High-tech criminals often come up with tricks and lures to steal people's money even though banking and financial applications have improved security.

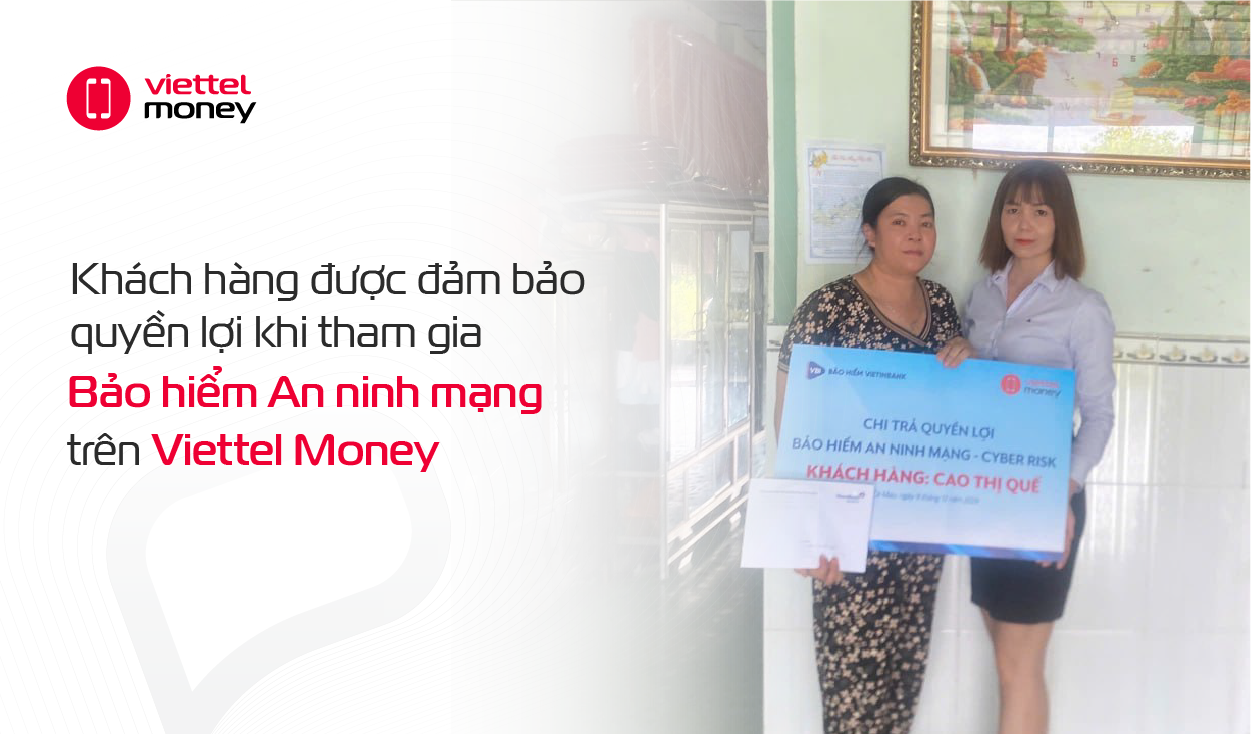

Customers receive Cyber Security Insurance benefits - Photo: NVCC

Losing your guard for a few seconds can lead to being scammed

Every year, before, during and after Lunar New Year, crimes, especially cybercrimes, operate in a complex manner with many sophisticated and daring methods.

To prevent the appropriation of people's money in their accounts, according to Decision 2345 of the State Bank, from July 1, money transfers of over VND10 million or VND20 million/day must be authenticated by face. After nearly 5 months of applying this regulation, the State Bank assessed that the number of cases of money loss in accounts has decreased significantly.

However, according to the Department of Cyber Security and High-Tech Crime Prevention (Ministry of Public Security), scammers are constantly researching and developing new methods and tricks, making it more difficult for people to identify them.

Such is the case of Ms. Cao Thi Que (born in 1978, in Ca Mau), a recent victim of fraud. Ms. Que said that last November, she received a call from a person claiming to be an electricity official. This person informed her family that the electricity would be cut off because they had not paid the previous month's electricity bill. In order to pay the electricity bill quickly and conveniently, the impersonator asked Ms. Que to install an application called EVNCSKH to pay the electricity bill.

Ms. Que followed the instructions by installing the fake application and entering the security password as instructed by the scammer, then restarting the device. After that, the scammer continued to impersonate her, calling to "entice" her to log in to the Viettel Money application herself. Using sophisticated tricks to remotely take control of the device, the scammer could easily transfer money out of her account.

When she discovered that her account had been lost, Ms. Que contacted Viettel Money and was instructed to look up her money transfer history and report it to local authorities. Through the investigation, the authorities determined that the customer's phone had accessed a fake website and downloaded an application containing malicious code, leading to the theft of information and money in the account.

It can be seen that customers only need to be careless and lose their vigilance for a few seconds when following the criminal's instructions to be scammed and have their money stolen.

VTM - proactive protection in every transaction

Faced with increasingly sophisticated fraud, what should users do to protect their rights if they are unfortunately scammed and lose money?

In Ms. Que's case, cyber security insurance is a practical solution, helping her ensure her rights.

Previously, Ms. Que successfully participated in Viettel Money's Cyber Security Insurance program. This is a complimentary program (free for the first month of using the insurance service) for money transfer transactions on Viettel Money, helping customers increase account protection.

At the time of the incident where the device was hijacked, Ms. Que was given a free insurance package by Viettel Money for money transfer transactions. After Ms. Que reported the incident, Viettel Money continued to accompany and coordinate with the insurance company to ensure her rights.

Viettel Money said that in order to proactively protect customers in all transactions, the application has launched a feature that allows customers to buy insurance when making transactions. Thus, when making money transfers on Viettel Money, customers have the opportunity to buy free Cyber Security Insurance for the first month.

From the following months, the maintenance cost is only 5,000 VND/month with compensation benefits of up to 50 million VND/year in case of an incident like Ms. Que's case.

Viettel Money's Cyber Security Insurance: Small Cost, Big Benefits

Not only protecting customers from risks of fraud, Viettel Money's Cyber Security Insurance packages are also responsible for paying a cost of 35 million VND, a protection level of up to 100% when the account owner encounters any risks related to accidental injuries and bears the cost of treating injuries caused by accidents.

Source: https://tuoitre.vn/bao-hiem-an-ninh-mang-bao-ve-huu-hieu-quyen-loi-cua-khach-hang-20241227100349082.htm

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)