Value added tax for business households and individual businesses is calculated using the following formula:

Value added tax payable = Value added taxable revenue x Value added tax rate

Personal income tax for business households and individuals is calculated by the following formula:

Personal income tax payable = Taxable revenue x Personal income tax rate

In there:

- Taxable revenue: Revenue subject to value added tax and revenue subject to personal income tax for business households and business individuals is the revenue including tax (in cases subject to tax) of all sales, processing fees, commissions, and service provision fees arising during the tax period from production and trading activities of goods and services. Including the following amounts:

+ Bonuses, sales support, promotions, trade discounts, payment discounts, cash or non-cash support.

+ Subsidies, surcharges, extra fees and additional charges are enjoyed according to regulations.

+ Compensation for breach of contract, other compensation (only included in personal income tax revenue).

+ Other revenue that business households and business individuals are entitled to regardless of whether they have collected money or not.

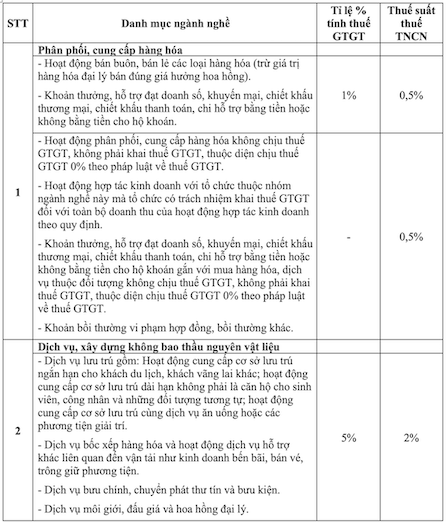

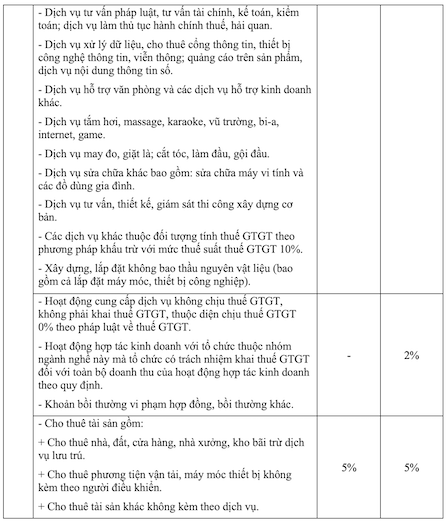

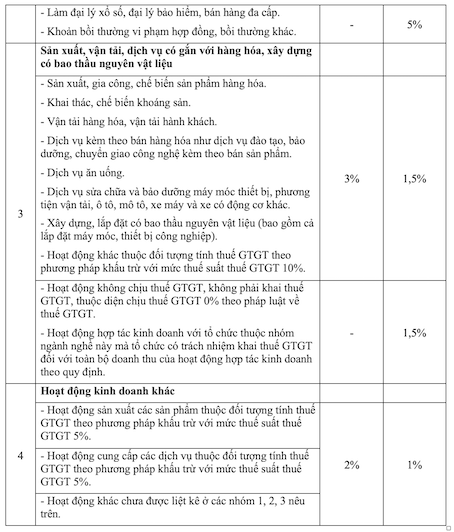

- Tax rate calculated on revenue:

+ Tax rates calculated on revenue include value added tax rates and personal income tax rates applied in detail to each field and industry according to the instructions in the following table:

+ In case a business household or individual conducts business in many fields and professions, the business household or individual shall declare and calculate tax according to the tax rate calculated on revenue applicable to each field and profession.

In case business households and business individuals cannot determine the taxable revenue of each field or profession or determine it inconsistently with business reality, the tax authority shall determine the taxable revenue of each field or profession according to the provisions of the law on tax administration.

Source

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

Comment (0)