Bank stocks support, VN-Index maintains 1,300 point mark

Many banking stocks had positive fluctuations with active trading, helping to keep the VN-Index green. Foreign investors continued to net sell more than VND1,400 billion on the HoSE floor in today's session.

After sessions of accumulation around the 1,282-1,292 point threshold, the market broke through the 1,292 zone with a decisive state to move towards 1,300 points in the session on June 12. HoSE liquidity was moderate in this session. Last night, investors received information that the US Consumer Price Index (CPI) did not increase in May and the possibility of the US Federal Reserve (Fed) cutting interest rates in September also increased... However, the less good news was that the Fed unexpectedly signaled that there would be only one interest rate cut in 2024, appearing more "hawkish" than the market forecast.

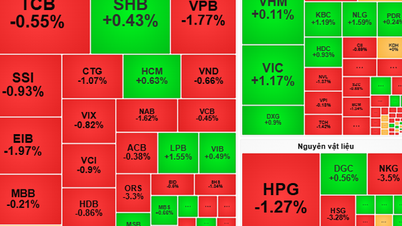

Entering the trading session on June 13, the market's excitement was maintained and many stock groups increased in price, helping to pull the indices above the reference level, VN-Index "jumped" Gap (price gap) to increase. However, the market's excitement could not be maintained for long when strong profit-taking pressure appeared, which caused some stock groups to no longer maintain their positivity. VN-Index then only fluctuated narrowly around the reference level.

At the end of the trading session, there was a time when demand increased in the banking group and helped the excitement return, but similar to the morning, profit-taking pressure was also continuously pushed up, so the market's fluctuations were still only around the reference.

The market focus was on the banking group, which was the main driving force in helping the VN-Index maintain the 1,300-point mark. In particular, TPB surprised everyone when it increased by nearly 3% to VND19,000/share and matched orders of nearly 44 million units. TPB was also in the top 10 stocks with the most positive impact on the VN-Index with 0.29 points. MBB also had a positive trading session when it increased by 1.95% and contributed 0.58 points. BID increased by 0.94% with a contribution to the VN-Index of 62 points.

On the other hand, after yesterday's dividend closing session, FPT faced strong profit-taking pressure and fell 1.52%, FPT took away 0.72 points from the VN-Index. FPT was also net sold by foreign investors today with 722 billion VND. Following that, SAB fell 2.1% and took away 0.44 points. Stocks such as PLX, GVR... were also in the red today.

Real estate stocks also attracted attention with positive fluctuations although they could not maintain the excitement at the end of the session. In particular, SGR was pulled up to the ceiling price. NRC increased by 4.3%, AGG increased by 1.9%, DIG increased by 1.6%... In contrast to the developments of the banking or real estate groups, the securities group had a relatively negative session. TCI decreased by 2.1%, VDS decreased by 1.7%, AGR decreased by 1.5%, FTS decreased by 1.2%...

At the end of the trading session, VN-Index increased by 1.32 points (0.1%) to 1,301.51 points. The entire floor had 246 stocks increasing, 187 stocks decreasing and 77 stocks remaining unchanged. HNX-Index increased by 0.05 points (0.02%) to 248.36 points. The entire floor had 83 stocks increasing, 83 stocks decreasing and 78 stocks remaining unchanged. UPCoM-Index decreased by 0.12 points (-0.12%) to 99.02 points.

Total trading volume on HoSE reached 891 million shares, worth VND23,073 billion, of which negotiated transactions accounted for VND1,770 billion. Trading value on HNX and UPCoM accounted for VND1,717 billion and VND988 billion, respectively.

