According to data from Batdongsan.com.vn, the demand for apartments in Ho Chi Minh City in the first 6 months of the year increased by 51% compared to the same period last year, and this is also the only type of property that recorded a 6% increase in selling price year-on-year. The unstoppable price increase of the apartment type is indicated to be due to the shortage of supply compared to the actual demand of the market.

Specifically, a recent report by Savills showed that in the second quarter of 2024, primary supply increased by 14% quarter-on-quarter but decreased by 3% year-on-year to 5,635 units. Primary supply was mainly concentrated in the East (Thu Duc City) with 57% market share and the West (Binh Tan, Binh Chanh) with 29% market share.

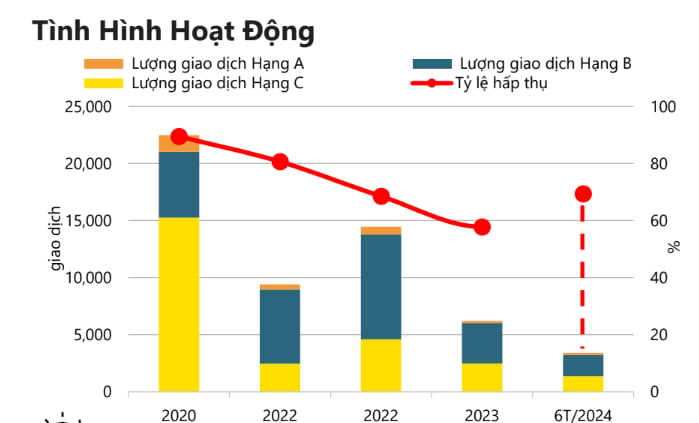

Absorption rate of apartment type in Ho Chi Minh City market according to Savills research

According to data from JLL Vietnam, during this period, Ho Chi Minh City only had about 2,500 new apartments for sale, of which the high-end and luxury segment had only 180 new apartments from an existing project that had just been licensed in Thu Thiem and 80 apartments from a project in District 7. Similarly, according to CBRE Vietnam, in the first two quarters of 2024, Ho Chi Minh City only had about 2,000 new apartments for sale. Of which, in the first quarter, there were about 500 apartments, and in the second quarter, the market recorded nearly 1,200 more apartments located in the East and South of the city. Most of the apartments offered for sale in the first half of the year were from old projects offering the next phase, with only 2 completely new projects.

The scarcity of supply has led to price increases in both the secondary and primary markets. However, it is worth noting that despite the price increase, apartment consumption is still very positive. Research by DKRA Group shows that in the last quarter, primary consumption in the whole market reached 3,349 units, a sharp increase of 88% compared to the previous quarter and an increase of 82% compared to the same period in 2023. Most transactions fell into projects with completed legal procedures, rapid construction progress, and convenient connections to the city center.

Actual records also show that, thanks to the positive state of the market, many projects that have just been launched in the first half of 2024 have had quite good sales rates. For example, in the East, a high-end project opened for sale in the final phase with a selling price of up to 170 million VND/m2 also "cleared" the inventory on the opening day.

In addition, some high-end projects with selling prices of around VND50 million/m2 also recorded high absorption rates, from 70-90% on the opening day. Even some new apartment projects in the booking stage also recorded acceptance rates of up to about 90% of the product portfolio, with a large number of investors interested in this type.

Many experts believe that the selling price of apartments will continue to increase due to the constantly increasing demand for housing, along with the profitability of investing in apartments that has been pointed out by many research units in recent times.

Apartment prices are expected to continue to increase.

In addition, input costs are still increasing, especially in the coming time when the revised Land Law applies land prices according to the market price framework, leading to increasing project investment capital costs, while people's housing needs are still very large. This leads to many apartment projects that have been handed over and have good rental prices increasing in price thanks to the interest of many buyers.

According to Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, most of the projects opened for sale in the first half of the second quarter have attracted attention, with an impressive number of customers making reservations. Because the investment demand in the market is still very large, including the demand for luxury and high-end segments, not just the segment that meets real estate needs. This is also the source of supply that contributes to the majority of real estate transactions in the first half of the second quarter of 2024.

Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, said that waiting for apartment prices to drop sharply is very difficult, because the supply cannot be improved quickly, and when the revised Law on Real Estate Business comes into effect, the number of investors meeting the requirements to implement the project will decrease. Meanwhile, the need to own a house is always present, especially in large cities.

According to Mr. Quoc Anh, in the long term, apartments are still a type of investment with profit growth (price growth rate plus rental yield) reaching 97%, ranking number 1 compared to other types of investment such as stocks, gold, savings, and foreign currency.

Source: https://www.congluan.vn/tp-hcm-can-ho-chung-cu-van-tieu-thu-tot-du-gia-ban-lien-tuc-tang-post303359.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)