The US Securities and Exchange Commission (SEC) has just approved the first Bitcoin exchange-traded funds (ETFs) to be listed on a stock exchange. This development is considered a turning point not only for Bitcoin - the world's largest cryptocurrency - but also for the entire cryptocurrency industry in general.

Requirements from practice

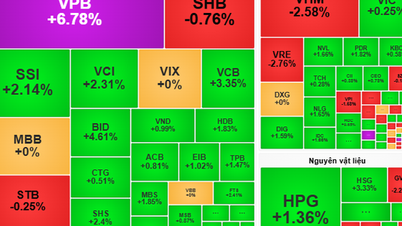

According to investors, this is an important boost for the cryptocurrency industry after a turbulent 2023. The Bitcoin ETF will be listed on the Nasdaq, NYSE and CBOE stock exchanges, and will be backed by the amount of Bitcoin purchased from cryptocurrency exchanges, with the supervision of specialized units, such as Coinbase Global. The parties will create a market monitoring mechanism, helping to avoid the risk of Bitcoin price manipulation and bring transaction fees to 0.2% - 0.8%, much lower than the average transaction fees in the general market.

The US's move towards Bitcoin also raises issues of conduct and building a legal framework for digital currency in Vietnam. According to statistics from Crypto Crunch App - an application in the US, Vietnam has nearly 26 million people owning virtual currency, ranking 3rd in the world, after India and the US. Other statistics also show that Vietnam is one of the countries with large cryptocurrency transactions on current exchanges.

According to the reporter's investigation, many people in Vietnam own valuable cryptocurrencies such as Bitcoin, Ethereum... and trade on foreign exchanges. Mr. Nguyen Quang H. (Cau Giay District, Hanoi) said that trading is quite easy now, just need to register an account on an electronic exchange, such as a large exchange like Binance. Investors transfer personal money to their accounts on the exchange to buy virtual currencies for the purpose of investing and accumulating assets.

After the US Securities and Exchange Commission approved the first Bitcoin exchange-traded funds to be listed on a stock exchange, the price of Ethereum skyrocketed while Bitcoin maintained its upward momentum. Photo: REUTERS

As early as 2017, the Prime Minister signed a decision approving the project to complete the legal framework for managing and handling virtual assets, cryptocurrencies, and virtual currencies. Accordingly, the Ministry of Justice was assigned to review and evaluate the current legal status of virtual assets and virtual currencies in Vietnam and to research and survey international experience; to be completed in 2019. However, to date, the assigned units are still in the "research" stage.

Dr. Nguyen Tri Hieu, a finance and banking expert, said that urgently researching the legal framework for virtual currencies and virtual assets is necessary, especially in the context of some countries having actions related to virtual currencies, especially the largest currency - Bitcoin. Mr. Hieu commented that the fact that ministries and branches have been assigned tasks since 2017 but have not yet completed them shows that policy response is still slow compared to practical requirements.

According to lawyer Bui Dinh Ung, Hanoi Bar Association, Vietnam has not recognized virtual currency as a legal means of payment, nor has it recognized ownership of virtual assets and digital assets. But in reality, transactions of exchanging and buying and selling virtual currency and virtual assets still take place every day. This will lead to possible disputes and many problems related to the implementation of tax obligations arising from virtual asset transactions.

Be cautious but not late

According to Dr. Nguyen Tri Hieu, in the face of rapid changes in policies towards virtual currencies in a number of countries around the world, it is very necessary to study experiences to manage digital currencies suitable for Vietnam.

Acknowledging that this is a difficult issue and there are many risks associated with money laundering, Mr. Hieu said that it is necessary to propose initial pilot plans soon, then consider issuing appropriate regulations. "We should not delay policy research because of concerns about risks," he said.

Ms. Jenny Nguyen, CEO of Kyros Ventures Financial Fund, stated that in order to manage crypto transactions (electronic money or encrypted money) in the near future, Vietnam needs to soon recognize Bitcoin as a commodity. From there, it will pave the way for building a legal framework that allows Bitcoin investment like other civil assets. At the same time, there will be measures to protect investors, prevent fraud and money laundering using high technology.

On the other hand, Ms. Le Ngoc My Tien, CEO of BlockchainWork JSC, believes that Vietnam should not be hasty and should consider carefully before passing regulations on crypto management. First of all, the management agency should increase exchanges with businesses and research units to have a basis of information and appropriate management plans. At the same time, it is necessary to monitor countries that have issued legal frameworks on cryptocurrency and crypto-asset transactions to learn from experience.

As the agency assigned by the Ministry of Finance to preside over and coordinate with ministries and branches to research and develop regulations on virtual assets and virtual currencies, the State Securities Commission said that this is a new field in Vietnam and is relatively sensitive. Therefore, the research method must be very careful to ensure comprehensiveness in all aspects.

After consulting with ministries and branches, the State Securities Commission reported to the Ministry of Finance to propose to the Prime Minister to establish an interdisciplinary working group to research and develop a policy framework for virtual assets and virtual currencies. This is to access the experiences of countries around the world to apply appropriately to the reality of Vietnam; advise competent authorities on building a legal framework, organizing strict, effective and safe management.

Anti-Money Laundering Solutions

Mr. Giap Van Dai, founder and CEO of Nami Foundation, said that having a legal framework for Bitcoin as a commodity with ownership and transaction rights means that money laundering can be prevented. When investors make any large Bitcoin transactions, the management agency has the right to be suspicious and prevent and trace the origin.

Many experts believe that cryptocurrency investors in Vietnam are facing great risks as there are no regulations to protect them. Therefore, there needs to be an organization that specializes in providing transaction information on cryptocurrencies so that investors can keep up to date and limit risks.

Source: https://nld.com.vn/can-thiet-co-khung-phap-ly-ve-tien-dien-tu-196240113214051367.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)