The Journey to Becoming the World's Largest EdTech Unicorn

The company’s founder, Baiju Ravindran, was an engineer by education but didn’t stay in a professional job for long. While helping his friends prepare for exams, Baiju Ravindran discovered his talent for tutoring and started making money from it.

In 2007, Baiju Ravindran founded a college prep company and became so popular that he had to hold large-scale lectures in stadiums.

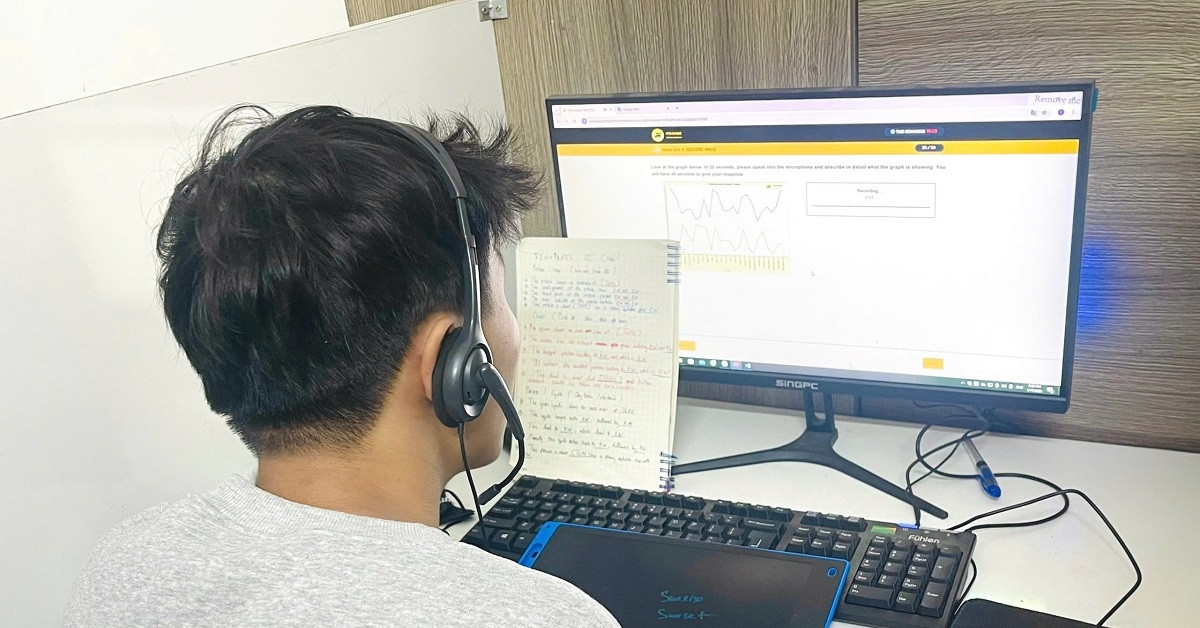

In 2011, the Think&Learn online platform was launched, followed by the official launch of the Byju's mobile app in 2015. The project has attracted millions of viewers in many English-speaking countries.

Initially, Byju's offered lessons in Maths, English and Science for self-study by primary school students, but gradually covered all levels of the school curriculum. Courses were also added to prepare for various Indian and international exams.

Byju's immediately attracted attention and investment. In 2018, the company officially became India's first unicorn (a startup valued at over $1 billion), but it has yet to go public. In 2019, Baiju Ravindran became a billionaire.

According to researchers, Byju's' rapid growth is due to favorable conditions specific to the Indian market: the application was launched at a time when Internet access was expanding massively in the country and local providers offered the most preferential rates in the world; India has a young and rapidly growing population, creating a community of many students and students with learning needs...

But it was the Covid-19 pandemic that really fueled Byju's explosive growth. In 2020, the platform's customer base skyrocketed by 50% and Byju's valuation doubled to $12 billion.

