(Dan Tri) - Mr. Bang's mother is 61 years old and has never participated in social insurance. He wants to pay voluntary insurance at once so that his mother can receive a pension.

Mr. Bang’s mother is 61 years old this year. He heard that when the Social Insurance Law 2024 takes effect, the minimum number of years of social insurance contributions to receive a pension will be reduced to 15 years. Therefore, he wants to pay voluntary social insurance for his mother so that she can receive a pension.

Mr. Bang asked: "When the Social Insurance Law 2024 takes effect, my mother will be 62 years old and has never participated in social insurance. Can she now pay voluntary social insurance for 15 years at once to receive a pension? If so, how will the payment level be calculated?"

According to Vietnam Social Security, Social Insurance Law No. 41 passed on June 29, 2024, effective from July 1, 2025 (referred to as Social Insurance Law 2024), stipulates that employees who reach retirement age and have participated in social insurance for 15 years are eligible for pension.

Clause 2, Article 36 of the Law on Social Insurance 2024 stipulates that voluntary social insurance participants are allowed to pay voluntary social insurance once for many years to come and once for the remaining social insurance payment period to be eligible for pension.

According to Clause 4, Article 36 of the Law on Social Insurance 2024, the Government shall specify the above content for implementation. However, at present, the Government has not issued a document guiding the implementation of this content, so Vietnam Social Insurance has no basis for implementation.

According to current regulations (applied according to the Social Insurance Law 2014), voluntary social insurance participants are allowed to pay voluntary social insurance once for many years in the future, but for a maximum of 5 years. In addition, when reaching retirement age, employees are allowed to pay voluntary social insurance once for the remaining social insurance payment period to be eligible for pension, but the remaining social insurance payment period must not exceed 10 years (120 months).

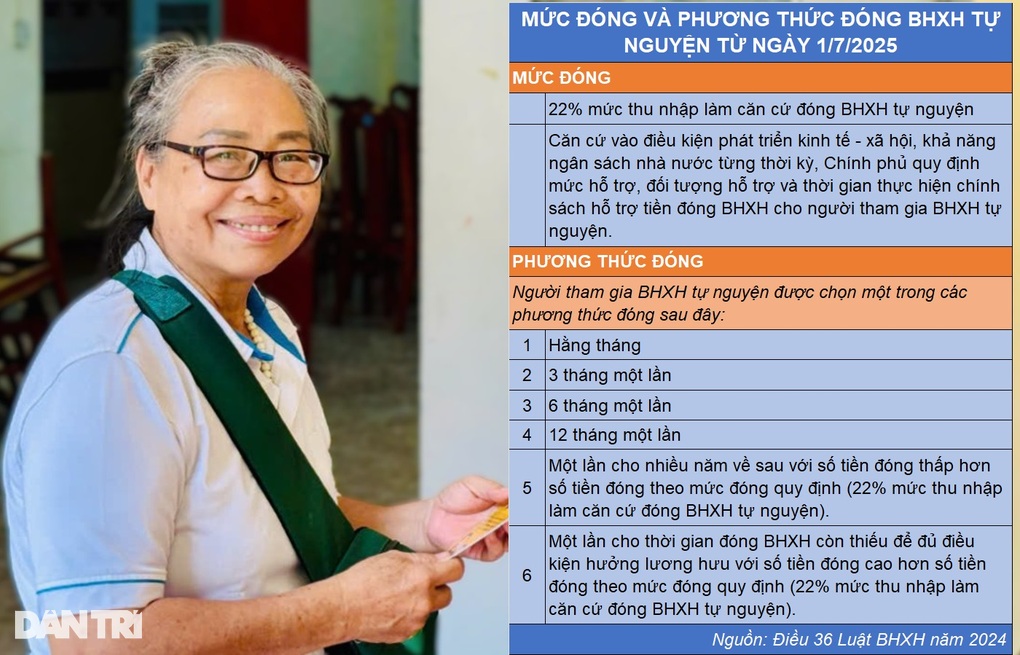

Contribution levels and methods of voluntary social insurance contribution from July 1, 2025 (Photo: Ho Chi Minh City Social Insurance; Graphics: Tung Nguyen).

