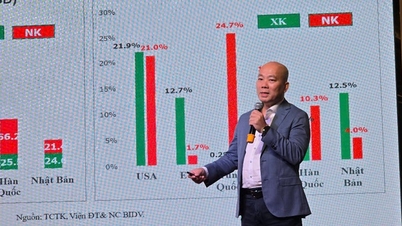

Deputy Director General of the General Department of Taxation Dang Ngoc Minh said: The application of additional corporate income tax under the regulations against global tax base erosion is part of Vietnam's commitment to international organizations, especially the Organization for Economic Cooperation and Development (OECD).

This is to ensure fairness in the international tax system, prevent profit shifting and avoid taxes being “lowered” through the transfer of interest or profits between multinational companies.

Currently, the General Department of Taxation is in the process of completing the draft Decree detailing Resolution 107/2023/QH15 dated November 29, 2023 of the National Assembly on the application of additional corporate income tax according to the provisions on preventing global tax base erosion to report to the Ministry of Finance to submit to the Government in accordance with the procedures of the Law on Promulgation of Legal Documents.

Accordingly, the draft Decree guides the contents that Resolution No. 107/2023/QH15 assigns the Government to specify in detail to fully implement the OECD's regulations on the synthesis of minimum taxable income (IIR) applicable to Vietnamese corporations investing abroad and the regulations on the standard domestic minimum supplementary tax (QDMTT) applicable to member companies with production and business activities in Vietnam of multinational corporations.

The draft decree has 3 parts, with 4 chapters and 24 articles, stipulating almost all relevant contents on the application of global minimum tax in Vietnam, from the scope of regulation, subjects of application, taxpayers, principles of applying QDMTT, determining the amount of standard domestic minimum additional corporate income tax... to tax inspection, examination and implementation responsibility.

According to VNA

Source: https://doanhnghiepvn.vn/kinh-te/chan-hien-tuong-chuyen-loi-nhuan-giua-cac-cong-ty-da-quoc-gia/20241209090517902

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)