Apartments under 3 billion VND are considered affordable.

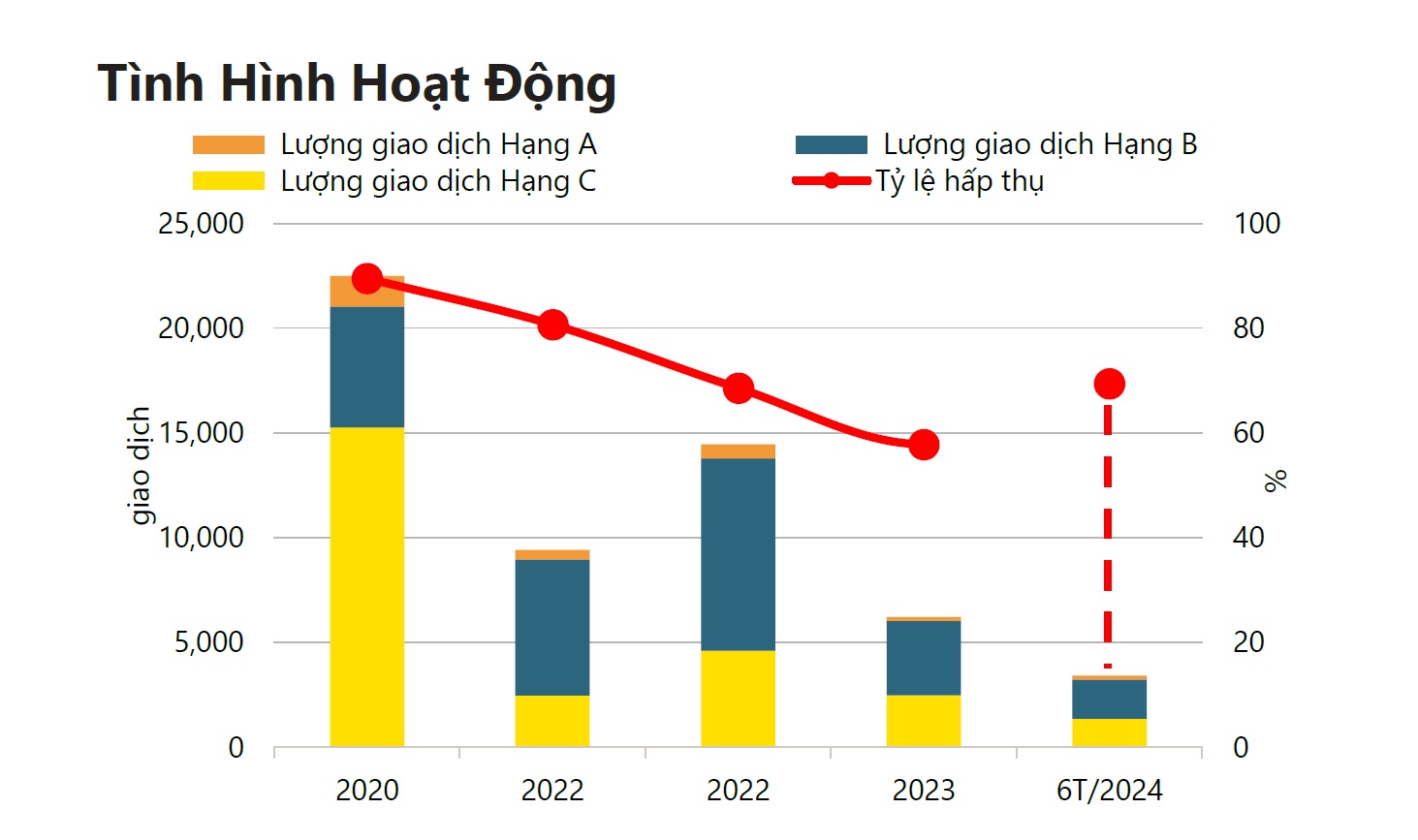

In the Ho Chi Minh City real estate market report recently released by Savills Vietnam, in the second quarter of 2024, the supply of new apartments in the quarter increased by 78% quarter-on-quarter and 199% year-on-year, to 1,125 units from a new project and 8 subsequent launches, of which Grade B accounted for 70% of the new supply market share. This brought the total primary supply up 13% quarter-on-quarter to 5,574 units.

