Financial pressure from financial leverage for BOT investment

Ho Chi Minh City Infrastructure Investment Joint Stock Company (Code CII) was established in 2001 and listed on the Ho Chi Minh City Stock Exchange (HoSE) in 2006. The company's main business activities focus on 3 areas: roads and bridges, water infrastructure and real estate infrastructure.

Currently, CII is facing problems surrounding its capital structure with a relatively high leverage ratio, with debt exceeding equity. This issue was raised by CII in the documents of the 2023 Extraordinary General Meeting of Shareholders.

CII said that in the past 5 years, the company's total assets have increased by VND7,850 billion (from VND20,709 billion to VND28,559 billion) while its charter capital has remained almost unchanged, at only VND2,800 billion. This has pushed up the financial leverage ratio.

CII issues 7,000 billion VND in bonds to restructure capital sources, will debt pile up on debt? (Photo TL)

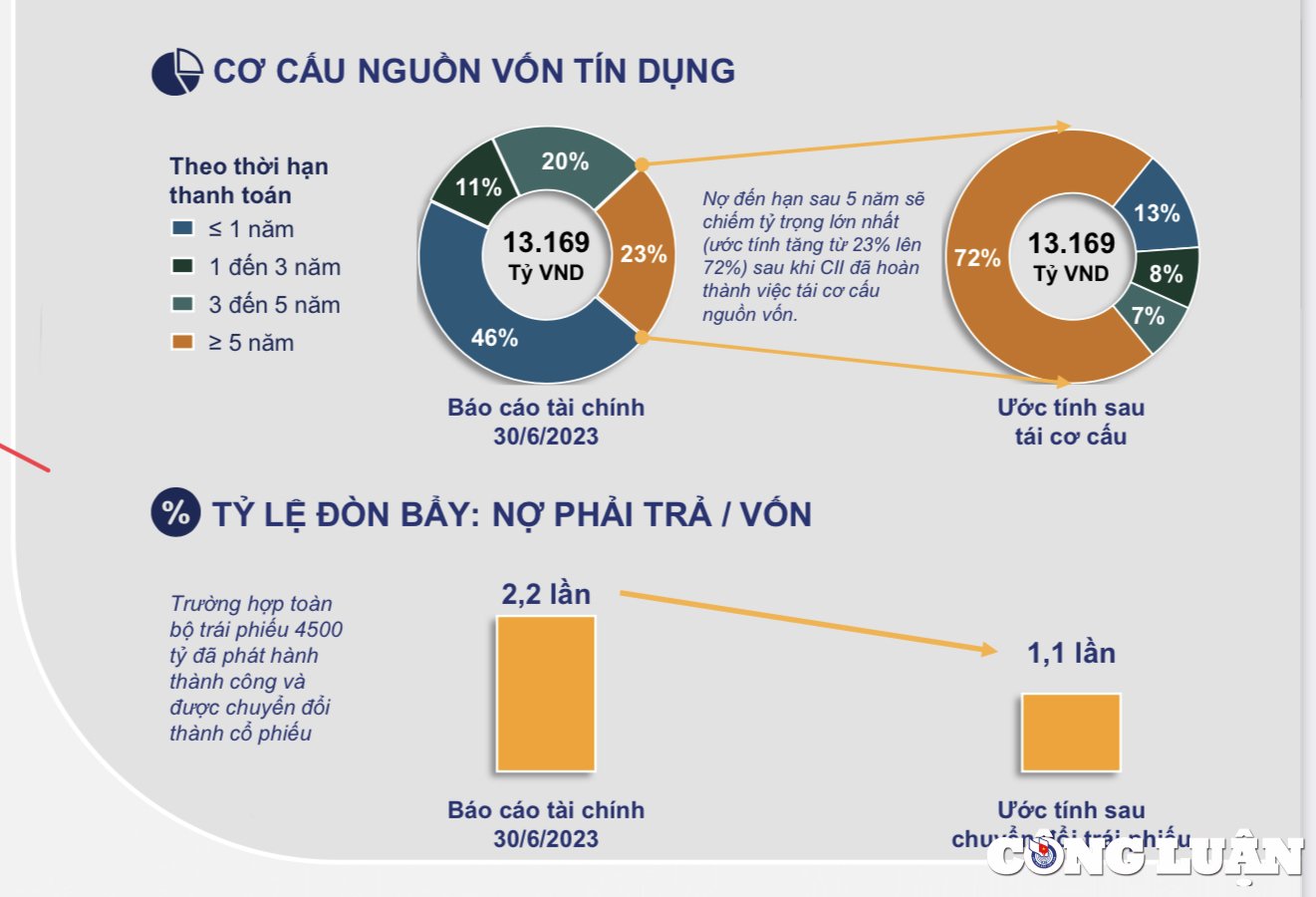

According to CII's explanation, this is the result of the company's financial leverage investment strategy to minimize dilution of stock value when issuing capital increases. As a result, the amount of debt increases, the financial pressure on CII is relatively large because credit sources only have a term of 5-7 years while BOT projects have a much longer payback period.

