Exporting goods faces many challenges when the US changes its import policy, requiring early and remote preparation from businesses and industries.

The United States is Vietnam's largest export market.

According to preliminary data from the General Department of Customs, in the first 11 months of 2024, the United States was Vietnam's largest export market with a turnover of 108.9 billion USD, up 23.9%; in the opposite direction, imports from the United States reached 13.5 billion USD, up 7.3%. With this implementation level, the total two-way turnover between Vietnam and the United States was approximately 123 billion USD, the trade balance was in favor of Vietnam with a trade surplus of 95.4 billion USD, up 26.7% over the same period last year.

|

| In the first 11 months of 2024, the total import-export turnover of goods reached 715.55 billion USD. |

The Department of European and American Markets ( Ministry of Industry and Trade ) said that Vietnam has now become the 8th largest trading partner of the United States and the fourth largest export market of the United States in the ASEAN region. In return, the United States is the second largest trading partner and the largest export market of Vietnam.

Some items in the Top 15 of Vietnam's exports with good growth turnover (over 20%) are: wooden furniture; machinery, optical equipment, medical measurement; office machines, printers; hand-held tools, hydraulic pneumatics; footwear; rubber and rubber products; plastic and plastic products; iron and steel.

On the other hand, some imported goods from the United States with high growth rates (over 20%) are: machinery, electronic equipment; animal feed, food waste; plastics and plastic products; edible fruits and nuts; meat. With the current rate of goods exchange, by 2024, Vietnam - US trade is expected to exceed 134 billion USD.

In the first 11 months of 2024, wood and wood product exports to the US market accounted for 56% of total export turnover, reaching nearly 9 billion USD, and imports from this market reached over 230 million USD. Thus, in the US market alone, the Vietnamese wood industry had a trade surplus of about 8.8 billion USD. This shows that the US is the main and most important market for the Vietnamese wood industry.

Mr. Do Xuan Lap - Chairman of the Vietnam Timber and Forest Products Association - assessed that the US market may have very big changes in the near future. These changes may be created due to the new tax policy applied by the US Government to imported goods in the future.

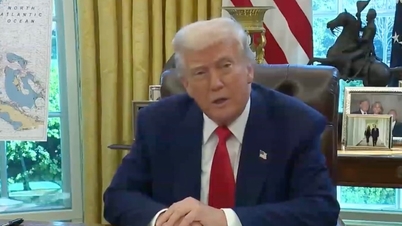

China, Mexico and Vietnam are the three countries with the largest trade surplus with the US. The US government is expected to impose a 60% tax on all imported goods from China and 15-20% on imported goods from other countries. With the upcoming change in US market policy under the administration of President Donald Trump, Vietnam in general and the wood industry in particular may benefit from the high US tax rate applied to goods from China.

However, if China’s imports and investments into Vietnam are not well controlled, Vietnam may suffer negative impacts. In addition, the US may also apply new tariffs on goods from Vietnam, including wood products. This will cause difficulties in exports and impact production.

Assessing that the potential for increased exports to the United States by the Vietnamese wood industry is still quite large, however, Mr. Huynh The Du - Lecturer, Manager of the Public Policy and Environment Program, Indiana University (USA) - said that Vietnam needs to especially avoid the case of being subject to higher taxes than the remaining countries outside of China. The wood industry needs to pay attention to ensuring issues of legal wood origin and environmental protection. Exporting enterprises need to adapt to new requirements from US policies, increase investment in technology, innovation, improve product quality and comply with international law.

“There are still some doubts about the risks when Mr. Donald Trump is re-elected as President of the United States, when this billionaire will impose high taxes on global trade in general and especially policies towards China” - Dr. Nguyen Quoc Viet - Deputy Director of the Vietnam Institute for Economic and Policy Research (VEPR) - commented and said that from the second half of 2025, if Mr. Donald Trump fulfills his promises to tighten trade and investment, to bring production back to the United States, we will see the phenomenon of foreign capital flows, especially indirect capital flows, starting to retreat to return to the United States.

Therefore, whether trade flows and investment flows can continue to spread to prevent trade risks to ASEAN countries, including Vietnam, this still needs to be calculated?

According to Dr. Nguyen Quoc Viet, Vietnam is still threatened by being targeted to avoid manufacturers, or exports related to the US-China tension. In fact, we have had a number of products targeted, so the growth potential of technology products, including some products related to new energy products such as solar panels, is not easy for us to promote strongly anymore.

And recommendations for businesses

Looking at it from a more positive perspective, according to Mr. Do Ngoc Hung - Commercial Counselor, Head of the Vietnam Trade Office in the United States, Vietnamese goods are increasingly popular in the US market due to their continuously improved quality, updated trends and competitive prices. On the other hand, changes in the supply chain as well as the wave of investment shifts have contributed to enhancing the production capacity of Vietnamese enterprises. This creates opportunities and room for Vietnamese goods to increase exports to the world in general and the US market in particular.

The United States is Vietnam's largest export market, and Vietnam is the United States' eighth largest trading partner. However, Mr. Do Ngoc said that Vietnam needs to take appropriate measures to effectively implement the Action Plan towards a harmonious and sustainable trade balance between Vietnam and the United States.

“Traditional industries such as textiles, footwear, wood and wood products, agriculture... serving consumer needs still maintain a stable growth rate, other industries also take advantage of export opportunities to the United States, while paying attention to the possibility of lawsuits that may occur” - Mr. Do Ngoc Hung noted.

Dr. Nguyen Manh Quyen - Head of the Vietnam Trade Office in Houston, Texas (USA) - recommended that the business community should pay attention to the changing policy mechanisms in the coming time, in which, grasp the advantages to improve competitiveness in the leading important markets of Vietnamese goods such as the United States.

For the Vietnamese wood industry, according to Dr. To Xuan Phuc - Policy Analyst of Forest Trends, it is necessary to promote cooperation and dialogue, along with that, there needs to be close coordination between businesses, associations and state agencies to find timely solutions to respond to the US trade protection policies. In particular, the confirmation of origin of goods (CO) is an important tool against trade fraud.

In addition, the wood industry needs to increase product value; focusing on producing high value-added products such as kitchen furniture, chairs, and other wooden furniture to meet market trends. Preparing for trade risks, businesses need to be ready to respond to anti-dumping investigations or trade defense measures from the United States, through enhancing legal capacity and improving risk management.

Source: https://congthuong.vn/xuat-khau-sang-thi-truong-hoa-ky-khuyen-nghi-tu-cac-chuyen-gia-363318.html

![[Photo] General Secretary To Lam and National Assembly Chairman Tran Thanh Man attend the 80th Anniversary of the Traditional Day of the Vietnamese Inspection Sector](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/17/1763356362984_a2-bnd-7940-3561-jpg.webp)

Comment (0)