Regarding the contribution level, Vietnam Social Security said it is stipulated in Clause 1, Article 36 of the Law on Social Insurance 2024. Accordingly, the voluntary social insurance contribution level is equal to 22% of the income used as the basis for voluntary social insurance contribution.

Vietnam Social Security instructs: "You can choose the income level as the basis for voluntary social insurance payment within the range of the lowest equal to the poverty line of rural areas and the highest equal to 20 times the reference level at the time of payment."

Source: https://dantri.com.vn/an-sinh/61-tuoi-dong-bhxh-tu-nguyen-mot-lan-de-huong-luong-huu-duoc-khong-20241102162948117.htm

![[Photo] Prime Minister Pham Minh Chinh chairs Government Standing Committee meeting on Gia Binh airport project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/6d3bef55258d417b9bca53fbefd4aeee)

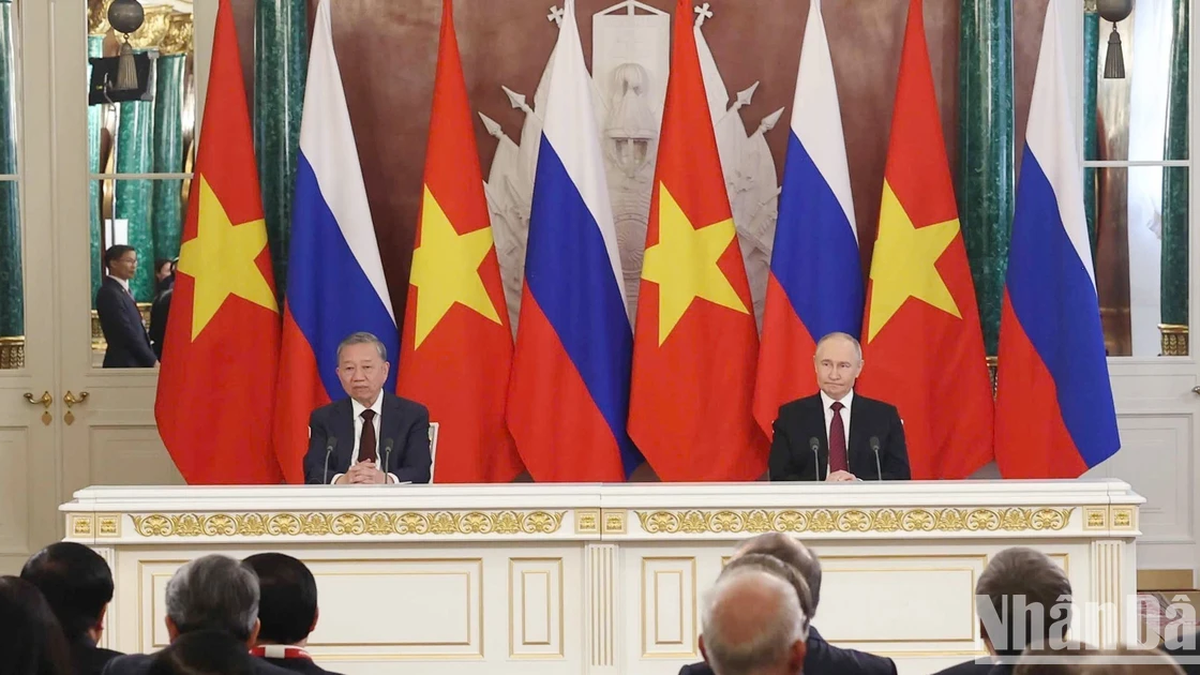

![[Photo] General Secretary To Lam holds a brief meeting with Russian President Vladimir Putin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/bfaa3ffbc920467893367c80b68984c6)

Comment (0)