanks to the application of technology, Buymed contributes to solving the problem of fragmentation in the pharmaceutical distribution market.

Another health tech startup that successfully raised capital in 2023 is Gene Solutions. Founded in 2017 by Vietnamese scientists with an educational background in the US, Gene Solutions aims to bring affordable and accessible genetic testing services, especially to people in developing countries. Developing testing technologies that reduce costs and waiting times for patients has made Gene Solutions attractive to investors. Therefore, in 2023, the startup successfully raised $21 million in capital from Mekong Capital.

Ms. Le Hoang Uyen Vy, co-founder of venture capital firm Do Ventures, commented: “Vietnam has many promising startups in the field of medical technology, the market is still in its early stages.”

According to experts, in the context of the "winter" of capital calling that has not yet passed, healthcare and education can continue to be magnets attracting investment capital. These are essential industries in life, so opportunities will still come to startups with good products and "healthy" cash flows. On the contrary, non-essential industries such as tourism, entertainment, fashion, payment, finance... or industries that need a lot of capital at the beginning to invest in facilities, attract users... will have more difficulties.

In the healthcare sector alone, Vietnam continues to assert its position as an attractive market for investors. The rapid growth of the middle class, increased health awareness among people after the pandemic, and the still unresolved overcrowding in public hospitals, have created a high demand for private healthcare services.

In a report on the outlook for the healthcare industry in Vietnam published by Kirin Capital, the analyst said the industry's market size is growing rapidly.

This is reflected in the total healthcare spending in Vietnam increasing from 16.1 billion USD to 22 billion USD in the period 2017-2022. In addition, healthcare spending/GDP of Vietnam also increased from 4.52% in 2016 to about 6.5% in 2022.

Kirin Capital forecasts that the healthcare industry will continue to maintain its growth momentum in the coming years with an average growth rate of 15% per year in the 2023-2025 period.

PwC, an auditing company, predicts that the healthcare sector will be one of the few leading sectors attracting FDI capital to Vietnam, in the context of businesses falling into the "winter" of capital calling. The size of the domestic healthcare market will increase gradually over the years, and is estimated to reach 23.3 billion USD by 2025.

Source: https://baodautu.vn/cong-nghe-suc-khoe-la-ngoi-sao-dang-len-trong-mang-goi-von-d214759.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)