VN-Index returns to the beginning of the year, Nhat Viet Securities welcomes a new female president, Dat Xanh has not paid dividends for 5 years, VN-Index shows no signs of improvement, weekly dividend payment schedule,...

VN-Index returns to the beginning of the year level

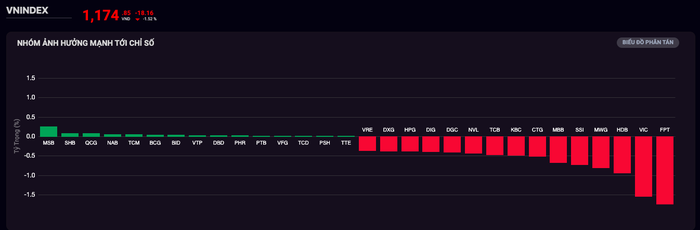

At the end of last week's trading session (April 19), the stock market continued to be on fire with the selling side dominating, the decrease ranged from 2-6%, to 1,174.85 points.

Liquidity reached VND 23,682 billion transferred, equivalent to 1,070 million matched shares, up 25% compared to the previous trading session on April 17.

The banking group improved slightly as it was no longer a drag on the market, and some stocks tended to increase slightly. The focus was on MSB (MSB, HOSE) up 1.9% at a market price of VND13,450/share. Next was SHB (SHB, HOSE) up slightly 0.45%, NAB (Nam A Bank, HOSE) up 0.63%, etc.

Large-cap stocks continue to hold back market growth, while small-cap stocks maintain a positive status (Photo: SSI iBoard)

Another bright spot appeared in foreign investors when they unexpectedly net bought 683 billion VND. Buying power focused on stocks: VNM (Vinamilk, HOSE) reached 94 billion, DIG (DIC Group, HOSE) reached 92 billion,...

After just one week of trading, the VN-Index lost a total of nearly 102 points, losing its efforts after the entire first quarter, returning to the starting point of 2024. Blue-chip stocks played a role in causing the market to fall sharply, in which, many stocks quickly lost nearly 20% of their value in just one week.

Typically, real estate, securities, public investment and retail groups: NVL (Novaland, HOSE) decreased by 18.36%, DXG (Dat Xanh Real Estate, HOSE) decreased by 21.21%, VND (VNDirect Securities, HOSE) decreased by 13.9%, PNJ (Phu Nhuan Jewelry, HOSE) decreased by 11.25%,...

The sharpest decline week "evaporated" nearly 480,000 billion VND (equivalent to 20 billion USD) of capitalization, of which, the HOSE floor alone had 413,700 billion VND (equivalent to 17 billion USD) of capitalization.

The rapid drop is mainly attributed to the fact that the VN-Index has been around the peak for quite a long time, so profit-taking pressure is inevitable. In addition, negative information flows, such as: the Fed's interest rate roadmap may be postponed; the escalating exchange rate creates pressure to maintain a loose monetary policy, etc., impacting market sentiment.

New female president of Nhat Viet Securities

Nhat Viet Securities announced the new Board of Directors for the 2024-2029 term and the new female chairwoman Nghiem Phuong Nhi (center) (Photo: Internet)

At the 2024 Annual General Meeting of Shareholders, Nhat Viet Securities Corporation (VFS, HOSE) elected a new Board of Directors for the 2024-2029 term with Ms. Nghiem Phuong Nhi as Chairwoman of the Board of Directors of VFS. Ms. Nhi graduated with a bachelor's degree from the National Economics University, and completed a bachelor's degree and master's degree in the Netherlands.

From 2008 to 2023, she was the Head of the Financial Investment Department of Viettel Group, a member of the Board of Directors of Viettel Post Corporation, and a member of the Board of Directors of Viettel Construction Corporation. Currently, Ms. Phuong Nhi is the Chairwoman of the Board of Directors of Hoa An Financial Investment Corporation and Chairwoman of the Board of Directors of Amber Fund Management Corporation.

In addition, at the meeting, the company announced this year's business plan along with approving a plan to sell 120 million shares to existing shareholders and issue 9.6 million shares to pay dividends.

Dat Xanh Real Estate 5 years no dividend payment

The minutes of the recent 2024 Annual General Meeting of Shareholders at Dat Xanh Group Corporation (DXG, HOSE) showed that the 2023 business results at DXG dropped significantly when profits decreased by more than 90%.

