The second proposal to tax real estate; villas and townhouses on the outskirts of Hanoi are gradually "heating up", prices will increase; many people have abandoned their deposits to bid for Thanh Oai land, cases of conversion of housing functions... are the latest real estate news.

|

| Real estate: Auctioned land in Hoai Duc district, Hanoi. (Source: Vietnamnet) |

Real estate 'falls' into the hands of the rich, prices continuously increase

The Vietnam Association of Realtors (VARS) said that the situation of abandoned houses, abandoned villas, and abandoned urban areas is increasingly appearing. Even in big cities, where land is scarce and population is dense, this situation is still widespread, showing the paradox between abandoned land and houses on one side and the scene of people struggling, working all their lives but still not sure if they can buy a piece of land or a house.

Also according to VARS, the practice of investors speculating - hoarding goods when they are scarce, not available to sell, then leaving them unsold waiting for prices to increase or creating artificial scarcity to push prices up in search of high profits, is very common, occurring from urban to rural areas. It affects the process of land fund development, supply and demand relations, and affects the economy in the long term.

VARS believes that the tax should be applied to second homes and more. It is natural that people with many assets, and assets that continuously generate profits, pay more taxes. In fact, most home buyers in recent times are second or third home buyers.

This proposal was made in the context of real estate prices continuously increasing, with no sign of decreasing.

According to this unit's data, the apartment price index in the second quarter of 2024 in Hanoi and Ho Chi Minh City increased by 58% and 27% respectively compared to the same period in 2019. The mid-range segment is increasingly scarce and more than 80% of the supply of newly opened apartments this year is priced above 50 million VND/m2.

Not only new projects, but also old apartment prices have skyrocketed. Many apartments that have been used for decades are still being advertised at prices 2-3 times higher than when they were first launched. The segment of villas, townhouses, and suburban land plots also shows signs of price increases, because some groups of investors create fake supply and demand to profit.

Therefore, to regulate the market to develop in a safe, healthy, and sustainable direction, so that land prices increase and decrease according to the market, according to VARS, promulgating a real estate tax policy is an urgent task that cannot be ignored because it is difficult.

VARS proposes a property tax policy that applies to two groups: buyers of second homes or more and owners who abandon their projects. The tax rate will increase gradually for transactions where the seller has a short ownership period.

As in Singapore, home buyers must pay a fee of 20% of the property value for a second home, 30% for a third home. Owners who sell their home in the first year will have to pay a tax of 6% of the property value, 8% in the second year, 4% in the third year and no tax or fee will be applied after the fourth year.

VARS also proposed that in case the owner does not build a project after receiving the land, he must also pay the real estate abandonment tax. This method is applied by Korea, land abandoned or in the process of land improvement for more than 2 years is taxed at 5% and the tax rate increases gradually according to the number of years the land is abandoned, 5 years is taxed at 8%, 7 years is taxed at 9%, abandoned for more than 10 years is taxed at 10%. In the US, abandoned land is taxed at 3%...

However, this association also recognizes that the use of tax tools to regulate the market faces many challenges. In particular, it requires large investments in technology and human resources, because in order to determine which is a second or third home... to use tax tools effectively and transparently, State management agencies need to promote the construction and completion of information systems and databases on housing and the real estate market.

VARS also recommends considering possible negative impacts, such as taxation that could cause people to "exhaust" their purchasing power, leading to other long-term consequences for the economy or creating legal loopholes where the rich can still avoid taxes by transferring ownership of second, third... properties to relatives, increasing house rents to offset costs from paying taxes...

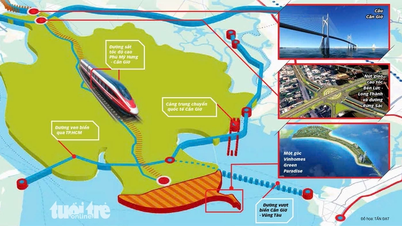

Adjacent, sought-after suburban villas

According to Vietnamnet, land auctions in the suburbs of Hanoi have been "hot" in recent days. Market developments have caused many investors and real buyers to rush to find land for villas and townhouses in the suburbs built in synchronous urban areas. Surveys in the suburban districts of Hanoi show that the supply of this segment is quite scarce, the number of villa and townhouse projects on the outskirts of Hanoi that are being opened for sale is small and quickly sold out.

In the West, some new villa projects cost from 180 million to nearly 200 million VND/m2.

In the Southern region, 159 Him Lam Thuong Tin shophouses are a rare supply that is being opened for sale. Currently, the shophouses, 5-storey townhouses with 2 front and back facades, which have been completed and have red books, are being introduced to the market with prices starting from 100 million VND/m2.

