Gloomy trading, VN-Index continues to decrease more than 12 points in session 9/16

Despite a strong recovery compared to the last two sessions, liquidity remains low. Trading on the market continues to be gloomy and many large stocks have fallen sharply, causing the indices to fluctuate mainly in the red.

|

| The stock market fell with the number of stocks falling in price overwhelming. |

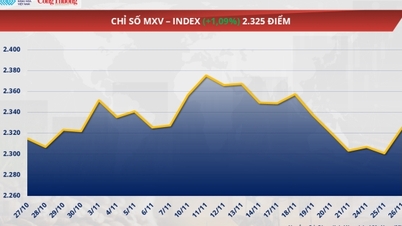

The two previous trading sessions of the weekend recorded the lowest trading volume since April 2023, along with a 1.75% decrease for the entire week, bringing the VN-Index to 1,251.71 points. Entering the new week, before a series of important events affecting the stock market such as the Fed meeting to decide on interest rates, the expiration of VN30 index futures contracts, and two large foreign ETF funds completing their investment portfolio restructuring for the fourth quarter of 2024, the indices fluctuated. However, demand in the market remained weak, many "holding" investors lost patience, and selling pressure therefore increased again in the second half of the morning session. The indices therefore also fell below the reference level. During the afternoon session, the indices fluctuated in red with some recoveries but not significantly.

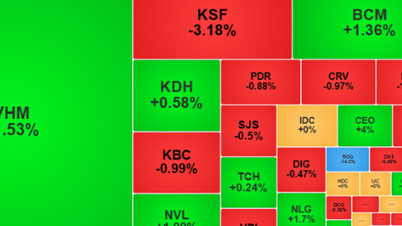

At the end of the trading session, VN-Index decreased by 12.45 points (-0.99%) to 1,239.26 points. The entire floor had 97 stocks increasing, 312 stocks decreasing and 62 stocks remaining unchanged. HNX-Index decreased by 1.58 points (-0.68%) to 230.84 points. The entire floor had 58 stocks increasing, 96 stocks decreasing and 61 stocks remaining unchanged. UPCoM-Index decreased by 0.38 points (-0.41%) to 92.57 points.

According to the Ministry of Planning and Investment , preliminary and incomplete estimates show that property damage caused by storm No. 3 is about VND40,000 billion; GDP for the whole year is estimated to decrease by 0.15% compared to the scenario of estimated growth of 6.8-7%. The impact of storm Yagi on the economy may partly affect investor sentiment, reflecting on the performance of the stock market - which is considered a barometer of the economy.

In the VN30 group today, only GVR increased in price with an increase of 0.87% to 34,900 VND/share. Meanwhile, the VN30 group recorded 25 stocks decreasing in price. Three bank stocks including MBB, SSB, TCB andVIB kept the reference price in today's session and somewhat did not put more pressure on the general market. Notably, both SSB and TCB had a good increase in price at the beginning of the session, but due to the strong selling in the general market, these stocks also retreated to the reference price.

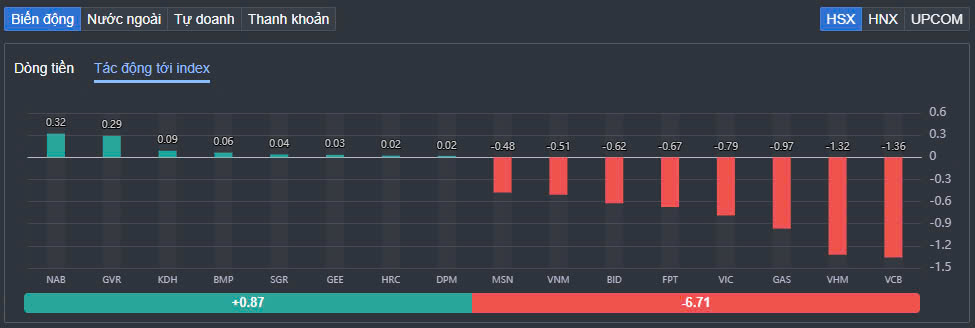

NamA Bank (NAB) shares had the most positive impact on the VN-Index today with 0.32 points, closing the session up 6.1%. Meanwhile, GVR ranked second with a contribution of 0.29 points. Shares such as KDH, BMP, SGR… were the next codes that had positive contributions to the VN-Index instead of other bluechip stocks.

On the other hand, a series of large-cap stocks fell sharply and put pressure on the VN-Index. VCB was the stock with the most negative impact on the index, taking away 1.36 points. At the end of the session, VCB fell 1.11% to VND88,900/share. Following that, VHM fell 2.91% and took away 1.32 points from the VN-Index. Stocks such as GAS, VIC,FPT , BID... were all on the list of stocks that had a strong negative impact on the index.

|

In the group of small and medium-cap stocks, CTD surprised everyone when it was sold to the floor price of VND57,300/share. However, at the end of the trading session, this stock also "withdrew" and decreased by 4.22%.

In the real estate group, PDR fell sharply by 3.7%, causing many other stocks to fall sharply. Of which, NVL fell more than 3%, DXG fell 2.6%, TCH fell more than 2.5%. Similarly, the securities group also recorded many stocks falling sharply such as HCM down 3.4%, VCI down 2.7%, MBS down 2.6%.

The total trading volume on HoSE alone reached 608 million shares (up 26% compared to the session at the end of last week), equivalent to a trading value of VND13,485 billion, of which negotiated transactions accounted for VND2,936 billion. The trading value on HNX and UPCoM reached VND871 billion and VND382 billion, respectively.

|

| Foreign net buying returned to become a bright spot in the gloomy trading session. |

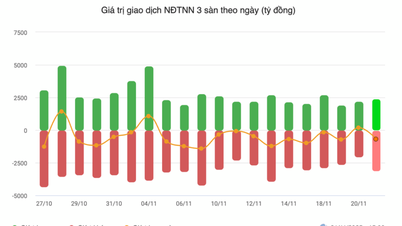

Foreign investors returned to net buying VND218 billion on HoSE. Of which, this capital flow bought the strongest net code TCB with VND70 billion. NAB - the stock that contributed the most points to the VN-Index's increase was also in the top two net buying with the disbursement value of foreign investors reaching VND54 billion. FPT was next with a net buying value of VND52 billion. In the opposite direction, HSG was the strongest net seller with a value of VND43 billion. MWG and VCI were net sold VND41 billion and VND33 billion respectively.

Source: https://baodautu.vn/giao-dich-am-dam-vn-index-tiep-tuc-giam-hon-12-diem-trong-phien-169-d225090.html

Comment (0)