The General Department of Taxation has just proposed that the State Bank study and submit to competent authorities regulations requiring non-cash payments for gold transactions.

Although this proposal is expected to help make the market more transparent, according to experts, there are still many things to discuss before implementing this principle.

Better tax management and collection

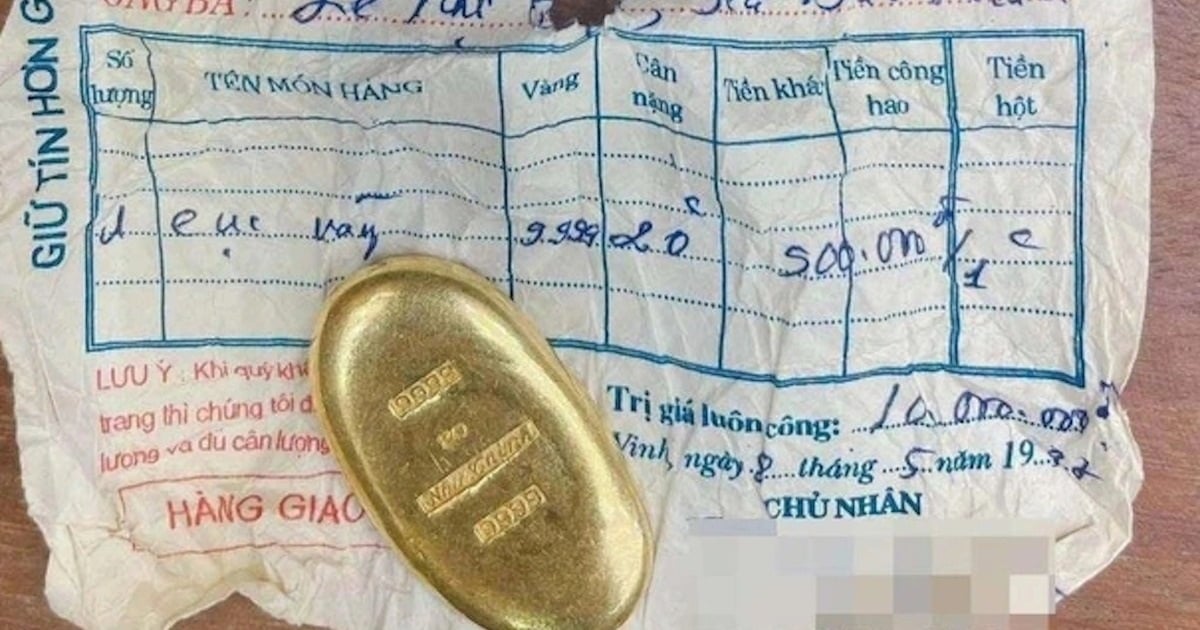

Evaluating the above proposal, Mr. Nguyen Van Duoc, Member of the Executive Committee of the Vietnam Tax Consulting Association, General Director of Trong Tin Accounting and Tax Consulting Company Limited, said that we currently cannot control the quantity and transactions of gold buying and selling among the people.

Therefore, non-cash payment will be very good, convenient for all parties, helping the management, tax collection, as well as the macro-management of the state will be more convenient and transparent. At that time, tax collection will be fairer and more equal among units.

There is no country in the world that has a regulation that 100% of goods cannot be bought and sold in cash.

However, Mr. Duoc said that the current tax law only stipulates that non-cash payments of VND20 million or more must be made to organizations to be deducted and included in expenses, and there are no regulations on gold trading transactions. Therefore, the State Bank must intervene, and issuing legal documents will be more appropriate.

Finance and banking expert Nguyen Tri Hieu also supports this orientation and highly appreciates the role of non-cash payments in preventing and combating money laundering.

"Gold shops often also trade in foreign currencies, many of which are illegal, so it will be difficult to apply non-cash payment methods. Transactions through banks will be screened, helping to better prevent money laundering," said Mr. Hieu.

Not feasible

Although the advantages are clear, Mr. Huynh Trung Khanh, Vice President of the Vietnam Gold Business Association and advisor to the World Gold Council in Vietnam, said bluntly that "it is not feasible".

Citing data from the General Department of Taxation, up to now, the whole country has 5,835 gold and silver businesses implementing electronic invoices generated from cash registers - accounting for 80-90% of the units in the gold and silver business industry, Mr. Khanh said that initially, the business units have been controlled.

Therefore, the application will add unnecessary complications to business. According to him, consumers will react first, not businesses. If you buy a large amount of gold or buy SJC gold bars, it can be applied; but if you only buy small amounts such as gold bars or jewelry, it will be difficult to do. Because not everyone has an account or credit card.

He raised the question, in the world, countries only encourage the use of less cash, but no country has yet issued a regulation that 100% of certain items cannot be bought and sold in cash, so why do they want to apply it to the domestic gold industry?

Expert Le Xuan Nghia also commented that requiring non-cash payments for gold transactions does not solve the current market bottlenecks.

Similarly, Dr. Vu Dinh Anh also said that this is an unrealistic proposal. According to Mr. Anh, banning the use of cash in gold trading will not solve the problem of the difference between domestic and world gold prices, as well as the import of raw materials, but will also aggravate this problem by confusing buyers and sellers.

What needs to be done now, according to the expert, is to amend Decree 24 on the management of gold trading activities.

Currently, the selling price of gold bars is at 85.1 million VND/tael, buying price is 83.6 million VND/tael. The record price so far is at 85.8 million VND/tael. The State Bank chose to auction gold again after 11 years with the aim of reducing the difference between domestic and international prices, however, the result was the opposite when the difference from nearly 10 million VND/tael has now increased to more than 14 million VND.

Source

![[Photo] Readers' joy when receiving the supplement commemorating the 50th anniversary of the liberation of the South and national reunification of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/283e56713da94988bf608393c0165723)

![[Photo] Young people line up to receive the special supplement commemorating the 50th anniversary of the Liberation of the South of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/9e7e624ae81643eba5f3cdc232cd07a5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of Steering Committee for key projects and railway projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/b9534596258a40a29ebd8edcdbd666ab)

![[Photo] Ho Chi Minh City people's affection for the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/7fcb6bcae98e46fba1ca063dc570e7e5)

Comment (0)