According to experts, workers facing difficulties will be limited in withdrawing one-time benefits if they are given a mortgage loan secured by contributions to the social insurance fund.

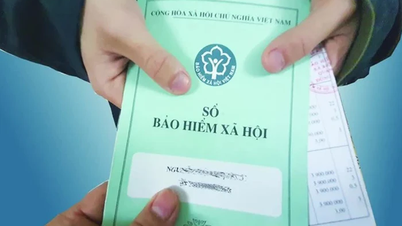

Recently, the Ho Chi Minh City Social Insurance (HCMS) proposed to study the issue of considering the number of years and the amount of money contributed to the pension fund as accumulated assets so that employees can borrow money from the Social Policy Bank at preferential interest rates when in urgent need. The amount of money borrowed is based on the financial credit rating such as the time and the level of compulsory social insurance contributions of the employee. The insurance agency is responsible for notifying the bank when the pension fund contribution changes so that both parties can conveniently handle debts.

The above proposal was also sent to the Prime Minister by the Private Economic Development Research Board (Board IV) at the end of May after consulting with workers.

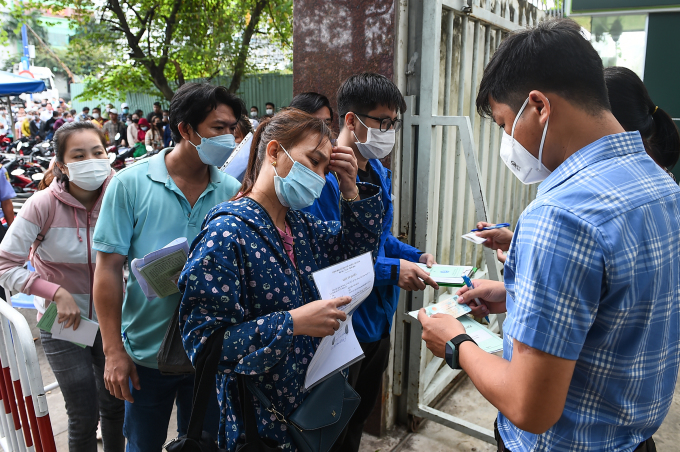

People withdraw one-time benefits at Thu Duc City Social Insurance, end of 2022. Photo: Thanh Tung

Dr. Vu Minh Tien, Director of the Institute of Workers and Trade Unions, said that in terms of workers' needs, this is a suitable solution. A survey conducted by the institute at the end of last year with over 6,200 workers showed that if they lost their jobs, only 11.7% had savings that could last less than a month; 16.7% could last 1-3 months and 12.7% could last more than three months. At this time, the money contributed to the fund is the only savings they have, "no different from a savings book".

According to Mr. Tien, there are people who only need 20-30 million VND to solve their difficulties. However, they cannot ask the Social Security agency to receive a portion of the amount they have paid, just enough to cover their expenses, but are forced to withdraw the entire amount. This forces workers to leave the social security system. If they have not worked for a year, workers will sell their insurance books at a child price.

In fact, there are cases where workers withdraw their social insurance at one time, then have a good job, have income and want to pay back the money, accept to pay the interest to receive a pension but the law does not allow it. Therefore, when lending with a mortgage, the amount of money received at one time will add more options for workers.

Mr. Cao Van Sang, former director of the HCM City Social Insurance Agency, said he had known about the model of mortgaging insurance books to borrow capital since 1999 when he went to the Philippines to study experience. All employees participating in the pension fund are eligible for loans depending on the time and level of contribution.

According to Mr. Sang, when implementing this policy, the social insurance industry has two benefits. First, employees are very interested in the results of contributions to the fund, because when contributing at a high level, they will be able to borrow a lot over a long period of time. Due to the immediate impact of benefits, employees will react when businesses "split" their salaries into many payments to participate in low-level insurance. This helps limit the situation of underpayment and underpayment.

Second, the fund's surplus is lent to banks by the Social Insurance but at a low interest rate of 6% per year. However, the interest rate when lending to employees through banks increases to 8% per year. This difference is divided in half for both parties, giving the fund more resources.

"This is a good way to help workers stay connected to the social insurance fund, make a profit and resolve the request to receive a one-time subsidy," said Mr. Sang.

People wait to withdraw their one-time social insurance in Hoc Mon district, Ho Chi Minh City, April 2023. Photo: Dinh Van

Financial expert Nguyen Cao Huu Tri said that in order to achieve the goal of mortgaging contributions to the social insurance fund when borrowing capital, helping workers stay in the social security system, the provision for one-time withdrawal of social insurance must first be closed. Because between one party having to pay interest on the loan and the other party receiving the entire contribution, workers will choose to withdraw insurance.

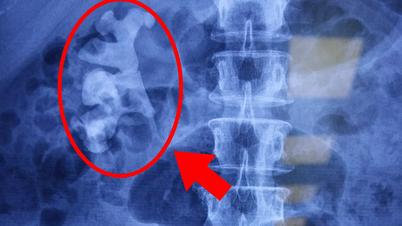

Currently, the draft Law on Social Insurance (amended) proposes that the maximum one-time withdrawal shall not exceed 50% of the total time of contribution to the pension and death benefit fund. Thus, the amount of the upcoming one-time benefit will be less than the current law. Therefore, if the loan limit is equal to the contribution to the fund, employees will switch to borrowing. Instead of withdrawing directly from the insurance fund, employees will switch to withdrawing indirectly from the bank. If they do not repay the debt, the last resort is to dispose of the mortgaged assets to preserve capital.

"When the amount of money contributed to the insurance fund is processed by the bank for a loan, the worker is no longer in the system. Thus, the goal of keeping them in the social security system will not be achieved," said Mr. Tri. Therefore, the loan limit needs to be designed appropriately, helping workers access capital to solve sudden difficulties while still maintaining the entire process of contributing to the fund so that they can receive a pension later.

Having worked in the banking sector for many years, Mr. Tri believes that in credit activities, lending is just a small matter, the important thing is the ability to repay the debt. If the worker is still working and has an income, commercial banks can participate. However, it will be very difficult for unemployed workers to pay off their debts. At this time, the participation of policy banks, state credit funds, and microfinance organizations with small loans will be more suitable.

Director of Ho Chi Minh City Social Insurance Lo Quan Hiep said that it is necessary to refer to the very successful approach of Korea. In addition to limiting one-time withdrawal, this country's banks design appropriate loan levels, quick disbursement, and support from employees. In particular, Korea stipulates that if a business has insurance debt, it will not be able to access loans from banks. Therefore, contributions to the fund are taken seriously, almost a top priority, making credit ratings very favorable.

Le Tuyet

Source link

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)