Minister Ho Duc Phoc said that the Ministry of Finance and the State Bank are coordinating to handle banks and insurance companies violating regulations on investment-linked products.

At the National Assembly's discussion session on socio- economic and budget issues on the morning of May 31, Ms. Nguyen Thi Thuy, Vice Chairwoman of the Judiciary Committee, pointed out the shortcomings of the insurance market. In particular, she mentioned life insurance and investment-linked insurance products that customers are forced to buy with loans, or are tricked into transferring savings to buy insurance.

Explaining on the morning of June 1, Finance Minister Ho Duc Phoc admitted that there were problems in the connection between banks and insurance companies to sell life insurance products and receive commissions. The insurance contracts were long and unclear, so buyers would be at a disadvantage if they did not read them carefully.

"The Ministry of Finance and the State Bank are coordinating to strictly handle banks and insurance companies that violate the law," said Mr. Ho Duc Phoc.

Finance Minister Ho Duc Phoc explains at the socio-economic discussion session on June 1. Photo: Hoang Phong

He added that the Ministry of Finance is developing a decree and circular on insurance business, which sets out principles for providing insurance products; insurance contracts, and maximum bonuses for insurance agents.

"The regulations on contracts will be clearer, shorter, more focused and clarify the rights, terms and obligations of the parties. Regulations on inspection, examination and handling of violations in the insurance sector will also be specifically regulated," he informed.

The Ministry of Finance has submitted it to the Government and Mr. Phuc expects it to be issued soon to improve quality in the direction of protecting customer rights.

At yesterday's discussion session, Deputy Chairwoman of the Judiciary Committee Nguyen Thi Thuy requested the Ministry of Finance to conduct a comprehensive inspection of life insurance, focusing on investment-linked insurance. The Ministry of Public Security should verify whether there are signs of fraud or deception of customers. If so, it should propose to initiate an investigation.

Investment-linked insurance products are advertised by insurers as having the meaning of risk protection and additional investment benefits. But in reality, the customer's insurance premium will be deducted a lot of costs, before being allocated to the investment-linked fund.

The insurer will collect an "initial fee" of 65% and 50% of the basic insurance premium in the first two years, which is non-refundable. After deducting various risk and other costs, the customer must accept that the basic insurance premium paid in the first year is almost "completely lost".

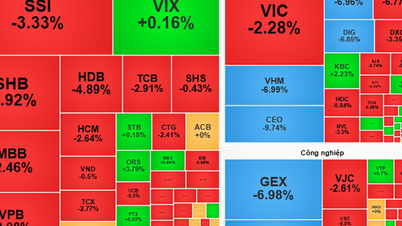

The basic annual insurance premium, after deducting the initial costs and risk costs, is then invested in investment-linked funds corresponding to different levels of risk, or investing in stocks, bonds or deposits. With unit investment-linked insurance, customers bear all investment risks, depending on market fluctuations and portfolio performance. Due to unfavorable stock market developments, currently, investments related to stock investment funds can lose up to several dozen percent or be completely lost.

Also at today's discussion , Finance Minister Ho Duc Phoc informed that the amount of money expected to be exempted, reduced, and deferred from taxes and fees this year for people and businesses is about 195,400 billion VND. Of which, 62% is for tax extension, the remaining 30% is for tax and fee reduction.

Regarding the current difficulties of enterprises, Mr. Phoc acknowledged that it is mainly due to the sharp decrease in aggregate demand. Therefore, the solutions proposed need to be aimed at removing aggregate demand, that is, increasing consumption, private investment in the fields of real estate, renewable energy, public investment disbursement or import and export.

Minister Phuc said that it is necessary to decentralize more strongly to localities, ministries and branches with tasks such as regular spending to repair and upgrade public works, machinery and equipment, or assess the environmental impact of projects. At the same time, ministries and branches also need to solve bottlenecks in the market and provide capital for businesses and the economy.

"Enterprises are the cells of the economy. Only when they develop can they create jobs, grow, and collect budget revenue," he said.

Source link

![[Photo] Party Committees of Central Party agencies summarize the implementation of Resolution No. 18-NQ/TW and the direction of the Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761545645968_ndo_br_1-jpg.webp)

![[Photo] The 5th Patriotic Emulation Congress of the Central Inspection Commission](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761566862838_ndo_br_1-1858-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man receives Chairman of the House of Representatives of Uzbekistan Nuriddin Ismoilov](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761542647910_bnd-2610-jpg.webp)

Comment (0)