Primary supply in the first 6 months of the year remained stable year-on-year at 6,690 units, of which Grade B accounted for 56% of the market share, followed by Grade C (40% market share) and Grade A (4% market share). Primary supply was mainly concentrated in the East (Thu Duc City) with 57% market share and the West (Binh Tan, Binh Chanh) with 29% market share.

The report assessed that the market is returning to recovery with a 655% increase in transaction volume compared to the same period last year, demonstrating market confidence. The second quarter of 2024 recorded 2,288 successful transactions, accounting for 70% of the total sales volume in the first half of the year thanks to lower lending interest rates, clear product legality and effective sales policies. In the first half of the year, the average selling price of primary apartments reached 72 million VND/m2 of net area.

However, the report also pointed out that the supply of apartments under VND3 billion is increasingly limited in Ho Chi Minh City, accounting for only 18% of the primary supply in the first 6 months of the year, mainly located more than 10km from the city center. According to Savills' research model, apartments under VND3 billion are currently considered the affordable segment. Experts analyze that affordability will be a big challenge for the market when this segment accounts for less than 5% of apartment supply in the next 3 years.

Apartment performance in the first 6 months of 2024

“We conducted an analysis to understand the affordable housing landscape in Ho Chi Minh City. This model uses different income levels based on their income, spending, and savings,” said Ms. Giang Huynh, Director of Research and S22M at Savills Vietnam.

This expert assumes that homebuyers save for 10 years, possibly supported by their mortgage or equity. From there, he concludes that a two-bedroom apartment priced under VND3 billion/unit is considered affordable.

"In the current context, most of the affordable apartments in Ho Chi Minh City have been sold, the operating and future supply is very limited in Ho Chi Minh City. And the new and future supply of affordable housing will mainly be introduced in Binh Duong, the area bordering Ho Chi Minh City. Therefore, it is clear that buyers in Ho Chi Minh City have to move to this area to get affordable supply," Ms. Giang analyzed.

Prices in the affordable segment are getting higher and higher.

Savills experts also added that the secondary market in the recent period has also been more positive in the context of limited handover supply and small primary products. In 2024, many Class B and Class C projects will have strong secondary price increases. Meanwhile, luxury projects after setting high prices in 2023 are under some pressure in the secondary market. It can be seen that districts with good connectivity thanks to improved infrastructure and low handover supply have strong secondary price increases.