In 2021, the company continued to attract multimillion-dollar investments to acquire other education startups and grow its customer base. The number of app users reached 100 million, of which more than 6 million were paying subscribers. Byju's became the world's most valuable startup by the end of the year, with a valuation of $21 billion. A listing is planned for early 2022.

Mistakes happen all at once

Byju's began to run into problems in 2022. Bloomberg said the project had grown too quickly in previous years. Investors who had poured billions of dollars into it soon realized the flaws in the management cycle.

For example, the company has been without a CFO for a year and a half; education startups have been acquired indiscriminately for a total of $2 billion; staff turnover is so high that many in-person training centers are empty. Meanwhile, demand for online classes has plummeted.

Additionally, despite huge investments, Byju's lacked the capital to buy more and more startups and expand rapidly, so founder Baiju Ravindran decided to turn to debt financing, leaving Byju's with a debt of around $1.2 billion.

In 2022, the investment in the project started to decline. The company was hit hard after two investment deals announced in July 2022 did not materialize as the funds disbursed capital to Byju’s “due to macroeconomic reasons”. The only major investment during this period was $400 million from Baiju Ravindran himself.

By the summer of 2022, the company was unable to provide Indian authorities with its financial statements for the previous fiscal year. When asked about the reason for the delay, Byju’s cited audit difficulties related to multiple startups it acquired during the fiscal year.

It was not until September 2022 that Byju's post-audit report was released that India's most valuable unicorn suffered a net loss of more than $570 million in 2021. So, despite Baiju Ravindran's assertions that the company's prospects of ending the following year with a net profit were no longer credible, Byju's officially entered a period of crisis.

The first signs involved the resale of $1.2 billion in debt to new creditors in the United States who demanded faster payments. Lawsuits followed, with some investors accusing the company of hiding $500 million. Other creditors who had yet to be paid also filed lawsuits.

Increased scrutiny from Indian authorities has added to tensions. Byju’s aggressive sales in 2022 drew the attention of the National Commission for Protection of Child Rights, after buyers were forced to pay interest on credit to pay for the app.

Against this backdrop, Byju's changed its sales strategy in late 2022. Salespeople no longer reach out to potential customers at home. However, the Indian government still keeps a close eye on the company, which has delayed its financial reporting.

In April 2023, the company's Bangalore office was raided. Authorities publicly announced that Byju's was suspected of violating currency laws. Witnessing the company's head's calls to investors at the time, many said Baiju Ravindran was in tears.

A bleak future awaits

In June 2023, representatives of the three largest investors left the company's board of directors, and auditor Deloitte refused to complete Byju's financial statements for the 2022 financial year. The Indian Ministry of Corporate Affairs also launched an investigation into the company's operations due to persistent delays in reporting.

Byju's has laid off more than 3,000 employees in 2022 and will continue to cut about 1,000 employees in 2023. Although Byju's is still a "unicorn", its valuation has dropped more than 4 times, from $22 billion to $5.1 billion.

Baiju Ravindran is no longer a billionaire either. The company is in debt and the previously agreed restructuring period has passed.

According to Bloomberg , founder Baiju Ravindran hopes to remedy this situation with a total investment of $ 1 billion by the end of 2023. If the deals are completed, the company can repay its creditors.

Many continue to believe in the success of Byju's, as the mobile app still has 150 million users, the products are still in demand, and are updated regularly.

At a June 2023 meeting with employees, Baiju Ravindran urged them to ignore the noise, saying “the best is yet to come for Byju’s.” But even if the company is rescued, the overall situation will discourage foreign investment in Indian startups.

Not to mention, the recent research results of the education market research company HolonIQ (USA) show that the amount of capital invested in EdTech continues to decrease globally. Therefore, analysts believe that most education technology companies will have to give up actively expanding their business operations in the near future.

