VN-Index closed yesterday at 1,242.13 points, up 0.6%, volume increased 23% compared to the previous session and equal to 80% of the average level.

VN-Index closed yesterday at 1,242.13 points, up 0.6%, volume increased 23% compared to the previous session and equal to 80% of the average level.

Despite the recovery in points and liquidity in the previous session, cautious sentiment continued to dominate the general market in the session of November 27.

The indices fluctuated within a narrow range. There was strong differentiation among the stock sectors. The VN-Index remained above the reference level in the first half of the morning session, but in reality it was just a state of green on the outside and red on the inside.

Some large stocks, especially FPT, played a major supporting role, while many stocks decreased in price. Foreign investors maintained their net buying status in the morning session and prevented selling pressure from being pushed too high.

The tug-of-war situation also continued in the afternoon session when the VN-Index fluctuated with alternating increases and decreases. However, with red dominating many stock groups, the indices all closed in red.

At the end of the trading session, VN-Index decreased by 0.16 points (-0.01%) to 1,241.97 points. HNX-Index decreased by 0.61 points (-0.27%) to 223.09 points. UPCoM-Index decreased by 0.1 points (0.11%) to 91.96 points.

The entire market today had 314 stocks increasing, 369 stocks decreasing and 899 stocks remaining unchanged or not traded. The market recorded 17 stocks increasing to the ceiling price and 11 stocks decreasing to the floor price. On the HoSE alone, the number of stocks decreasing was nearly double that of stocks increasing.

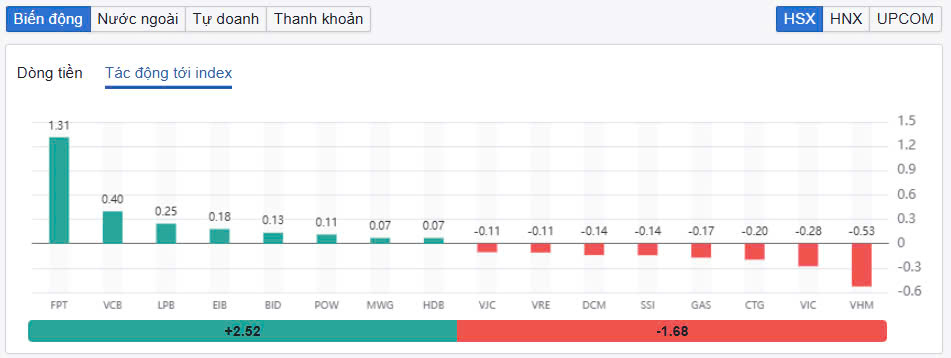

At the opening, FPT was the bright spot of the market today when it increased by 2.74% to VND138,900/share and was the most important factor supporting the VN-Index. FPT contributed 1.31 points to this index. In addition, banking stocks such as VCB, LPB, EIB, BID... all maintained green.

EIB increased by 2.2% right before the extraordinary shareholders' meeting to take place on November 28. At the meeting, the Board of Directors of Eximbank will submit to shareholders for consideration and approval the change of the head office location from Floor 8, Office No. L8-01-11+16, Vincom Center Building, No. 72 Le Thanh Ton, Ben Nghe Ward, District 1, Ho Chi Minh City to the new address of No. 27-29 Ly Thai To, Ly Thai To Ward, Hoan Kiem District, Hanoi. In addition to the issue of the head office, the extraordinary shareholders' meeting will also consider the proposals of the group of shareholders owning more than 5% of shares on the dismissal of senior personnel. Most recently, a group of shareholders owning more than 5% of capital at Eximbank has proposed to dismiss Mr. Nguyen Ho Nam and Ms. Luong Thi Cam Tu from the positions of members of the Board of Directors.

On the other hand, stocks such as SSI, VHM, VRE, VIC, CTG… were all in red and put a lot of pressure on the general market. VHM decreased by 1.18% and was the stock with the most negative impact on the VN-Index, taking away 0.53 points.

