BIDV is the leading commercial bank in the market for green project financing.

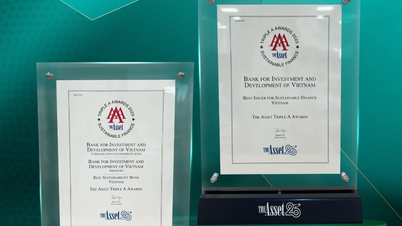

With this issuance, BIDV has become the first organization to successfully issue sustainable bonds in the domestic market. Previously, in 2023, BIDV was also the first Vietnamese commercial bank to successfully issue VND 2,500 billion in green bonds. Through two consecutive issuances of green bonds and sustainable bonds in two consecutive years with a total successful offering value of VND 5,500 billion (~ USD 220 million), BIDV continues to maintain its position as the No. 1 ESG bond issuing credit institution in the domestic market, while contributing to the development of the sustainable finance sector in Vietnam. BIDV's sustainable bonds have an unsecured structure and do not require payment guarantees. The fact that investors have purchased 100% of the offering value of sustainable bonds has demonstrated a high level of trust in BIDV's capacity and reputation. In addition, the issuance has attracted leading institutional investors in the market, including insurance companies, commercial banks, fund management companies, and enterprises. The bond capital will be used by BIDV to lend to customers and projects that have a positive impact on the environment and society, with the assessment criteria specifically specified in BIDV's Sustainable Bond Framework. Mr. Doan Viet Nam, Deputy General Director of BIDV, said: BIDV is very interested in ESG and will soon have a clear strategy to link the bank's business activities with the requirements of promoting green credit growth and managing ESG risks in credit granting activities... As a leading financial institution and determined to join the Government in implementing the commitment to achieve net zero emissions by 2050, it is hoped that BIDV's pioneering issuance of ESG bonds in general and sustainable bonds 2024 in particular according to international standards will contribute to the effort to green the economy and build a green, sustainable future. In both the recent green bond and sustainable bond issuances, BIDV has received technical support from the World Bank in many aspects: building a bond framework, establishing criteria for evaluating eligible projects, issuing external evaluation opinions, disclosing information as well as consulting on appropriate implementation plans to best meet market expectations. Ms. Mariam Sherman, World Bank Country Director for Vietnam, Cambodia and Laos - commented: The first sustainable bond in Vietnam successfully issued by BIDV, following the premise of issuing green bonds in 2023, is a testament to our joint efforts and also an important milestone for the development of the green financial market in Vietnam on the path of transition towards a low-carbon economy. The World Bank is proud to accompany Vietnam's green growth ambition ... We wish to contribute our part to Vietnam towards a sustainable and prosperous future .| Currently, BIDV is the leading commercial bank in the market in financing green projects. By June 30, 2024, BIDV's green credit balance reached VND 75,459 billion, BIDV's medium and long-term debt balance to finance projects with social factors was VND 76,059 billion. |

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

Comment (0)