Tax authorities are stepping up tax debt collection with many measures, including suspending exit. In the photo: People are doing procedures at the tax authority - Photo: NGOC PHUONG

This information has just been announced by the Ho Chi Minh City Tax Department in the context that the total estimated tax debt as of June 30 in Ho Chi Minh City is up to 61,582 billion VND, equal to 17.5% of the estimated state budget revenue in 2024.

Bad tax debt increased by 35.68% over the same period

Although this tax debt decreased compared to May, it increased sharply compared to the same period and increased by VND 11,099 billion compared to December 31, 2023, equivalent to an increase of 22%.

Of which, recoverable debt is 30,923 billion VND, up 9.42% over the same period.

Bad debt is 17,220 billion VND, up 35.68% over the same period. Debt being processed is 13,440 billion VND, up 11.37% over the same period. Debt awaiting adjustment is 950 billion VND, up 15.9% over the same period.

The Ho Chi Minh City Tax Department said that tax debt increased compared to the end of 2023 due to a number of main reasons such as: the debt has expired but the taxpayer has not paid it to the state budget in time. In addition, there are also difficulties and problems with land rent and large land use fees that have not been resolved.

In addition, there is also an increase in corporate income tax after the 2023 settlement, and an increase in late payment fees due to the system recalculating late payment fees in 2023 for debts paid during the year.

Or because the business has not resolved financial difficulties and difficulties in bank credit, leading to increased tax debt.

However, compared to the previous month, the tax debt situation in June 2024 has shown signs of decreasing.

Departure suspension is a tough measure to collect tax debts.

To speed up the handling and collection of the above tax debts, in the first 6 months of 2024, the Ho Chi Minh City Tax Department issued 66,018 enforcement decisions with a total enforcement amount of VND 512,004 billion.

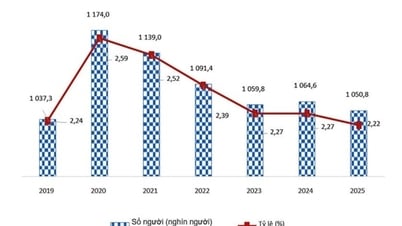

The tax authority has temporarily suspended exit for 2,766 individuals debt and business representatives with tax debts, and publicly disclosed information on taxors on mass media for 1,196 taxpayers with tax debts, with the total estimated tax debt by the closing date of June 2024 being VND 19,656 billion.

Thanks to drastic measures to handle, urge debt collection and enforce tax debt collection, it is estimated that by the end of June 2024, the amount of debt collected will be VND 21,581 billion.

Of which, debt collection in 2023 is 6,141 billion VND, debt collection arising in 2024 is 15,440 billion VND.

Recently, a series of chairmen, general directors, and legal representatives of large companies and corporations have had their exit from the country temporarily suspended due to tax debts.

According to the Ministry of Finance , implementing the measure of temporarily suspending exit to collect tax debts is a drastic measure. It also serves as a warning to other people who owe taxes.

Currently, the number of people with tax debts of less than 1 million VND is very large and prolonged. In cases of temporary exit suspension, the tax authority will review, compare, and accurately determine the tax obligations of taxpayers who are subject to temporary exit suspension.

A notice requesting temporary suspension of exit will then be sent to the immigration authority and the taxpayer so that they can fulfill their tax obligations before leaving the country.

Source: https://tuoitre.vn/2-766-nguoi-tai-tp-hcm-bi-tam-hoan-xuat-canh-vi-no-thue-20240718154118572.htm

Comment (0)