Non-interest income declines, profits "evaporate"

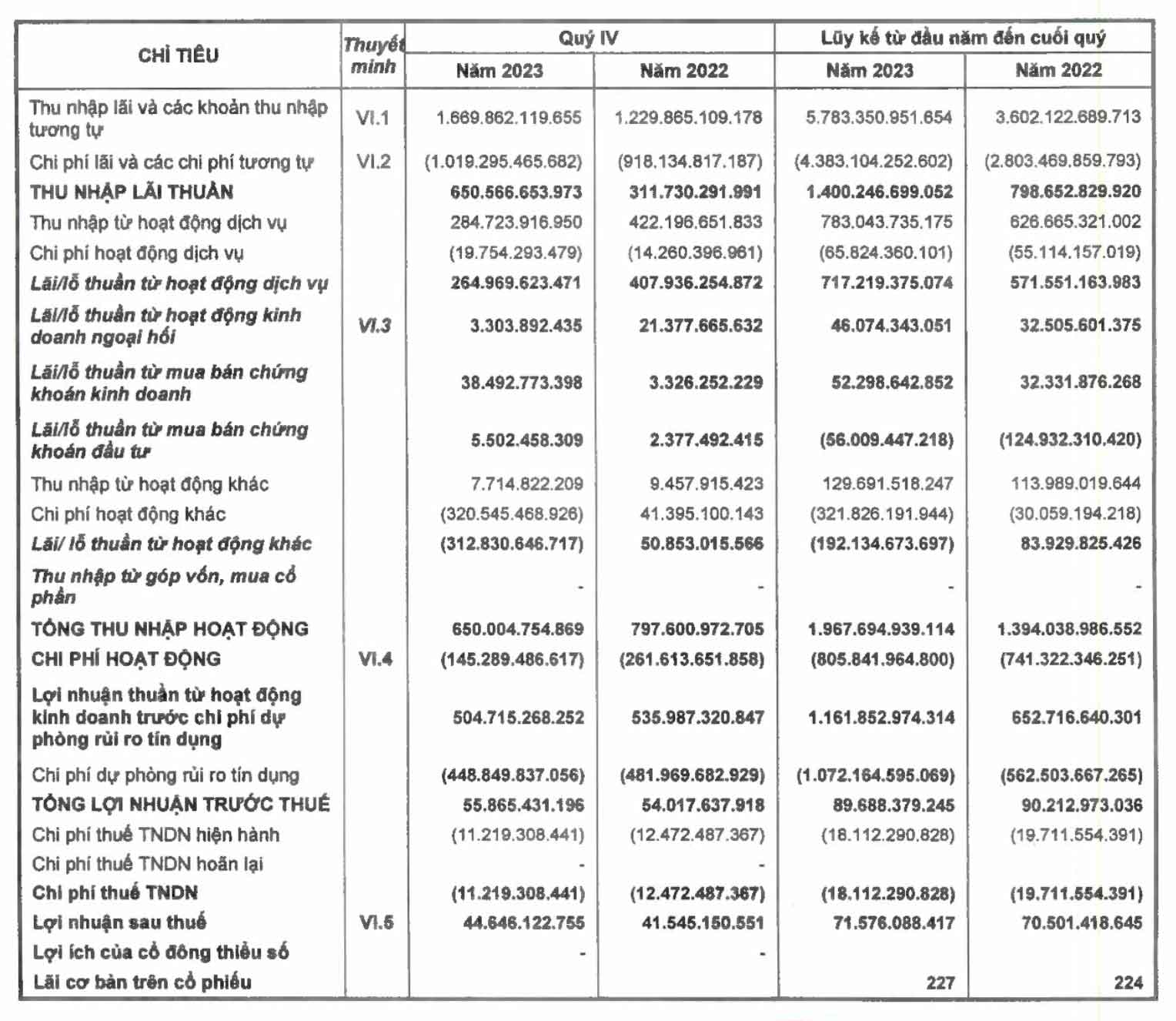

According to the financial report for the fourth quarter of 2023, Bao Viet Commercial Joint Stock Bank (BaoViet Bank) recorded net interest income for the whole year of 2023 reaching VND 1,400 billion, an increase of 75% compared to 2022.

The reason is that interest income from customer loans at BaoViet Bank increased sharply from VND 780 billion (recorded on December 31, 2022) to VND 1,332 billion (recorded on December 31, 2023). In addition, interest income from debt trading also increased, recorded at VND 126 billion.