Real estate facing many challenges

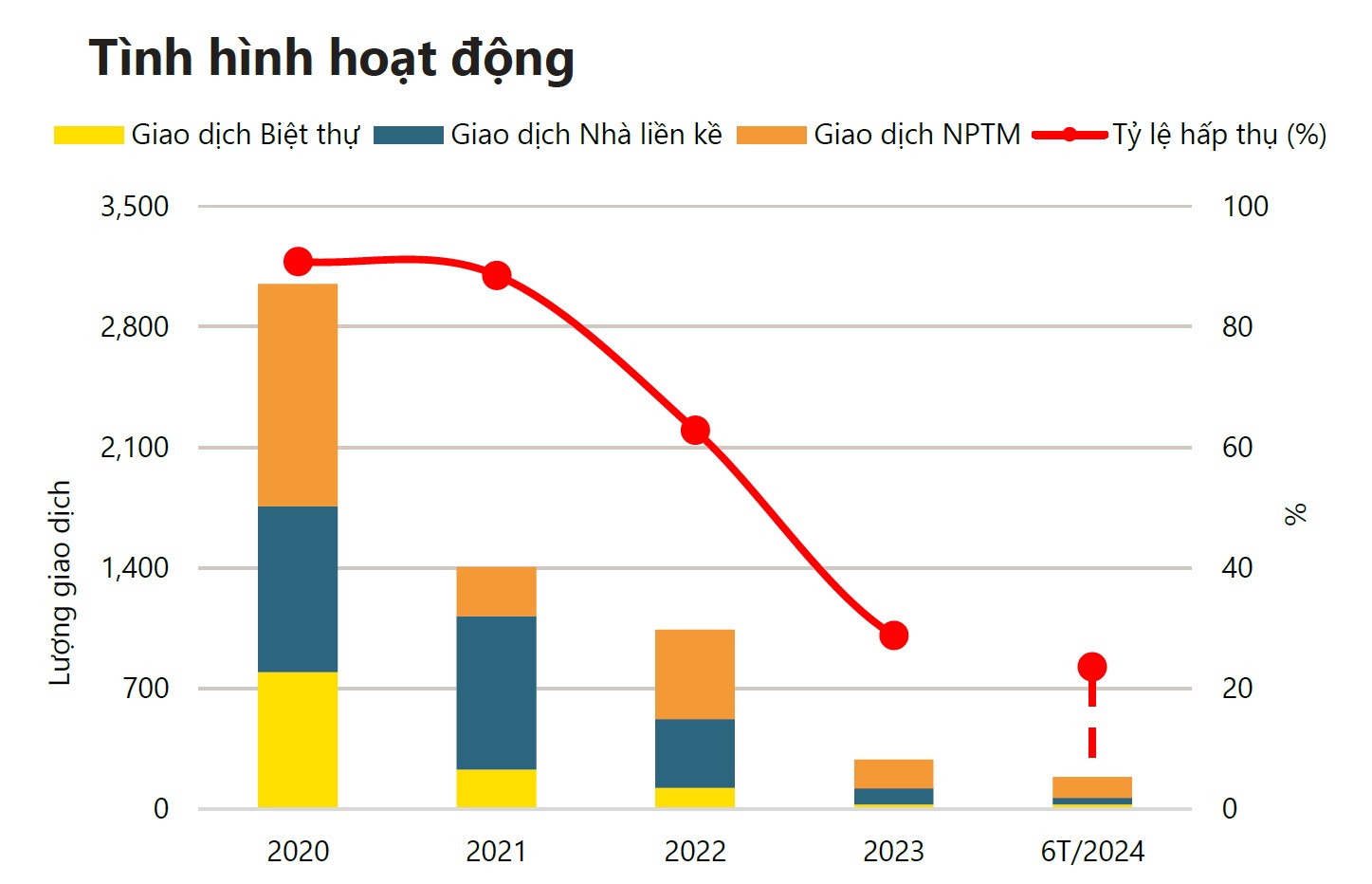

Analyzing the townhouse/villa segment, the Director of Research and S22M of Savills also commented: "In a city of more than 10 million people, we only have 668 primary townhouse products, 10 new units, and 72 transactions in the second quarter. The market has also declined similarly to the apartment segment in recent years due to many challenges. Therefore, primary prices continue to increase higher in the context of limited supply. Although it will decrease in 2024, the market's inventory is still dominant with high-priced products".

Specifically, the data shows that more than 77% of the total primary supply is priced above VND30 billion/unit. Most of these high-end products are located in urban areas and are mainly concentrated in Thu Duc City. High-priced primary products, competition from the secondary market and affordable products in neighboring provinces have made it difficult for the HCMC market. Products above VND30 billion struggled with only 6% absorbed. Townhouses had the highest absorption rate at 31%, thanks to real demand and competitive prices.

In Q2/2024, expensive commercial townhouses at The Global City were sold, causing primary prices to decrease by 2% QoQ and 4% YoY, reaching VND320 million/m2 of land.

Operational situation of Villa and Townhouse segment in Ho Chi Minh City in the first 6 months of 2024

The report notes that by 2026, Ho Chi Minh City will no longer have low-rise products priced under VND5 billion and only 10% of primary supply will be priced under VND10 billion. Meanwhile, products with this price range account for 85% of supply in Binh Duong and 55% in Dong Nai.

In the second half of 2024, 883 low-rise houses are expected to be launched, mainly from the next phases of existing projects. Products priced above VND20 billion will account for 80% of future supply. Two new projects, Foresta and The Meadow, will provide 30% of future supply with villas and townhouses. Both projects have received construction permits.

By 2026, future supply is expected to reach 4,663 units, mainly concentrated in District 2, Binh Chanh and Nha Be. With scarce land and infrastructure support, home prices in Ho Chi Minh City have tripled in the primary market and doubled in the secondary market over the past five years. Rising prices have pushed homebuyers with real residential purposes to neighboring provinces for more suitable options.

Providing an overview, Savills experts said key infrastructure projects are underway and will benefit the area with future supply along major infrastructure routes.

Source: https://www.congluan.vn/phan-khuc-can-ho-binh-dan-chi-chiem-chua-day-5-nguon-cung-trong-3-nam-toi-post304244.html

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)