|

| In the first 11 months of 2023, Ho Chi Minh City is the locality with the highest export turnover in the country. (Source: Cafe F) |

Top 5 localities with the highest export turnover in the country

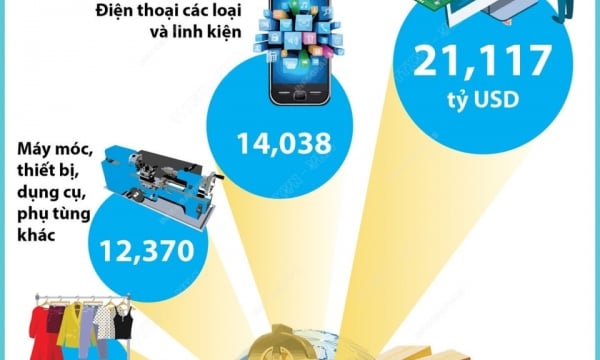

According to the latest data from the General Department of Customs on import and export situation in the first 11 months of 2023, the total import and export turnover of goods in November is estimated at 60.88 billion USD, down 1.4% compared to the previous month and up 5.9% over the same period last year.

Regarding exports, the report said that the export turnover of goods in November 2023 was estimated at 31.08 billion USD, down 3.6% compared to the previous month. Of which, the domestic economic sector reached 8.49 billion USD, down 2.4%; the foreign-invested sector (including crude oil) reached 22.59 billion USD, down 4.1%. Compared to the same period last year, the export turnover of goods in November increased by 6.7%, of which the domestic economic sector increased by 13.5%, the foreign-invested sector (including crude oil) increased by 4.4%.

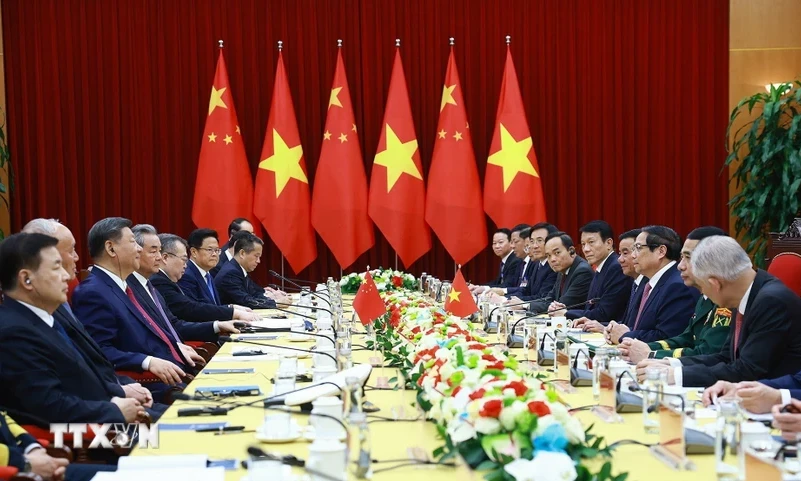

By province and city, the General Department of Customs' report said that in November 2023 alone, the five localities with the highest export turnover in the country were Ho Chi Minh City (3.62 billion USD), Bac Ninh (3.4 billion USD), Hai Phong (2.9 billion USD), Binh Duong (2.6 billion USD) and Bac Giang (2.3 billion USD).

In the first 11 months of 2023, Ho Chi Minh City is the locality with the highest export turnover in the country, with an export turnover of 38.5 billion USD. In second place is Bac Ninh, with an export turnover of 36.4 billion USD in 11 months. Following are Binh Duong, Thai Nguyen and Hai Phong, with export turnover reaching 27.7 billion USD, 24 billion USD and 23.93 billion USD, respectively.

Regarding imports, according to the General Department of Customs, the import turnover of goods in November 2023 is estimated at 29.8 billion USD, up 1% over the previous month. Of which, the domestic economic sector reached 10.6 billion USD, down 0.4%; the foreign-invested sector reached 19.2 billion USD, up 1.7%. Compared to the same period last year, the import turnover of goods in November increased by 5.1%, of which the domestic economic sector increased by 4.2%; the foreign-invested sector increased by 5.6%.

By province and city, the General Department of Customs' report said that in November 2023 alone, the five localities with the highest import turnover in the country were Ho Chi Minh City (4.9 billion USD), Hanoi (3.36 billion USD), Bac Ninh (3.12 billion USD), Hai Phong (2.4 billion USD) and Binh Duong (1.98 billion USD).