It can be understood that the problem that CII is facing is that the company is borrowing medium-term capital for long-term investment. This has caused financial pressure on business operations.

As of the end of the third quarter of 2023, CII's liabilities accounted for VND 18,022.6 billion, equivalent to 69.1% of total capital. Of which, the company is borrowing and owing short-term financial leases of VND 5,106.6 billion, borrowing and owing long-term financial leases of VND 7,791.1 billion. The company's total debt and financial leases are VND 12,897.7 billion.

In addition, CII is also recording other short-term payables of VND 2,039.7 billion and other long-term payables of VND 2,032.2 billion on the financial statements.

Regarding financial costs, in the first 9 months of 2023, CII had to pay financial costs of up to VND 1,170.2 billion. Of which, VND 920 billion was for interest payments. Thus, each month CII has to pay more than VND 100 billion in interest, equivalent to the pressure of paying interest of more than VND 3 billion per day, not to mention other obligations.

Plan to issue 7,000 billion VND in bonds to restructure capital sources, will there be debt on debt?

In the 2023 extraordinary shareholders' meeting document, CII announced a plan to restructure capital sources by issuing an additional VND 7,000 billion in long-term bonds.

This includes VND2,400 billion of bonds with a term of over 10 years, guaranteed by an international financial institution with a credit rating of AA-, which the company is negotiating. In addition, the company also offered an additional VND4,500 billion of convertible bonds to existing shareholders, with a term of 10 years. CII has worked with the State Securities Commission on the documents for the first batch of convertible bonds with an issuance value of VND2,840 billion.

CII's plan to restructure capital sources using convertible bonds (source: Documents of CII's 2023 Extraordinary General Meeting of Shareholders)

According to CII's estimates, CII's leverage ratio: liabilities/equity at 2.2 times (as of the end of the second quarter of 2023) will decrease to only 1.1 times after converting the entire VND 4,500 billion bond lot into shares.

However, it should be noted that this only happens if the above bond lot is converted into company shares. Otherwise, if the conversion does not take place, this additional capital will still be considered debt. The company will fall into a situation of debt on debt.

CII General Director and his wife divest all capital to buy convertible bonds, shareholders are concerned

Also revolving around the story of CII's convertible bond issuance, recently the company's shareholders have been very concerned when Mr. Le Quoc Binh, General Director, and his wife have divested all their capital to get money to buy convertible bonds.

Specifically, Mr. Binh sold 6 million CII shares, reducing his ownership ratio from 2.13% to 0% of charter capital. Ms. Hang, Mr. Binh's wife, sold 4 million CII shares, reducing her ownership ratio from 1.41% to 0%. Both transactions were conducted from October 10 to October 23.

At the extraordinary shareholders' meeting, Mr. Binh spoke up to reassure shareholders. According to Mr. Binh, he sold his shares to have capital to buy CII's convertible bonds. According to Mr. Binh, his position with the company has not changed after the above stock sales transactions.

During the period when Mr. Binh and his wife sold 10 million CII shares, the price of CII continuously decreased from VND18,400/share to VND15,600/share. It can be seen that CII decreased by 15.2% in value when Mr. Binh and his wife "dumped their stocks". This means that public shareholders temporarily suffered losses because CII shares lost 15.2% in value between October 10 and October 23.

Keeping his promise, Mr. Le Quoc Binh registered to buy 10 million convertible bond purchase rights coded CII42301. Ms. Hang, Mr. Binh's wife, also registered to buy 6 million convertible bond purchase rights CII42301. Trading period from October 26 to November 9.

Bond code CII42301 was issued by CII with a face value of VND100,000/bond. It is estimated that Mr. Binh and his wife spent about VND162 billion to buy these convertible bonds.

When the transaction is completed, Mr. Binh and his wife will become bondholders, equivalent to the position of creditors of CII. If these bonds are converted into shares, Mr. Binh and his wife will once again become shareholders of CII.

However, in case these bonds are not converted into shares, Mr. Binh and his wife will be in the position of bondholders, equivalent to creditors of CII. With this position, Mr. Binh and his wife will be given priority to repay the debt before other shareholders in case CII goes bankrupt. This is really an issue that many shareholders feel concerned about.

Returning to the story of CII's capital restructuring, the same assumption can also happen. If the VND4,500 billion of bonds are converted into shares, CII will follow the drawn scenario, reducing its financial leverage ratio from 2.2 to 1.1 times. But if the bonds are not converted into shares, CII will be in a situation of debt on top of debt.

Source

![[Photo] Fireworks light up the sky of Ho Chi Minh City 50 years after Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8efd6e5cb4e147b4897305b65eb00c6f)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)