Recent developments in DXG stock (Photo: SSI iBoard)

Perhaps for this reason, the company announced that it would not pay dividends in 2023, and that in 2024, DXG plans to pay dividends at a rate of 20%. This also means that for the past 5 years, since 2018, DXG shareholders have not received dividends.

With the 2024 dividend payment set at 20%, under favorable business conditions, Dat Xanh shareholders will have to wait until the second half of 2025 to have the opportunity to receive dividends again.

Meanwhile, DXG shares on the floor are still one of the "hot" stocks as they are constantly being traded strongly, tens of millions of shares per session.

A Masan stock is expected to be listed on the HOSE next year.

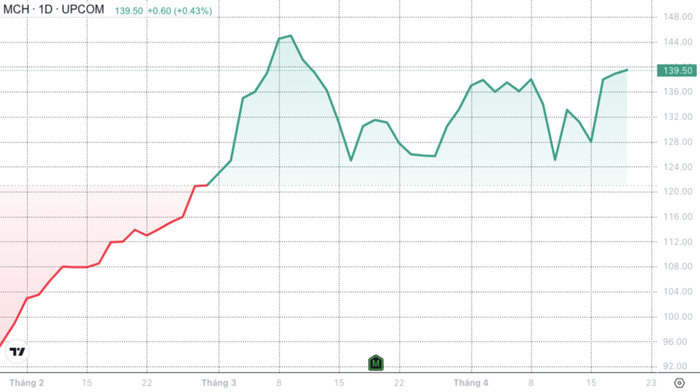

According to the latest analysis report, Masan Consumer Corporation (MCH, UPCoM) - a member of Masan Group (MSN, HOSE) is considering listing its shares on the HOSE in early 2025.

MCH is performing quite positively, contrary to the market trend (Photo: SSI iBoard)

With trading on the UPCoM floor as it is now, MCH's liquidity is relatively low. Moving to the HOSE floor is expected to be a big boost to MCH's liquidity.

HSBC believes that the plan to list MCH shares on HOSE may be boosted by the recent recovery of Masan Consumer.

MCH also impressed with high profit margins and steady earnings growth, outperforming its regional FMCG (fast-moving consumer goods) and packaged food peers.

Accordingly, HSBC maintains a BUY recommendation with a price target of VND 98,000/share.

Stock market comments and recommendations this week

KB Securities commented that the trading session at the end of the week was low because the selling side continued to dominate the whole week. This shows that the VN-Index is likely to continue to decline because negative sentiment is dominating the market. Investors should limit new purchases for existing positions, prioritize risk management and sell off, and restructure the portfolio in early recovery phases.

Sharing the same view, TPS Securities believes that a week of deep decline with high liquidity will affect investor sentiment in the coming trading weeks. The selling side will likely still dominate in the coming sessions when the two support zones of 1,210 points and 1,180 points were quickly broken after only 2 sessions. TPS recommends that investors should wait for reactions to the same support zones such as 1,150 points and 1,180 points if there are signs of price increase with strong liquidity before disbursing.

Dividend schedule this week

According to statistics, 10 companies announced dividend payouts this week. Of these, 9 companies paid in cash and 1 company issued additional shares.

The highest payout rate is 25%, the lowest is 2%.

Ba Ria - Vung Tau Housing Development Corporation (HDC, HOSE) will pay dividends by issuing additional shares at a rate of 14.8%, the ex-dividend date is April 26.

Cash dividend payment schedule of enterprises from April 22 - 28

* GDKHQ: Ex-rights transaction - is the transaction date on which the buyer does not enjoy related rights (right to receive dividends, right to buy additional issued shares, right to attend shareholders' meeting...). The purpose is to close the list of shareholders owning shares of the company .

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| BBM | UPCOM | April 23 | June 13 | 2% |

| VPD | HOSE | April 23 | 5/22 | 10% |

| RAL | HOSE | 24/4 | 9/5 | 25% |

| HSG | HOSE | 24/4 | 10/5 | 5% |

| SZC | HOSE | 24/4 | 9/26 | 10% |

| EPH | UPCOM | 24/4 | 5/27 | 13% |

| FHS | UPCOM | April 26 | 14/5 | 12% |

| SCY | UPCOM | April 26 | 15/5 | 3.8% |

| KTW | UPCOM | April 26 | 17/5 | 2.9% |

Source

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

![[Photo] Fireworks light up the sky of Ho Chi Minh City 50 years after Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8efd6e5cb4e147b4897305b65eb00c6f)

![[Photo] Feast your eyes on images of parades and marching groups seen from above](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/3525302266124e69819126aa93c41092)

Comment (0)