There are two ways to deal with individual business owners who have their insurance collected illegally: either withdraw the collection or pay pension benefits to eligible people, but either way is problematic.

Nationwide, there are currently 4,240 individual business owners in 54 localities paying compulsory social insurance (SI) while according to regulations they are not required to pay, according to statistics up to September 2016. Some people have paid for 20 years but are not eligible for pension and have filed a lawsuit against the social insurance agency in court.

Vietnam Social Security proposed that the competent authority handle the matter by putting household owners in the mandatory payment category, allowing the payment period to be calculated to receive benefits. This agency does not want to withdraw social insurance (return money) because "it will be very complicated due to their disagreement, affecting their benefits".

Mr. Dinh Ngoc Quy, Standing Member of the Social Committee of the National Assembly. Photo: National Assembly Media

From the perspective of the supervisory agency, Mr. Dinh Ngoc Quy, Standing Member of the National Assembly's Social Affairs Committee, said that no matter how the issue is handled, there will be problems because the law does not stipulate that individual business owners are subject to compulsory social insurance, so there is no legal basis. However, they have long-term contributions to the Social Insurance Fund, so the authorities need to quickly come up with a solution.

According to him, first of all, Vietnam Social Security needs to review and accurately report the number of business owners who were wrongly collected, classify the payment period, and the benefits they have enjoyed. 4,240 household owners is the number as of 2016, while the State Audit pointed out that in 2021, 220 cases of compulsory social insurance were incorrectly collected from business owners with more than 3.5 billion VND.

After reviewing, Vietnam Social Security needs to classify and see what the household owners' wishes are. Among the households that were wrongly collected, there are those who want to continue participating in compulsory social insurance to receive retirement and other benefits. During the process of persuading them, they may agree to switch to voluntary social insurance, but there are also those who want their money back.

Mr. Quy said that we should not approach the wrong collection by returning the original status (withdrawal), nor should we switch all household owners to the voluntary social insurance regime because from the beginning they paid at the rate for the compulsory group. "We need to solve the correct contribution-benefit principle, meaning that household owners who have paid compulsory social insurance must enjoy the full benefits of participants in this area," he said.

Regarding the source of payment, the household head contributes to the Social Insurance Fund like other groups, so taking money from here to pay for the regime even though they are not required to "is not a difficult problem". The Fund has independent accounting and calculates the balance of revenue and expenditure based on the contributions of the participating parties, Mr. Quy analyzed.

Supporting the inclusion of business households in the mandatory contribution category to enjoy pension benefits, former Deputy Minister of Labor, War Invalids and Social Affairs Pham Minh Huan argued that the mistakes of the implementing agency should not cause thousands of people who voluntarily pay compulsory social insurance, even though they are not eligible, to suffer losses.

If the National Assembly Standing Committee does not agree with the proposal, the collection must be withdrawn. But according to Mr. Huan, returning the money is also bad because the calculation of compensation for decades of contributions is very complicated, and it will cause disadvantages for household owners. Returning the money also creates inequality in pension benefits between the group of household owners who were wrongly collected and the group who voluntarily paid social insurance in the later period.

"Refunding money may make workers lose more confidence, making it harder to attract participants while the policy of Resolution 28 of the Central Committee is to expand the scope of social insurance contributions," Mr. Huan warned.

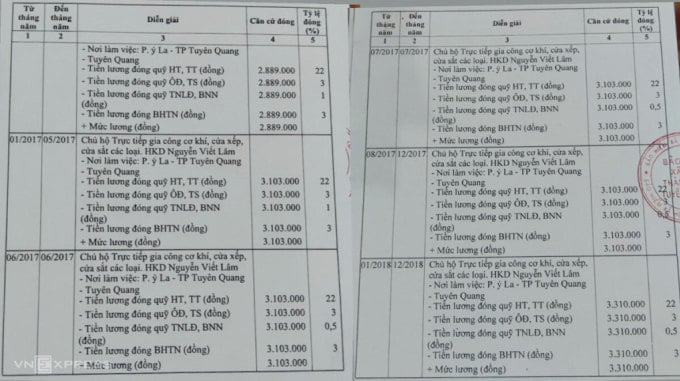

The social insurance book records the compulsory payment process in 2017-2018 of Mr. Nguyen Viet Lam, the owner of a sole proprietorship in Tuyen Quang, although since 2016, Vietnam Social Security has requested localities to stop collecting from this group. Photo: NVCC

Reviewing responsibilities, regaining trust for social insurance participants

Mr. Dinh Ngoc Quy said that it is necessary to consider the responsibility of the relevant parties when the situation of incorrect collection lasted for decades in 54 provinces and cities. Vietnam Social Security said that in 2016, it directed the local vertical sector to stop incorrect collection and report to the Ministry of Labor, War Invalids and Social Affairs. But according to the feedback from the Petition Committee, the incorrect collection lasted from January 2003 to the end of December 2021.

"The request to stop collecting from 2016 but the wrong collection continued until 2021 is a manifestation of the situation where the superiors do not listen to the subordinates . When discovering the wrong collection, Vietnam Social Security should have asked for a solution to handle it, not to let it drag on and cause many problems," Mr. Quy said, adding that the National Assembly's supervisory agency on the management of the Social Insurance Fund did not receive the report after receiving feedback from the Petition Committee.

Assessing the case of incorrect collection affecting the rights of many people, with some household owners suing in court, causing psychological impacts on participants, Mr. Quy recommended that it should be resolved promptly and thoroughly to "increase trust in the social security system, not pushing difficulties onto the people".

Sharing the same view, former Deputy Minister Huan said that it is necessary to handle this issue soon because in addition to the interests of business owners, it is also related to the trust of workers, to avoid people having a wrong perception of the state's social security policy. In the long term, the revised Law on Social Insurance should soon include the group of individual business owners in the mandatory contribution category, but it is not necessary to pay and receive at the old rate, but should design different rates for them to have the right to choose.

The State Audit's report on the management and use of the Social Insurance and Health Insurance Fund in 2021 indicated that Vietnam Social Security had illegally collected compulsory contributions from 220 business households with a total amount of VND 3.5 billion. This agency requested Vietnam Social Security to rectify the management of social insurance collection and disbursement; closely inspect and assess collectors and beneficiaries in accordance with regulations; and at the same time report to competent authorities for solutions to cases of illegal collection and disbursement of individual business households.

Son Ha - Hong Chieu

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)