According to the financial report for the third quarter of 2023, Duc Long Gia Lai Group Joint Stock Company (code DLG) recorded VND 289 billion in net revenue and VND 15.7 billion in profit after tax. Accumulated in 9 months, revenue reached VND 800 billion, profit after tax was nearly VND 50.2 billion.

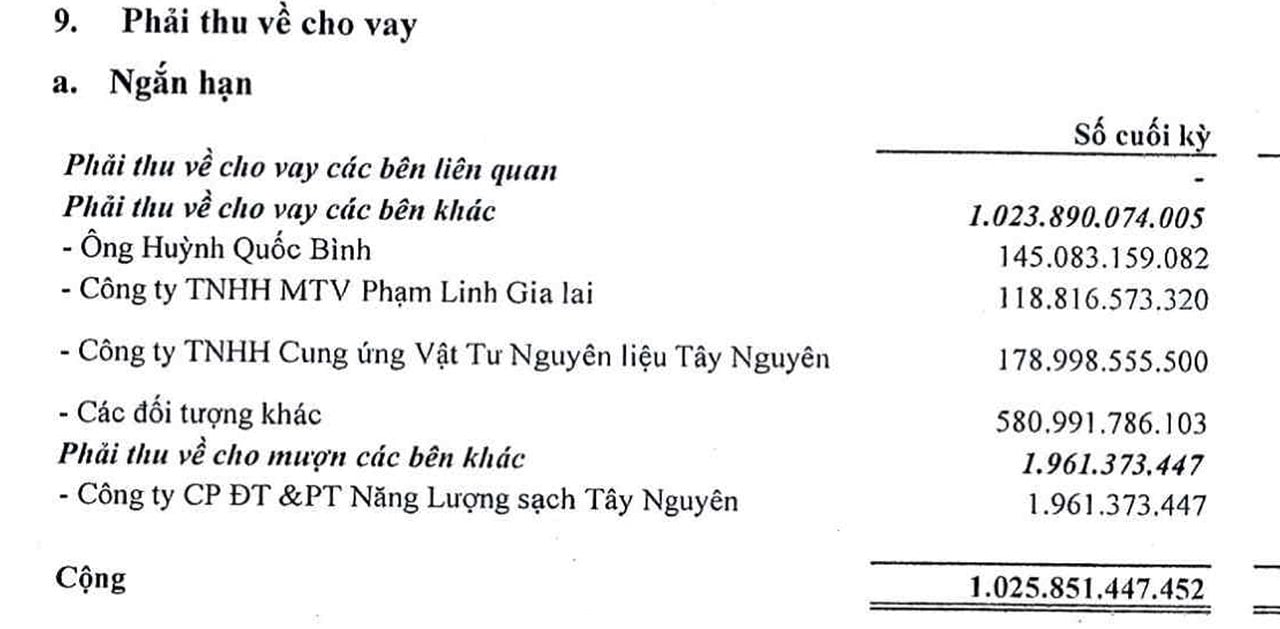

Notably, the mountain town tycoon has short-term loan receivables of up to VND1,025 billion, including short-term loan receivables of VND145 billion for Mr. Huynh Quoc Binh.

Long-term loan revenue is 1,298 billion VND. Of which, Duc Long Gia Lai lends to some companies such as Duc Long Gia Lai Forestry and Industrial Park JSC 378 billion VND, Tay Nguyen Stone Industry and Construction JSC 321 billion VND, etc.

In addition, Duc Long Gia Lai still has short-term receivables from customers of 779 billion VND, including 391 billion VND for Mr. Ly Tran Tien and 133.3 billion VND for Mr. Nguyen Tuan Vu.

Recently, the Ho Chi Minh City Stock Exchange has issued a document reminding Duc Long Gia Lai to delay in announcing information about the verdict related to the Gia Lai Provincial People's Court's decision to open bankruptcy proceedings against this company at the request of Lilama 45.3 Joint Stock Company.

At the end of July 2023, Lilama 45.3 submitted a petition to the Gia Lai People's Court requesting to open bankruptcy proceedings against Duc Long Gia Lai because it could not collect a debt of 20 billion.

After the Gia Lai Provincial People's Court issued a decision to open bankruptcy proceedings against Duc Long Gia Lai, on October 12, Duc Long Gia Lai filed a complaint.

Duc Long Gia Lai said the enterprise is not insolvent and has total assets of nearly 6,000 billion VND, with sufficient financial resources to repay debts to partners, customers, and banks from production and business activities as well as receivables from partners.

Quoc Cuong Gia Lai has no revenue from real estate.

Quoc Cuong Gia Lai Joint Stock Company (code QCG) has just announced its financial report for the third quarter of 2023. In the last quarter, QCG recorded net revenue of nearly 67 billion VND, down 87% over the same period. The revenue structure shows that the company did not generate any revenue from real estate business activities. Accordingly, revenue only comes from two segments: selling goods of more than 18 billion VND and selling electricity of nearly 49 billion VND.

QCG said the main reason is that the real estate market continues to face many difficulties, legal procedures are still overlapping, the process of commenting on amendments is still being completed, leading to the request for procedures to implement projects not being resolved. In addition, most banks are tightening lending capital for real estate transactions.

Accumulated in 9 months, QCG's net revenue reached 277 billion VND (down 76%), after-tax loss was 3.4 billion VND (same period profit was 43.7 billion VND).

As of September 30, the payable debt was VND5,308 billion, down 5% compared to the beginning of the year. Accounting for more than 54% of the payable debt is the amount received from Sunny Island for the Phuoc Kien project (VND2,882 billion). The remaining debt accounts for only 11%, reaching VND590 billion, down 3 billion compared to the beginning of the year.

Mr. Duc made a profit of more than 140 billion from selling hotels?

According to the third quarter 2023 financial report of Hoang Anh Gia Lai Joint Stock Company (code HAG) chaired by Mr. Doan Nguyen Duc (Bau Duc), the company has a strong increase in revenue from liquidating fixed assets, earning a profit of more than 144 billion VND.

This revenue was recorded in the context of Hoang Anh Gia Lai announcing the liquidation of all assets attached to land belonging to Hoang Anh Gia Lai Hotel at No. 1 Phu Dong Street, Pleiku City, Gia Lai Province. This is the first 4-star hotel in the Central Highlands, operating since the end of 2005 with 117 bedrooms. Hoang Anh Gia Lai has held many annual shareholder meetings at this hotel.

In mid-October 2023, Hoang Anh Gia Lai announced its estimated business results for the first 9 months of the year, including other revenue from asset liquidation of VND 180 billion.

After that, the market reported that Hoan Sinh Gia Lai Investment Company Limited was the transferee of this hotel, but the transfer value has not been officially announced.

Bau Duc's company sold the hotel to pay off part of the bond debt issued in 2016 at the Vietnam Joint Stock Commercial Bank for Investment and Development ( BIDV ). All proceeds from the sale of this unprofitable asset will be given priority to pay off the bond obligation at BIDV.

For many years, Mr. Duc has been determined to clear all debts at the bank, including debts worth thousands of billions of VND at BIDV, which are expected to be resolved this year.

Source

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

Comment (0)