SSI decreased by 1.22% to VND24,300/share. Selling pressure also spread to many other securities stocks. Of which, BVS decreased by 2.1%, AGR decreased by 1.45%, VDS decreased by 1.38%, VND decreased by 1%...

|

| FPT is the main pillar supporting the VN-Index to rise. |

The most notable group of stocks today was fertilizer. Strong selling pressure appeared and caused many fertilizer stocks to plummet. DDV fell by 4.26%, BFC fell by 3.72%, DCM fell by 2.89%, DPM fell by 2.34%. The National Assembly just passed the Law on Value Added Tax (amended) on November 26, thereby deciding to impose a 5% tax on fertilizer. However, "news" has come out that this group of stocks did not have a positive trading session.

Real estate stocks also traded inactively, with many stocks in the red. NLG closed down 1.56%, CEO down 0.7%, NTL down 0.8%, and DIG down 0.24%.

Total trading volume on HoSE today was 429 million shares, equivalent to a trading value of VND11,356 billion, down 14.6% compared to the previous session. Of which, negotiated transactions contributed more than VND2,092 billion on HoSE. Trading values on HNX and UPCoM were VND570 billion and VND806 billion, respectively.

|

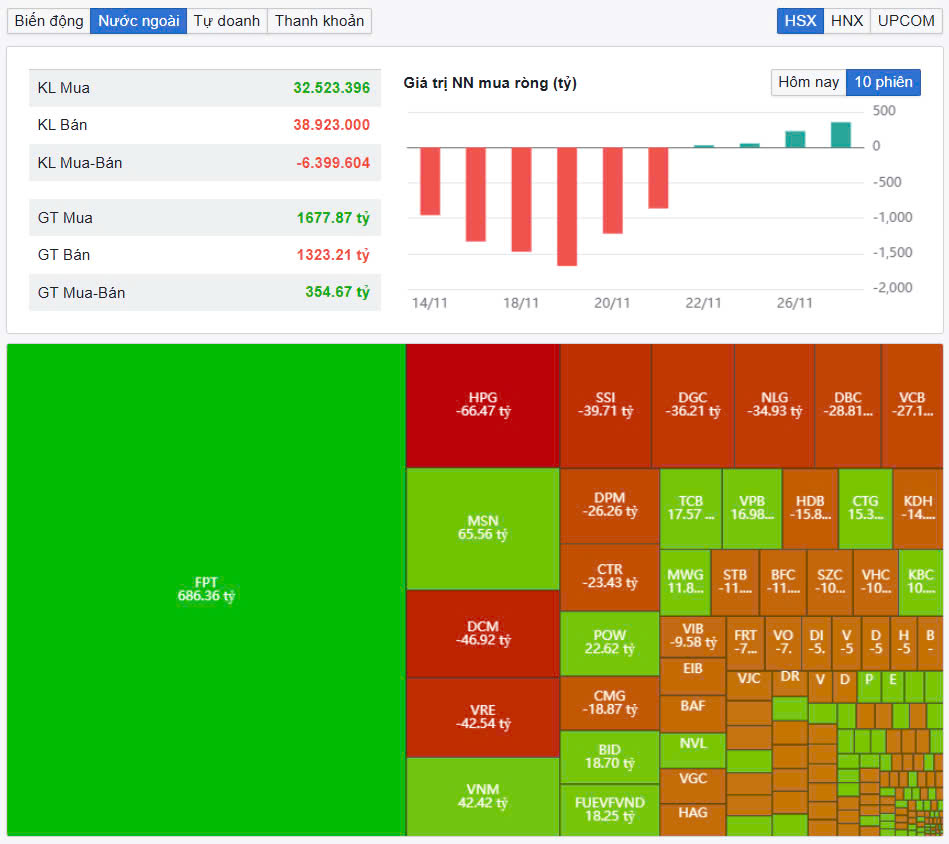

| The highlight of today's session is that foreign investors continue to disburse for the fourth consecutive session. |

The stock with the strongest trading value today was FPT with 1,358 billion VND, far surpassing the second-placed code DCM with 344 billion VND. MWG and DPM traded 297 billion VND and 232 billion VND respectively.

Foreign investors continued to maintain net buying status with about 359 billion VND on three exchanges.

FPT topped the list of foreign net purchases with VND686 billion. MSN followed with VND66 billion. Meanwhile, HPG was the most net sold with VND66 billion. DCM and VRE were net sold with VND47 billion and VND43 billion, respectively.

Source: https://baodautu.vn/chung-khoan-viet-nam-giao-dich-giang-co-phien-2711-diem-sang-fpt-d231112.html

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)