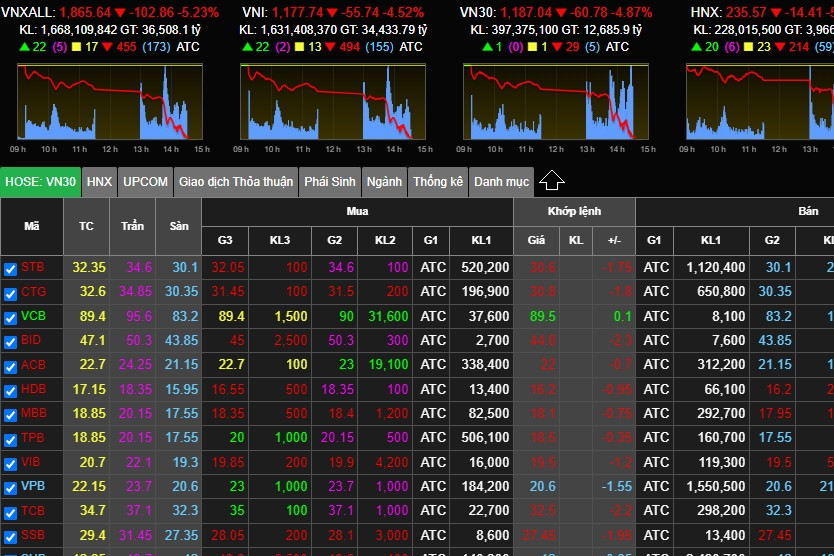

So what is happening to the stock market, when domestic investors are selling off at all costs, causing thousands of stocks to fall in price, including 275 stocks hitting the floor, while foreign investors are turning around and buying strongly again.

VietNamNet reporter had an interview with Mr. Vicente Nguyen, Chief Investment Officer (CIO) of AFC Vietnam Fund, about the rare price drop associated with some new records as well as the prospects of cash flow and the Vietnamese stock market.

Take profit + weak mentality so panic

- The stock market just experienced a sharp decline on August 18, with the VN-Index falling 55.5 points, equivalent to a decrease of 4.5%. This is a rare strong loss in many years. In your opinion, what led to such a strong selling session?

Mr. Vicente Nguyen: Profit taking is one of the main reasons, after that many brokers took profits and called on customers to sell off stocks. Weak sentiment and resonance on the floor led to the sell-off like the afternoon of August 18. In terms of fundamentals or economics, there is nothing new.

Specifically, which group of stocks/stock codes dominated this sharp decline?

With more than 270 stocks hitting the floor, almost every group has fallen equally sharply. But if we look at the details, it probably belongs to the real estate (RE) stock group because this group has recently attracted a huge speculative cash flow and increased very strongly despite the gloomy business situation.

- Is there a margin call phenomenon that occurs during the session or is it likely to occur in the following sessions, sir?

The market has only dropped 4.5%, not enough to call margin on a large scale, but it is possible for certain stocks if they have dropped a lot before. If the next sessions drop another 5-7%, then margin calls on a large scale may occur.

- Liquidity in the trading session on August 18 reached 42,000 billion VND (about 1.75 billion USD), nearly double the average level/recent session. This is a very large number. How do you explain the phenomenon of such a sudden increase in liquidity?

The market is like that, there are sellers and buyers, when sellers panic and sell at all costs, there are also buyers willing to buy good stocks at cheap prices. At that time, liquidity will increase rapidly.

For example, in such sell-off cases, most of the strong sellers are individual investors and the buyers are organizations, including both domestic and foreign ones. Therefore, high liquidity is also normal.

VinFast is a good sign

- VinFast's listing on the US stock market has brought a positive wind to the "Vin family" stocks. However, VinFast shares have been falling sharply since then. How do you evaluate VFS's listing on the US market and its impact on the domestic market?

The listing of VFS is a very good sign for Vingroup and the Vietnamese financial and economic system. For Vingroup, the event increases access to international capital markets, thereby increasing the opportunity to raise capital.

Because VFS chose to list through a SPAC rather than a traditional IPO.

For Vietnam's economy or finance, this event is a great promotion for Vietnam. Many investors will know about Vietnam and the Vietnamese economy.

In addition, this listing also creates great motivation for other Vietnamese enterprises when they want to list or raise international capital.

- What do you think about VinFast's price as of the end of the session on August 17 - about 20 USD/share, equivalent to a capitalization of 46 billion USD?

Whether the valuation is high or low depends on each investor's perspective and approach. If based only on profits and current status, this is an overvalued valuation, but if based on VFS's prospects or potential, it may be only normal or just a little high.

However, the electric vehicle (EV) sector is a completely new industry, even in the world. The number of profitable companies in this sector is currently only on the fingers. Therefore, VFS's loss is also normal. The most important thing is that the product must be good, trusted and favored by customers, then the future and prospects are still bright, because EV seems to be the trend of the world.

- Is the downward price fluctuation of VinFast shares a negative factor affecting Vingroup shares' price (floor price) in the session of August 18?

In this respect, that is true. Because what goes up is what goes down. Domestic investors often think that VFS is valued at 85 billion USD, Vingroup accounts for 51%, which is more than 42 billion USD. So VIC must also be valued at over 42 billion USD, not including Vinhomes or Vincom Retail...

