The Europe and Latin America (LATAM) market grew the fastest in Q2 2024, with double-digit growth, as consumer sentiment and shopping demand improved year-on-year. In China, the market continued to grow year-on-year thanks to Huawei's strong comeback and the 618 shopping festival.

Smartphone sales hit a decade low in 2023, but the market quickly recovered thanks to a change in consumer sentiment, said Tarun Pathak, research director at Counterpoint Research.

In addition, according to him, companies have responded quickly to consumer demand, refreshing their portfolios, thereby boosting sales. “We are optimistic about smartphone sales in the coming quarters and expect the market to grow 4% by 2024,” Tarun Pathak predicted.

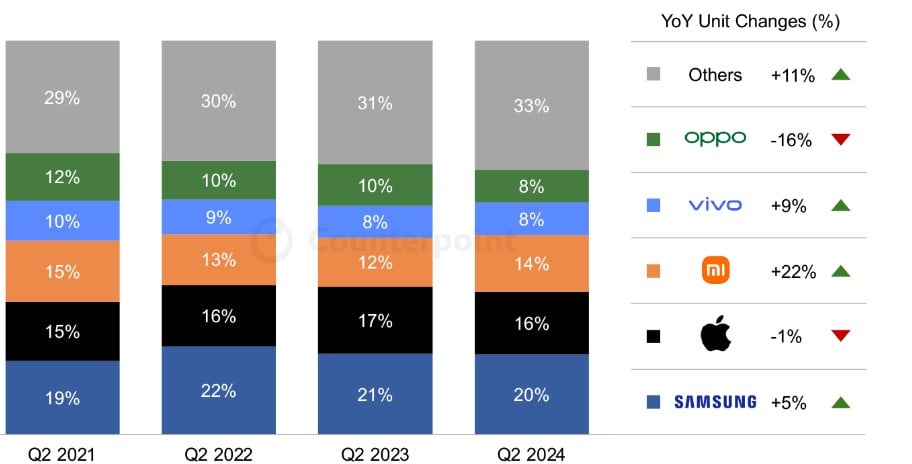

The top 5 brands in the market remain the same as previous quarters, ranked in order as Samsung, Apple, Xiaomi, Vivo and Oppo.

Samsung retained its No. 1 position in Q2 2024, thanks to strong sales of its Galaxy S24-centric series and an early refresh of the Galaxy A series – with many best-selling models in the low- to mid-range segments.

Apple ranked second with 16% of the global smartphone market share from April 1 to June 30, 2024. The company still recorded growth in Europe and Latin America, making up for a slight loss in China. In the second half of 2024, Apple is expected to continue growing with new iPhones.

Xiaomi was the fastest growing brand in the top 5 in Q2 this year. Strong demand for the Redmi 13 and Note 13 series, coupled with a leaner product portfolio, helped Xiaomi capture 14% of the global market share, up 2% from Q2 2023.

Vivo and Oppo both accounted for 8% of the global market share in the second quarter of this year. Vivo has a strong position in the world's two largest smartphone markets, China and India. Meanwhile, Oppo has focused on increasing profits, including launching more devices in the mid- to high-end price segment to adjust its business strategy. As a result, its market share in the second quarter of this year decreased by 2% compared to the second quarter of last year.

Following these five brands are mainly Huawei, Honor, Motorola as well as brands of the Transsion group. Overall, the market share of the top 10 brands accounts for 90% globally, showing fierce competition between manufacturers. Among them, Huawei is making great strides in China. Honor and Tecno are also expanding their influence, while Motorola has seen strong growth in the past two years.

The global smartphone market has entered a new era of slow but steady growth, said Ankit Malhotra, senior analyst at Counterpoint Research. He expects revenue to grow faster than unit sales, driven by the trend of premiumization of smartphones across regions, as well as rising demand for foldable and GenAI-equipped phones.

Source: https://laodong.vn/cong-nghe/apple-samsung-xep-tren-cac-thuong-hieu-trung-quoc-trong-quy-2-nam-2024-1366812.ldo

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)