Vinh Hoan Seafood's May revenue in key markets all grew positively, such as: Europe increased by 21%, China increased by 12%. In addition, revenue in the domestic market increased by 47% compared to the same period in 2023.

Vietnam Customs data shows that in the first half of May 2024, Vietnam's pangasius exports to markets reached 76 million USD, up 13% over the same period in 2023. As of May 15, 2024, cumulative pangasius exports reached 656 million USD, up 3% over the same period in 2023. The Chinese market continues to lead Vietnam's pangasius exports.

The 5 enterprises announced by VASEP with the largest export volume of pangasius to China in the first 4 months of this year include: Truong Giang Seafood Joint Stock Company, Nam Viet Joint Stock Company, Dai Thanh Company Limited, Vinh Hoan Joint Stock Company, and IDI Multinational Investment and Development Joint Stock Company.

In which, Vinh Hoan Corporation (VHC, HOSE) of "tra fish queen" Truong Thi Le Khanh continues to maintain its leading position in tra fish exports nationwide.

According to the May 2024 business report, Vinh Hoan Seafood's revenue reached VND 1,131 billion, up 19% over the same period last year, mainly from pangasius products (VND 598 billion). This result is thanks to strong growth in the Chinese, European, domestic and other potential markets.

In fact, many economic factors are positively impacting the seafood export industry, said Ms. Tran Thi Kim Dung, senior investment consultant at Mirae Asset Securities. The US and Western governments are continuing to put pressure on fish exports from Russia. Stopping the import of seafood products from Russia will create a large gap, which creates opportunities for Vietnamese pangasius exports.

In addition, US inflation is gradually cooling down, which may soon stimulate consumption in the US again. The end of the second quarter is often the time when US retailers stock up on inventory to serve the peak year-end shopping season, which is also the driving force for pangasius prices to continue to increase.

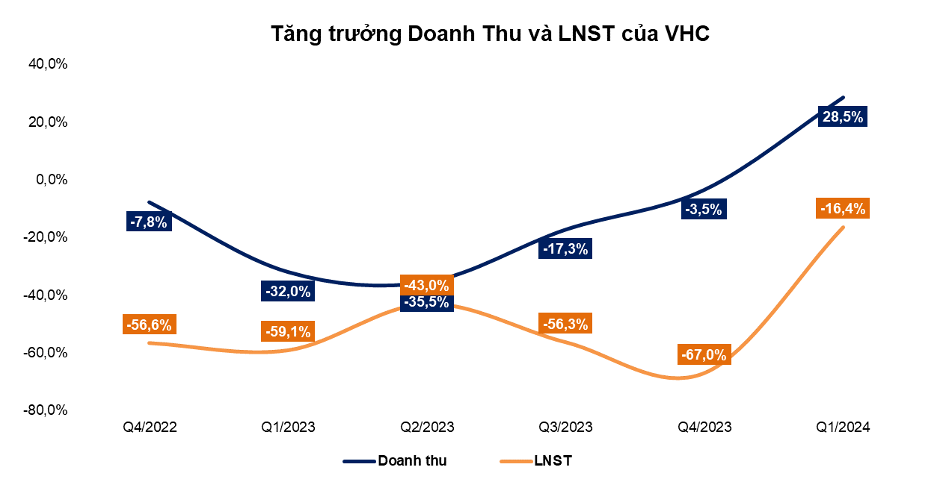

Revenue and profit growth trends at VHC over the quarters

Source: Mirae Asset Securities

With the above factors, VHC is showing many signs of recovery after an unfavorable first quarter of 2024 when after-tax profit "regressed" by 16.4%, to VND 189 billion, due to high cost of goods.

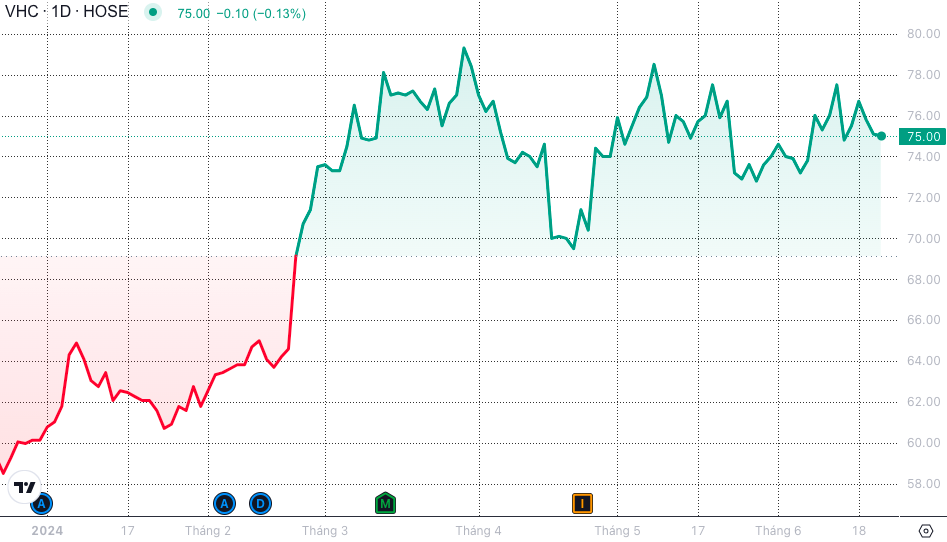

Recent developments in VHC stock (Photo: SSI iBoard)

On the floor, since the beginning of the year, VHC stock value has increased positively by 24.2%, currently trading at 75,000 VND/share.

Assessing Vinh Hoan Seafood, SSI Securities estimates that VHC will achieve net revenue of VND11,700 billion (up 16.8% year-on-year) and net profit of VND1,260 billion (up 29.5% year-on-year) this year.

Thanks to that, VHC shares are expected to reach a market price of VND 88,000/share in the next 1 year, an increase of 16% in value.

According to the plan presented at the 2024 Annual General Meeting of Shareholders, VHC will spend VND930 billion on expansion investment this year. Specifically, expanding and upgrading collagen production capacity and renovating the factory at Vinh Hoan Collagen Company, expanding warehouses and upgrading and increasing the capacity of the seafood factory, etc.

Expert Kim Dung recommended that some risks may occur, affecting the export industry in general and seafood in particular, typically a sharp increase in shipping rates, significantly affecting costs and reducing the competitiveness and profits of businesses.

Some other potential seafood enterprises that investors may be interested in: Sao Ta Joint Stock Company (FMC, HOSE), Minh Phu Joint Stock Company (MPC, UPCoM)... when benefiting from exporting shrimp to some markets such as the US, EU; reducing anti-dumping tax will help frozen shrimp products increase competitiveness compared to competitors such as Ecuador, China, India.

Source: https://phunuvietnam.vn/xuat-khau-ca-tra-tich-cuc-co-phieu-vinh-hoan-duoc-ky-vong-tang-16-20240621121720997.htm

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)