Meanwhile, the bank's investment securities trading activities recorded a loss of VND56 billion (in the same period in 2022, BaoViet Bank lost VND124 billion). In addition, net loss from other activities amounted to VND192 billion, while the previous year's profit was nearly VND84 billion.

In terms of expenses, this bank's operating expenses in 2023 increased to nearly VND806 billion compared to VND741 billion last year.

Notably, the cost of credit risk provisioning skyrocketed to VND1,072 billion, equivalent to 91%. This is the reason why BaoViet Bank's pre-tax profit grew negatively, reaching only VND89.6 billion, down 1% compared to the previous year.

Remember, at the Annual General Meeting of Shareholders at the beginning of the year, BaoViet Bank set a target of 95 billion VND in pre-tax profit for the whole year of 2023. With the above business results, BaoVietBank could not complete the proposed profit plan.

Bad debt on balance sheet is growing, bad debt at VAMC is still not clean

By the end of 2023, BaoViet Bank's total assets reached VND 84,644 billion, an increase of 8% compared to the beginning of the year, of which deposits at other credit institutions were nearly VND 15,600 billion.

The good news is that customer deposits increased by nearly VND11,500 billion, reaching VND53,000 billion at the end of the period, customer loans also increased by 25%, reaching nearly VND41,400 billion.

However, while profits are modest, remaining at tens of billions of dong, bad debt at BaoViet Bank continues to swell to thousands of billions of dong, not to mention bad debt at VAMC.

Group 3 debt (substandard debt) recorded a slight decrease at the end of 2023, but bad debt showed signs of "jumping groups", when group 4 (doubtful debt) and group 5 (debt with potential loss of capital) "jumped" to 192 billion and 1,295 billion VND, respectively.

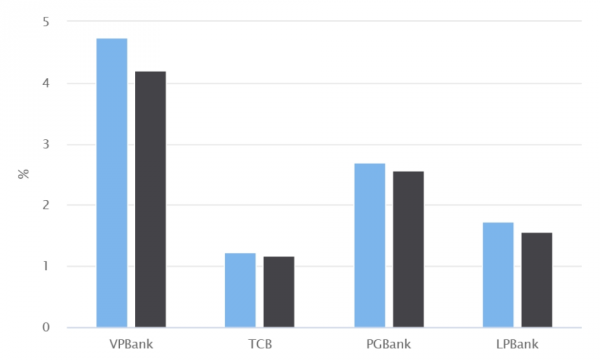

Compared to the figure recorded at the end of 2022, total bad debt at BaoViet Bank increased to 49%. The ratio of bad debt to outstanding loans increased from 3.34% at the beginning of the year to 4%, exceeding the limit allowed by the State Bank.

As of December 31, 2023, BaoViet Bank's bad debt at VAMC was nearly 3,005 billion VND, an increase of more than 14% compared to the beginning of the year, equivalent to an increase of 381 billion VND and the amount of provisions set aside was nearly 888 billion VND.

Special bonds issued by VAMC are time-limited valuable papers to purchase bad debts from credit institutions.

Credit institutions account for debt trading transactions using special bonds according to the guidance in Official Dispatch No. 8499/NHNN-TCKT issued by the State Bank of Vietnam on November 14, 2013 and Official Dispatch No. 925/NHNN-TCKT issued by the State Bank of Vietnam on February 19, 2014.

These special bonds are classified as held-to-maturity investment securities, recorded at par value on the transaction date and subsequently reflected at par value less allowance for impairment.

For each bad debt sold to VAMC, the bank receives 01 special bond issued by VAMC. The face value of the special bond corresponds to the book value of the outstanding principal of the bad debt after deducting the specific amount of unused provisions for that bad debt.

Upon completion of the bad debt purchase and sale procedure, the credit institution shall reduce the book value of the bad debt, use the specific unused provision and close the off-balance sheet account tracking the unrecovered interest of that bad debt.

Source

![[Photo] Ho Chi Minh City people's affection for the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/7fcb6bcae98e46fba1ca063dc570e7e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of Steering Committee for key projects and railway projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/b9534596258a40a29ebd8edcdbd666ab)

![[Photo] Readers' joy when receiving the supplement commemorating the 50th anniversary of the liberation of the South and national reunification of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/283e56713da94988bf608393c0165723)

![[Photo] Young people line up to receive the special supplement commemorating the 50th anniversary of the Liberation of the South of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/9e7e624ae81643eba5f3cdc232cd07a5)

Comment (0)