SHB was the stock with the strongest matching order in the market with 48.4 billion VND. VPB and TPB matched orders with 44.3 billion VND and 44 billion VND respectively. Banking codes such as MBB and STB also matched orders strongly in this session.

|

| Photo caption |

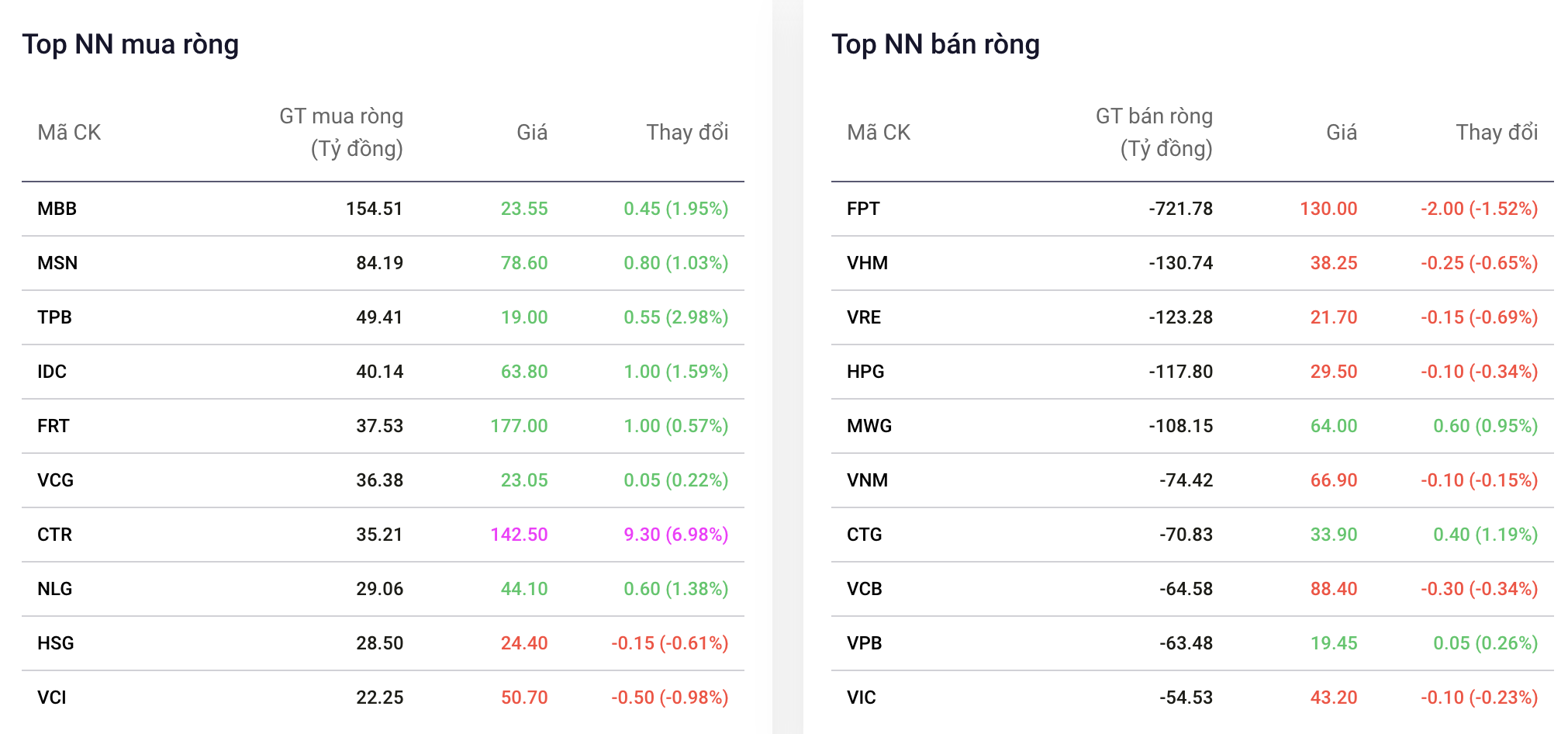

Foreign investors continued to net sell more than VND1,400 billion on HoSE in today's session, of which FPT was net sold VND722 billion. VHM, VRE, HPG and MWG were all net sold VND100 billion. Meanwhile, MBB was the most net bought with VND155 billion. MSN and VCG were net bought VND84 billion and VND36 billion, respectively.

Source: https://baodautu.vn/co-phieu-ngan-hang-nang-do-vn-index-giu-duoc-moc-1300-diem-d217603.html

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)