VN-Index faces profit-taking pressure, dividend payment schedule, Vietnam Airlines flies high on the floor, VNDirect net sells for 11 consecutive sessions, Sacombank has no plan to pay dividends,...

VN-Index loses points due to profit-taking pressure

At the end of the week, VN-Index closed at 1,255.11 points, down more than 13 points compared to the previous session, marking the third consecutive session of decline this week.

At the end of the week, VN-Index lost more than 26.4 points after 1 week of trading.

Liquidity remained positive, around VND21,000 billion. This shows that cash flow is still being traded regularly in the market, but the profit-taking trend is dominant, causing selling pressure to increase, causing the VN-Index to decrease.

Source: SSI iBoard

"Red" spread across the market with a series of large codes, the VN30 group and previous leading stock groups, including: banks, securities, real estate,... VIX (VIX Securities, HOSE) decreased by nearly 4%, SSI (SSI Securities, HOSE) decreased by 2.26%, MBB (MBBank, HOSE) decreased by 1.9%,...

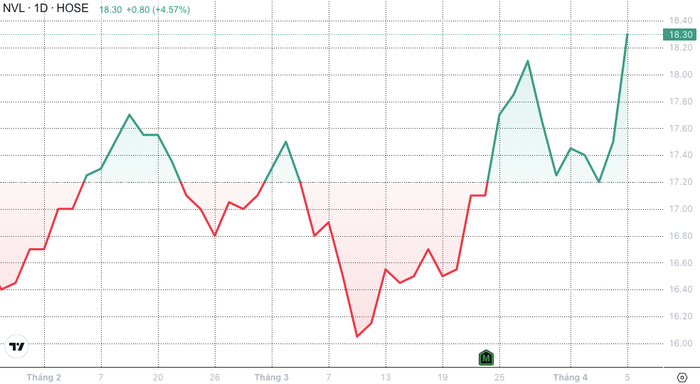

Recent stock performance of NVL (Source: SSI iBoard)

Meanwhile, many stocks unexpectedly broke out, notably NVL (Novaland, HOSE) which increased sharply by 4.57%, reaching record trading volume and value, respectively nearly 108 million shares, equivalent to 1,955 billion VND. This is also the 3rd highest liquidity in the history since NVL's listing.

In addition, Vietnam Airlines shares (HVN, HOSE) "flew high" with 6.67%, reaching a market price of 16,000 VND/share.

Foreign investors returned to net buying with NVL (Novaland, HOSE) reaching 224 billion VND (highest on the floor), MWG (Mobile World, HOSE) followed with 121 billion VND,...

VND under net selling pressure of nearly 50 million shares

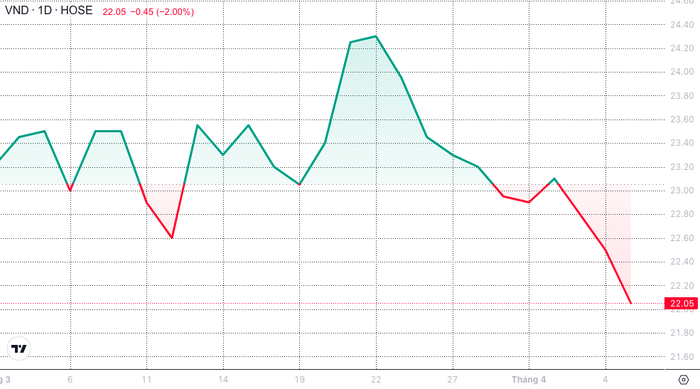

VND shares (VNDirect, HOSE) have been under pressure to correct in the last 2 weeks with 9/10 sessions decreasing. VND value dropped sharply by 9.3% to 22,050 VND/share, among the strongest declines in the securities group. Marking the 11th consecutive session of net selling by foreign investors in VND.

VND has "plummeted" since the system error incident until now (Source: SSI iBoard)

Since March 8, foreign investors have net sold VND stocks in 18/21 sessions, equivalent to about 48 million units. Based on current trading prices, foreign investors have withdrawn about VND 1,100 billion from VND.

This development is believed to have come from a system attack two weeks ago. Although it has been resolved, the consequences for both VNDirect and investors are quite significant.