In the first 11 months of 2023, Ho Chi Minh City is the locality with the highest import turnover in the country, with an import turnover of 50.4 billion USD. Hanoi ranked second, with an 11-month export turnover of 33.9 billion USD. Following are Bac Ninh, Binh Duong and Bac Giang, with export turnover of 30.4 billion USD, 19.98 billion USD and 18.4 billion USD, respectively.

In the first 11 months of 2023, the total import and export turnover of goods reached 619.17 billion USD, down 8.3% over the same period last year. Of which, the export turnover of goods is estimated at 322.50 billion USD, down 5.9% over the same period last year. Of which, the domestic economic sector reached 85.94 billion USD, down 2.2%, accounting for 26.6% of the total export turnover; the foreign-invested sector (including crude oil) reached 236.56 billion USD, down 7.1%, accounting for 73.4%.

In the first 11 months of 2023, the total import turnover of goods is estimated at 296.67 billion USD, down 10.7% over the same period last year, of which the domestic economic sector reached 105.94 billion USD, down 8.8%; the foreign-invested sector reached 190.73 billion USD, down 11.7%.

The trade balance of goods in 11 months of 2023 is estimated to have a trade surplus of 25.83 billion USD.

China keeps buying this tuber from Vietnam

The Import-Export Department (Ministry of Industry and Trade) cited statistics from the General Department of Customs, saying that in November 2023, Vietnam exported 268.91 thousand tons of cassava and cassava products, worth 134.77 million USD. In the first 11 months of 2023, the export of cassava and cassava products reached over 2.66 million tons, worth 1.16 billion USD, down 6.8% in volume and 7.3% in value compared to the same period in 2022.

In November 2023, China remained Vietnam's largest export market for cassava and cassava products, accounting for 92.09% in volume and 92.59% in value of the country's total cassava and cassava product exports, reaching 247.64 thousand tons, worth 124.78 million USD, up 2.5% in volume, but down 0.1% in value in October 2023; Compared to November 2022, it decreased by 10.6% in volume, but increased by 6.8% in value.

The average export price of cassava and cassava products to China was 503.9 USD/ton, down 2.5% compared to October 2023, but up 19.5% compared to November 2022. In the first 11 months of 2023, Vietnam exported 2.43 million tons of cassava and cassava products to China, worth 1.05 billion USD, down 6.7% in volume and 7.7% in value compared to the same period in 2022.

According to statistics from the China Customs Administration, in October 2023, China imported 233.76 thousand tons of cassava chips (HS 07141020), worth 66.92 million USD, down 7.9% in volume and 10.2% in value compared to October 2022. Thailand, Vietnam, and Laos are the three markets supplying cassava chips to China.

In the first 10 months of 2023, China imported nearly 5.35 million tons of cassava chips, worth 1.47 billion USD, down 17.1% in volume and 20.4% in value compared to the same period in 2022. Thailand, Vietnam, Laos, Cambodia and Nigeria are the 5 markets supplying cassava chips to China.

Notably, China’s imports of cassava chips from Vietnam, Cambodia and Nigeria increased, while imports from Thailand and Laos decreased compared to the same period in 2022.

In the first 10 months of 2023, Vietnam was the second largest supplier of cassava chips to China with 667.15 thousand tons, worth 183.01 million USD, up 28.9% in volume and 19.5% in value over the same period in 2022. Vietnam's cassava chip market share accounted for 12.47% in volume and 12.38% in value in China's total cassava chip imports, higher than the same period in 2022.

In October 2023, China imported 308,070 tons of cassava starch (HS 11081400), worth 169.14 million USD, up 10.8% in volume and 19.4% in value compared to October 2022. Thailand, Vietnam, Indonesia, Laos, and Cambodia are the markets supplying cassava starch to China. Except for Laos, cassava starch imports from these markets all increased significantly compared to October 2022.

In the first 10 months of 2023, China imported 2.54 million tons of cassava starch, worth 1.28 billion USD, down 26.8% in volume and 29.2% in value compared to the same period in 2022, mainly imported from Thailand, Vietnam, Laos, Cambodia and Indonesia.

