POM shares under strong selling pressure after news of mandatory delisting

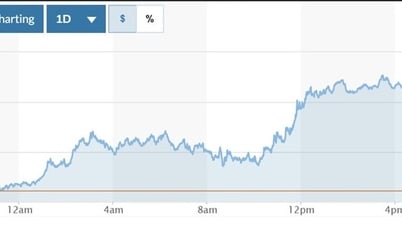

Pomina Steel shares lost momentum, falling more than 3% in the morning session of April 3 after HoSE announced that it would delist the shares because the company was late in submitting financial reports for 3 consecutive years.

This morning, the Ho Chi Minh City Stock Exchange announced that it will delist shares of Pomina Steel Joint Stock Company (stock code: POM) because the company has been late in submitting financial reports for three consecutive years.

The news of the stock being delisted caused POM to lose its momentum from yesterday's session, and face strong selling pressure in the April 3 trading session. This morning, the stock fell sharply by less than 0.5% compared to the reference price, down to VND5,000. However, from mid-session, the market price dropped rapidly and is currently down 3.2% compared to the reference price, down to VND4,860. Stock liquidity this morning reached more than 1 million shares, equivalent to a trading value of VND5 billion.

POM's current price range has decreased by 16% compared to the peak of VND5,800 since the beginning of the year. With more than 279.6 million listed shares, the company's market capitalization at current market price is VND1,353 billion.

On March 28, the company submitted an application for an extension of the deadline for submitting the audited financial statements. The extension is until May 15. Explaining the delay in submitting the audited financial statements for 2023, the company's management said that it is actively working with its investment partners on a restructuring plan to provide auditors with a review of the ability to assume a going concern, along with solid evidence for this assumption to overcome the negative equity situation.

“Because the investor is still considering making a cooperation agreement, it will take a certain amount of time,” Pomina Steel added.

According to the independent financial report, in 2023, the company recorded net revenue of VND 3,281 billion, a sharp decrease compared to VND 12,936 billion of the previous year and far below the revenue target of VND 9,000 set by the company's management. The company reported a loss after tax for the whole year of VND 960 billion, far exceeding the expected loss of VND 150 billion.

The company currently has VND8,809 billion in liabilities, an increase of nearly VND400 billion compared to the beginning of the year. Most of this is short-term and long-term financial debt. Owners' equity at the end of the year was VND1,594 billion. Undistributed loss after tax increased to VND1,270 billion.

Recently, Pomina Steel also announced a restructuring plan. Specifically, the company's board of directors said the purpose of the restructuring is to synchronize the steel smelting and rolling stages to optimize production capacity at Pomina 1 Steel Plant and Pomina 3 Steel Billet Plant. In addition, another purpose of the restructuring plan is to improve the financial structure of the company.

Accordingly, the company will establish a new legal entity, Pomina Phu My Joint Stock Company, with a charter capital of VND2,700-2,800 billion and a bank loan of VND4,000 billion. Pomina will own 35% of the charter capital (equivalent to VND900-1,000 billion) and the investor will own 65% of the charter capital (equivalent to VND1,800-1,900 billion). Pomina will contribute all the land, factories, and equipment lines of the two factories Pomina 1 and Pomina 3, while the new investor will contribute capital in cash.

Another content of the restructuring plan is that Pomina Phu My Joint Stock Company will use the Pomina brand and distribution system. Next, the Board of Directors will be authorized to continue negotiating with investors on the merger of Pomina 2 Joint Stock Company and Pomina Phu My Joint Stock Company to take advantage of the blast furnace and reduce production costs. The final content is to terminate the business registration of the two units, Pomina 1 and Pomina 3.

After contributing capital, Pomina expects to recover about 5,100-5,800 billion VND. Pomina said it will use the money recovered from the new legal entity to pay short-term and long-term debts to banks, debts payable to suppliers and the remaining capital to supplement working capital. Of which, the company will pay debts to banks (short-term and long-term) about 3,757 billion VND and pay debts to suppliers about 1,343 billion VND.

Previously, the company's management said that the strong restructuring process, especially with the participation of a strategic investor, is a milestone marking an important turning point for the company. This strategic cooperation will provide the necessary capital for the company to restart the steel billet blast furnace. The company plans to resume operations of the blast furnace in the last quarter of this year to anticipate the return of real estate projects.

Source

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

Comment (0)