Along with existing supplies, the market also attracted attention with information about a project in Dong Anh preparing to launch in the fourth quarter with a price of around 300 million VND/m2...

The supply of villas and townhouses is considered to be at its lowest level in the past 10 years, which has pushed the selling price of the villa and townhouse segment to continuously increase over the past year. Villa prices in some areas in Hoai Duc and Ha Dong are continuously setting new levels, increasing by 30-50% compared to more than a year ago. In some potential areas, the number of interested customers has even increased, causing a local price fever.

Ms. Le Thi Bich Ngoc - Deputy General Director of Truong Son Land said that the sharp increase in apartment prices and high auction prices have caused many investors to shift to suburban areas. Accordingly, the low-rise segment will continue to heat up. In the near future, the price of new products in suburban areas may establish a new price level when the Land Law officially takes effect from August 1, pushing up the costs of villas and townhouses.

According to observers, in the short term, the liquidity of the villa and townhouse segment will increase, and secondary prices will likely continue to rise. "From now until the end of the year, the villa and townhouse segment in Hanoi will continue to witness price increases as supply is scarce and demand continues to increase. However, the supply will mainly be in suburban districts, and the inner city area has exhausted land funds for new projects," said Ms. Nguyen Hoai An - Director of CBRE Hanoi.

According to Mr. Nguyen Van Dinh - Vice President of Vietnam Real Estate Association, when resort real estate is still quite quiet, land in the provinces is waiting for the right time, and inner-city apartments are too hot, suburban villas and townhouses are still the choice of many investors because they both ensure stability and have high potential for price increase. "Currently, the market for villas and townhouses in Hanoi has run out of inner-city products, forcing the demand for low-rise housing to move to the suburbs. This will also be the driving force for continued price increase of this segment in the future," Mr. Dinh affirmed.

Thanh Oai auctioned land: 55/68 lots with deposit

The deadline for payment has passed, but only 13/68 plots of land in Ngo Ba area, Than village, Thanh Cao commune, Thanh Oai district (Hanoi) have fulfilled their financial obligations. The 55 plots with forfeited deposits have winning prices ranging from 80 million VND/m2 to over 100 million VND/m2.

According to regulations, the land auction winner must fulfill financial obligations in two installments within 30 days. The final payment of this auction is on September 14.

However, information shared by the Thanh Oai District Land Fund Development Center with the press shows that, as of today (September 16), although the payment deadline has expired, only 13/68 land lots have fulfilled their financial obligations. Among the lots that have paid in full, the highest lot costs more than 55 million VND/m2.

The lots with high winning prices from 80 million VND/m2, including the winner of the lot with the highest price of 100.5 million VND/m2, have not paid on time. Thus, 55 lots are understood to have forfeited their deposits.

Previously, the auction of 68 land lots in Ngo Ba area, Thanh Than village, Thanh Cao commune caused a stir among real estate investors and the public when there were more than 4,000 qualified applications, with more than 1,500 customers. The winning price was 7-8 times higher than the starting price. From the starting price of 8.6-12.5 million VND/m2, the highest winning price exceeded 100 million VND/m2.

Specifically, lot LK03-10 with an area of nearly 65 square meters has the highest winning price of up to 100.5 million VND/square meter, 8 times higher than the starting price.

It is known that the auction of 68 land lots in Ngo Ba area, Thanh Than village, Thanh Cao commune was held on August 10, expected to collect more than 400 billion VND. With 13 land lots fulfilling financial obligations, the total amount collected was just over 80 billion VND, or 20% of the expected amount.

Cases of housing function conversion from August 1

Article 124 of the 2023 Housing Law clearly stipulates cases where housing functions can be converted.

Accordingly, cases of conversion of housing functions include:

Conversion from resettlement housing to social housing.

Convert from public housing or social housing when no longer needed to resettlement housing.

Converting housing under the provisions of Point d, Clause 1, Article 13 of the 2023 Housing Law to public housing or social housing for rent.

Other cases according to the decision of the Prime Minister based on the proposal of the Ministry of Construction .

Note: The conversion of housing functions as prescribed in Clause 1 of this Article must comply with the following principles:

Must be consistent with the approved provincial housing development program and plan, and not cause loss of public assets.

After being converted, the house must be used effectively, for the right purpose and in accordance with the standards and technical regulations of the converted house.

Must be approved by the Ministry of Construction or the Provincial People's Committee.

Source: https://baoquocte.vn/bat-dong-san-moi-nhat-vung-ven-lap-mat-bang-gia-moi-de-xuat-danh-thue-bat-dong-san-thu-2-bo-coc-dau-gia-dat-thanh-oai-286601.html

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

Comment (0)