At the regular press conference for the second quarter of 2023 of the Ministry of Finance held on June 16, Mr. Doan Thanh Tuan - Deputy Director of the Department of Insurance Supervision and Management (Ministry of Finance) - informed about the results of the inspection of 4 life insurance companies cross-selling products through a number of commercial banks. The inspection agency discovered certain violations.

To date, the Insurance Supervision and Management Department has completed the inspection conclusions for 4 life insurance companies and reported to the competent authority. After completing the inspection conclusions, the Ministry of Finance will publicly announce them according to regulations.

4 life insurance companies inspected all have violations

Previously, the Ministry of Finance has implemented many management and supervision solutions to rectify the operation of the insurance market; including the sale of insurance through banks. The Ministry of Finance has requested insurance companies to strengthen inspection and supervision of the implementation of insurance agency contracts with banks; strictly comply with the provisions of the Law on Insurance Business on not forcing organizations and individuals to buy insurance in any form.

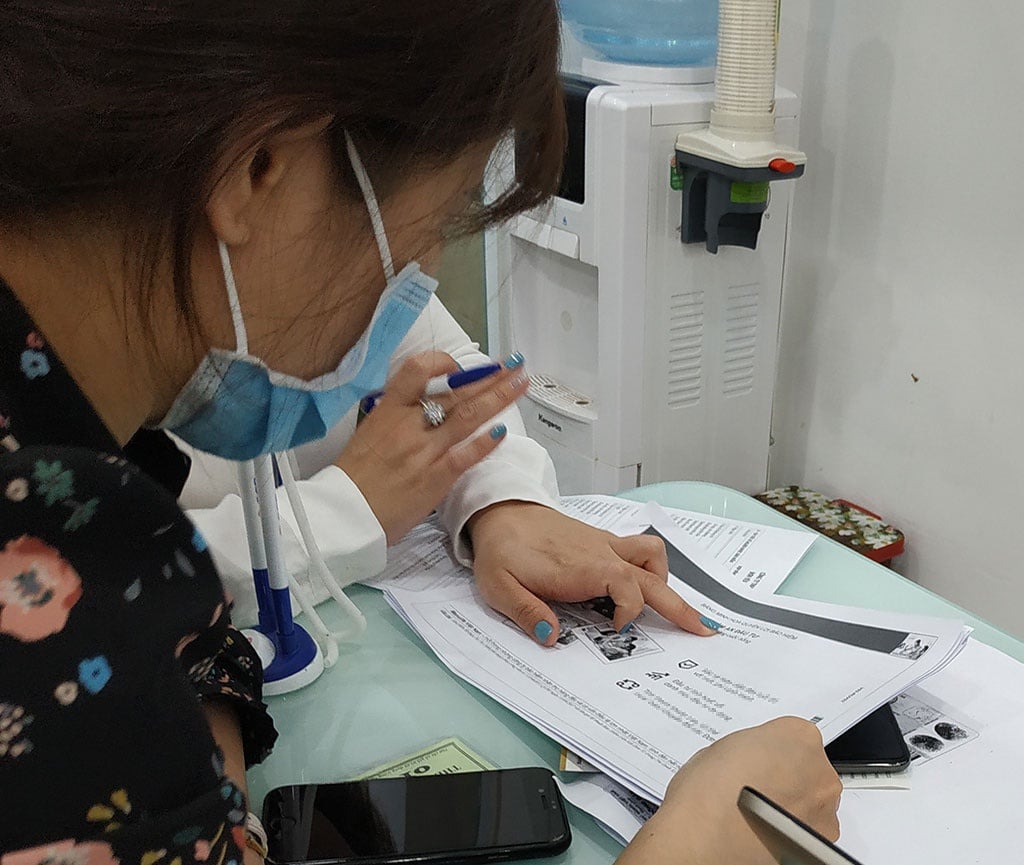

Since the end of 2022, from the reflections of insurance customers and the press, especially the fact that bank employees solicit and force customers to buy insurance. The leaders of the Ministry of Finance have directed the inspection of the activities of insurance companies selling products through banks and set up a hotline to receive information and recommendations related to the sale of insurance products through credit institutions. After just over 1 month, at the first quarter press conference of 2023 held by the Ministry of Finance at the end of March 2023, this agency said that the hotline had received 178 phone calls and the unit also received 218 emails from people about this issue.

According to the Ministry of Finance, the distribution of insurance products through banks has developed rapidly and has made certain contributions to the total revenue of the insurance industry. This activity accounts for about 20% of the total premium revenue of the life insurance market and about 14% of the non-life insurance market. In 2022, the total premium revenue is estimated to reach VND 251,306 billion, an increase of more than 15%, of which 73% is life insurance.

Source link

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)