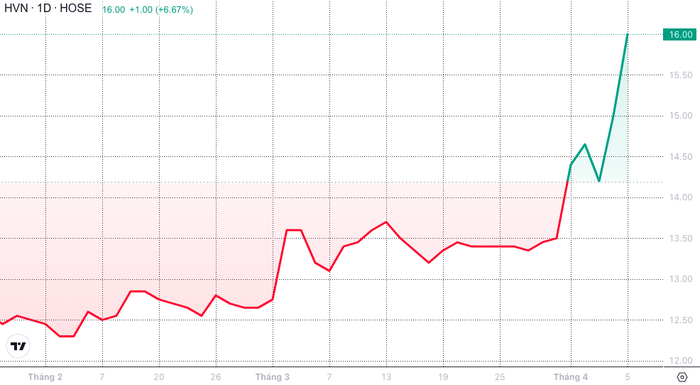

Vietnam Airlines "flying high" on the floor

At the end of last week's session (April 5), HVN shares (Vietnam Airlines, HOSE) soared 6.67%, reaching a market price of VND16,000/share. Since the beginning of the year, HVN shares have increased in value by more than 30%.

HVN unexpectedly "flew high" in an unfavorable context (Source: SSI iBoard)

Notably, HVN is currently under control and restricted trading (only allowed to trade in the afternoon session) by HOSE. Facing the risk of being delisted, HVN is waiting for a "special case" according to the draft amendment and supplement to the Securities Law of the State Securities Commission, which was consulted at the beginning of the year.

This situation comes from the airline's continuous losses over the past 4 years, with negative equity.

In 2023 alone, Vietnam Airlines achieved revenue of VND92,231 billion, up 30% over the same period, but HVN still lost VND5,631 billion after deducting expenses. Although the loss has been shortened compared to last year, Vietnam Airlines has not been able to return to positive profits.

Sacombank has not mentioned dividend for the 9th consecutive year.

According to the documents of the 2024 Annual General Meeting of Shareholders (AGM) of Saigon Thuong Tin Commercial Joint Stock Bank - Sacombank (STB, HOSE), in addition to the 2024 business story with profit targets, bad debt ratio, ... the issue that shareholders are particularly interested in is dividend distribution.

Sacombank still "forgets" to pay dividends to shareholders for the past 9 years (Photo: Sacombank)

Like previous years, Sacombank still did not mention the dividend plan. This year's profit distribution plan only includes allocation to the bonus and welfare fund.

As of 2024, Sacombank shareholders have been "forgotten" for 9 consecutive years about dividends from the bank (since 2015, dividends have been paid in shares, at a rate of 20%).

Previously, at the 2023 Annual General Meeting of Shareholders, many shareholders questioned Sacombank's leadership because of high profits, rising stock prices but still not paying dividends.

In 2023, Sacombank's profit was VND7,719 billion, a significant increase of 53% over the same period. STB shares increased in value by 15% in 2023.

Downtrend continues?

KB Securities commented that the market has not escaped the negative state and risks still exist. The possibility of a decline is high this week before there are clearer signs of recovery around the support zone near 1,250 points.

TPS Securities said that the large trading volume shows that the sellers are taking control of the market. The market is entering a correction phase. This week, the 1,230-point zone is the closest support zone for the market. If it cannot be maintained, the index may retreat to the 1,180-point zone. In addition, the company emphasized that short-term risks are tending to last, investors should carefully observe the market to restructure their portfolios.

At the same time, VCBS Securities believes that the market will continue to maintain its correction with the nearest support level at 1,235 - 1,240 points. Investors are advised to consider reducing their portfolios and not panic selling stocks during a sharp decline. Notable industry groups with buying signals include oil and gas, banking, real estate and public investment.

Dividend schedule this week

According to statistics, 5 companies announced dividend payment this week. Of these, 4 companies paid in cash and 1 company paid in shares.

The highest payout rate is 30%, the lowest is 5%.

PetroVietnam Transportation Corporation (PVT, HOSE) has set the right to pay dividends in shares, with the ex-dividend date being April 11, at a rate of 10%.

Cash dividend payment schedule of enterprises from March 25 - 31

* GDKHQ: Ex-rights transaction - is the transaction date on which the buyer does not enjoy related rights (right to receive dividends, right to buy additional issued shares, right to attend shareholders' meeting...). The purpose is to close the list of shareholders owning shares of the company .

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| WSB | UPCOM | 8/4 | April 26 | 30% |

| SBB | UPCOM | 12/4 | April 29 | 5% |

| REE | HOSE | 12/4 | April 26 | 10% |

| PAT | UPCOM | 12/4 | April 29 | 10% |

Source

![[Photo] Vietnam and Sri Lanka sign cooperation agreements in many important fields](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/9d5c9d2cb45e413c91a4b4067947b8c8)

![[Photo] President Luong Cuong and Sri Lankan President Anura Kumara Dissanayaka visit President Ho Chi Minh relic site](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/5/0ff75a6ffec545cf8f9538e2c1f7f87a)

![[Photo] President Luong Cuong presided over the welcoming ceremony and held talks with Sri Lankan President Anura Kumara Dissanayaka](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/5/351b51d72a67458dbd73485caefb7dfb)

Comment (0)