In the first 10 months of 2023, Vietnam was the second largest market supplying cassava starch to China, with 795.99 thousand tons, worth 386.03 million USD, down 39.2% in volume and 42% in value compared to the same period in 2022. Vietnam's cassava starch market share in China's total imports accounted for 31.28% in volume and 30.06% in value, lower than in the first 10 months of 2022.

Meanwhile, China continued to boost imports of cassava starch from Laos and Indonesia compared to the same period in 2022. Laos' cassava starch market share accounted for 6.78% in volume and 5.91% in value of China's total imports, up from the first 10 months of 2022; Meanwhile, Indonesia's cassava starch market share accounted for 2.95% in volume and 2.99% in value of China's total imports, up from the first 10 months of 2022.

According to the data, in the first 10 months of 2023, China tended to reduce imports of cassava starch from Vietnam, Thailand and Cambodia, while increasing imports from Laos and Indonesia. In the Chinese market, cassava and cassava starch from Vietnam are facing strong competition with cassava and cassava starch from Thailand, Indonesia, Laos and Cambodia.

Rubber exports "face difficulties" in India

According to statistics from the Indian Ministry of Commerce, in the first 9 months of 2023, India imported 869.51 thousand tons of rubber (HS 4001; 4002; 4003; 4005), worth 1.58 billion USD, down 8.1% in volume and 25.4% in value compared to the same period in 2022. Indonesia, South Korea, Thailand, Malaysia and Vietnam are the 5 largest markets supplying rubber to India.

India's rubber imports from Vietnam decreased sharply in the first 9 months of 2023, with 77.77 thousand tons, worth 114 million USD, down 26.5% in volume and 44.8% in value compared to the same period in 2022. Rubber imported from Vietnam accounted for only 8.94% of India's total rubber imports, down from 11.19% in the same period in 2022. In the Indian market, Vietnam's rubber market share is shrinking compared to the same period in 2022, while the rubber market share of Indonesia, Thailand, Korea, and China increased sharply compared to the same period in 2022.

In the first 9 months of 2023, India imported 362.44 thousand tons of natural rubber (HS 4001), worth 540.62 million USD, down 14.3% in volume and 33.5% in value compared to the same period in 2022. Indonesia, Vietnam, Malaysia, Ivory Coast and Thailand are the 5 largest markets supplying natural rubber to India.

|

| In the first 11 months of 2023, rubber exports to most markets still decreased compared to the same period last year. (Source: Industry and Trade Newspaper) |

Of which, Vietnam is the second largest market supplying natural rubber to India in the first 9 months of 2023 with 76.24 thousand tons, worth 111 million USD, down 27% in volume and 45.2% in value compared to the same period in 2022. Vietnam's natural rubber market share in India's total imports accounted for 21.04%, down sharply compared to 24.69% in the same period in 2022.

In this context, many experts recommend that rubber exporting enterprises need to have a strategy to increase the proportion of processed rubber rather than raw rubber to increase export value. It is forecasted that by the end of 2023, rubber export turnover will hardly reach the target of 3.5 billion USD and will only stop at 3 billion USD.

In the first 11 months of 2023, rubber exports to most markets still decreased compared to the same period last year, especially large markets such as: India, the United States, Germany, Taiwan (China), Turkey, Sri Lanka, Russia, Indonesia, Spain... However, rubber exports to some markets still grew well in volume compared to the same period in 2022 such as: China, Korea, the Netherlands, Singapore, the Czech Republic...

Source

![[Photo] Japanese Prime Minister's wife visits Vietnamese Women's Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/8160b8d7c7ba40eeb086553d8d4a8152)

![[Photo] Fireworks light up Hanoi sky to celebrate national reunification day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/5b4a75100b3e4b24903967615c3f3eac)

![[Photo] General Secretary To Lam receives Chairman of the Liberal Democratic Party, Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/63661d34e8234f578db06ab90b8b017e)

![[Photo] General Secretary To Lam's wife and Japanese Prime Minister's wife make traditional green rice cakes together](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/7bcfbf97dd374eb0b888e9e234698a3b)

![[Photo] Living witnesses of the country's liberation day present at the interactive exhibition of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/b3cf6665ebe74183860512925b0b5519)

![[Infographic] Weather forecast for the holiday season April 30 - May 1, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/d5f61d280e674c1abaa84aa22951d1f2)

Comment (0)