(According to Skillbox)

Source

![[Photo] More areas of Thuong Tin district (Hanoi) have clean water](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/55385dd6f27542e788ca56049efefc1b)

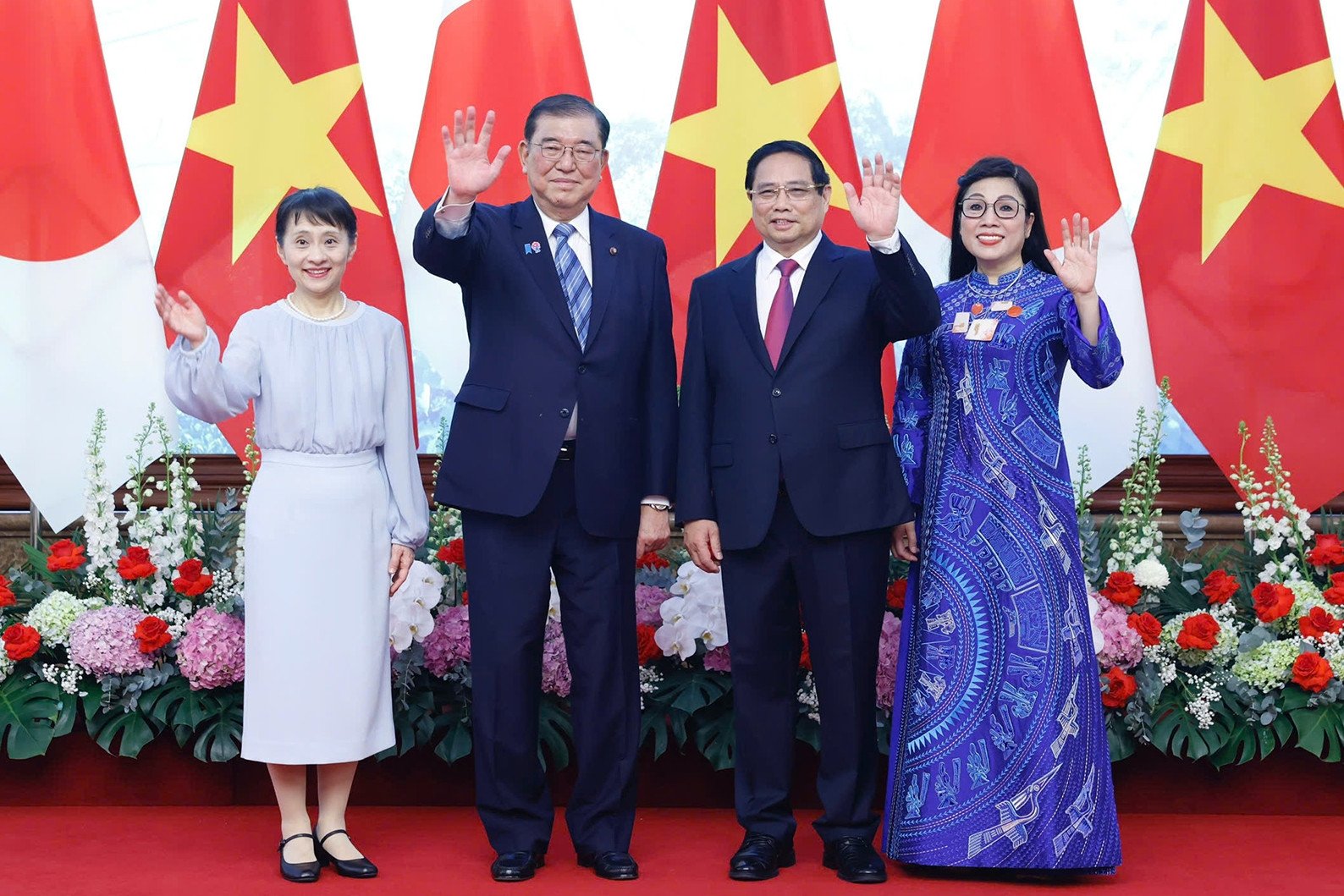

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

![[Infographic] Plan for the arrangement of commune-level administrative units in Phu Yen province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/3e4df7648975454a8fe2f06f93f1f6f3)

Comment (0)