So when VFS decreases, VIC's valuation also decreases accordingly, which is understandable. From the perspective of an investment fund like us, it is not too related. However, other funds may have a different perspective.

- What do you think about the news that China's "debt bomb" Evergrande - China's second largest real estate developer - filed for bankruptcy protection in the US? How does this affect the real estate market, Vietnam's finance and investor psychology?

That would be a pretty big blow to China's real estate industry, leading to a loss of confidence in the long term and greatly affecting the Chinese economy. However, this bankruptcy event has been predicted and its impacts have already occurred, so the declaration of bankruptcy is just a formality, so the impact is no longer big. In the short term, there will be an impact on Vietnam, but not related to the financial situation but the economy. Because the impact of this real estate crisis in China will cause purchasing power in this country to decrease sharply, thereby causing the demand for imported goods from Vietnam to also decrease. And that is an indirect impact.

- So what is the outlook for real estate stocks after the news from China's Evergrande?

Information about China's Evergrande has a negative psychological impact on Vietnam's real estate, but is not inherently related. However, Circular 06 (of the State Bank of Vietnam on lending activities) will have a major impact on many current real estate businesses, because many businesses are mobilizing capital from customers through investment cooperation contracts or business capital contribution contracts for projects that are not eligible for sale.

However, it helps businesses to do business properly, have good legal status, meet the conditions for sale, increase market share and customers. Therefore, the group of real estate companies that are inherently weak in finance, have poor legal status, and mobilize capital through this form will easily fall into a long-term hibernation. Personally, I think it is a necessary purification for the market.

Businesses with strong finances, clean projects, good legal status are still fine, can sell products and customers can still borrow and they will overcome difficulties.

Meanwhile, many businesses will hibernate or go bankrupt. Then the market will gradually recover, strong businesses will overcome. But I think this will happen in 2025-2026, 2024 will still be very difficult.

"The August 18 crash is more opportunity than risk"

- How do you evaluate the banking industry/stock group?

The difficulty of bad debt will increase but will be overcome because the banking industry is the backbone of the economy. The government will definitely support. That is about the business situation, but in terms of stocks, in the long term, banking stocks are still very promising because the economy is sure to grow long-term and strongly.

Therefore, the banking industry is definitely growing. Currently, this group is being valued extremely attractively with P/E just under 10 times and P/B around 1 time. But it will only be for institutional investors with more capital, and I personally think that they do not have enough patience and are willing to hold a stock for 3-5 years. They would rather burn their accounts than wait that long.

- Interest rates are currently very low. What do you think will be the outlook for cash flow into the stock market in the coming time?

Low interest rates will stimulate investment in the stock market. Therefore, in this environment, cash flow will increase sharply. As on August 18, we saw a trading session of more than 1.5 billion USD. If interest rates continue to be low, cash flow will continue to flow into the stock market.

Personally, I think the stock market is in a long-term uptrend cycle, at least for the next 5 years. Therefore, crashes like August 18 are more of an opportunity than a risk. As long as you choose the right company and wait patiently, you will win big in the next 5 years, I am almost sure.

- The USD/VND exchange rate has recently increased sharply, surpassing the threshold of 24,000 VND/USD. How does this affect indirect investment (FII) capital flows and the stock market? What is your forecast for the exchange rate from now until the end of the year?

If the exchange rate increases too much, foreign investors will certainly hesitate to disburse, especially new investors. It will not only affect indirect investors but also direct investors (FDI). But it also has some positive impacts, such as stimulating better exports, and exporting enterprises will benefit greatly from the increase in exchange rate.

Personally, I think the USD will continue to increase for the rest of the year, because the US Federal Reserve (Fed) seems to still raise interest rates once more and keep them at high levels.

Currently, there is no sign that the Fed will cut interest rates soon. On the contrary, the State Bank of Vietnam is urging commercial banks to reduce lending rates, even deposit rates, which makes the interest rate gap between VND and USD larger. Therefore, the exchange rate trend is still increasing from now until the end of the year. We need to be very careful with this.

The economy is improving:

Commenting on the economic outlook for the end of the year, Mr. Vicente Nguyen said that "growth will be better and stronger in the first half of the year", because the most difficult time has passed, US interest rates have peaked, while inflation is gradually returning to normal levels. Therefore, exports will gradually improve and industrial production will also improve significantly in the second half of 2023. GDP this year is about 5-5.5% due to the Government actively increasing public investment.

However, according to him, credit growth will still be low because businesses are reluctant to borrow and interest rates are still high.

"The US, European and Chinese economies will be better in the second half of 2023. However, it is not much better because they have basically passed the worst period but are still in a weak state, not a strong recovery. This will certainly affect Vietnam, which is that exports and investment are also increasing gradually but cannot be stronger yet," said Mr. Vicente Nguyen.

However, commenting on the long-term prospects of the Vietnamese economy and stock market in the next few years, he is optimistic that it is "as bright as the full moon".

The reason is that a series of good agreements, capital flows from China to Vietnam, and the policy of restructuring and diversifying supply sources of European and American enterprises will be a great driving force for the Vietnamese economy. Therefore, the stock market will increase well.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)