Need to perfect flexible and modern institutions

Sharing at the event “International experience and the role of the banking system in the financial center” organized by Banking Times on the morning of June 16, Ms. Le Thi Thuy Van, Deputy Director of the Institute of Strategy and Economic - Financial Policy, Ministry of Finance said that currently, our development orientation is that Ho Chi Minh City will be a global international financial center and Da Nang will be an international financial center at the regional level. These two levels are different to avoid competition between the two centers within the country.

According to Ms. Van, if we want to build an international financial center that can compete with existing international financial centers in the region, we need to pay attention to the financial center ranking index (GFCI) according to 5 criteria: Business and tax environment, human resources, infrastructure, financial market development, reputation...

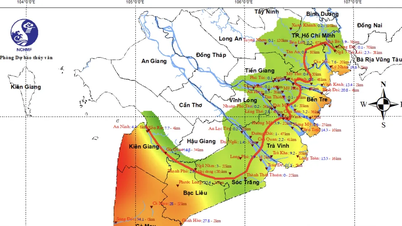

The favorable factors for building an international financial center in Vietnam are its strategic geographical location and deep economic integration. In addition, Vietnam is also actively improving its institutions, legal system, and investment environment; and its macroeconomic stability. Ho Chi Minh City also has modern financial market institutions and a dynamic economy. This city will be included in the GFCI assessment list from 2022.

Experts share about building financial center in Vietnam

However, there are also certain challenges. For example, in terms of infrastructure and institutions, socio-economic infrastructure has made positive contributions but is still lacking in synchronization, traffic is overloaded, and there is an imbalance between types of transportation.

In addition, the legal framework has not met international standards, lacking regulations on cross-border transactions and investor protection. Regional competition is also increasingly fierce as other international financial centers have strong foundations and attractive attraction policies. In addition, Vietnam has not fully liberalized finance, and has limitations in technology and cybersecurity.

Given the above reality, Ho Chi Minh City is suitable for the semi-classical model, linking trade, technology, capital market and financial services, while Da Nang is suitable for the new generation model, integrating free trade zones, green financial services, risk management and foreign exchange.

According to the representative of the Ministry of Finance, the first thing to do when wanting to build an international financial center is to perfect a flexible and modern institution. Specifically, build a transparent legal framework, in line with international practices, allowing for testing of new models such as fintech and digital platforms. At the same time, apply the sandbox model like Singapore with a fast licensing process and good investor protection. At the same time, strengthen risk monitoring according to international standards, ensuring market stability and transparency.

Along with that is developing financial and technological infrastructure; having tax exemption/reduction policies for organizations and individuals operating in international financial centers; simplifying administrative procedures, developing high-quality human resources...

Must create an environment similar to international

Sharing from international experience, Mr. Richard D. McClellan - Independent Advisor specializing in economic policy, financial sector development and investment strategy said that to become a modern and competitive financial center, it is necessary not only to establish but also to build on the common characteristics of the world's leading IFCs.

Mr. Richard D. McClellan

This includes: high capital mobility, allowing for the free repatriation of profits; access to foreign exchange and multi-currency operations; financial openness, facilitating the ownership and operations of global companies, especially FDI. Legal stability and predictability, through contract enforcement, international arbitration and compliance with common law, are key to building trust.

In addition, the adoption of global accounting standards (IFRS) and the building of a solid financial infrastructure (exchanges, clearinghouses, credit agencies) are required.

Equally important, soft infrastructure includes attracting and retaining talent through an attractive, safe lifestyle and a quality education system. This requires complementary policies, harmonization with the current, enhanced communication to international investors and a clear distinction between activities within and outside the financial center.

“Investors are familiar with the environments of international financial centers. Therefore, we must make sure that Vietnam has the closest environment to the international environment, so that when they come to Vietnam, they feel at home, not in a strange place,” said Richard D. McClellan.

Mr. Nguyen Duc Long - Director of the Department of Credit Institutions Safety, State Bank of Vietnam, said that currently, establishing a financial center in Vietnam is more difficult and different from other countries not only in terms of population size, geography... but also in terms of legal framework.

We have strict regulations to ensure macroeconomic safety. For example, regarding capital transaction regulations, capital flow liberalization is a major condition for establishing a financial center, but Vietnam has strict regulations. Opening more financial institutions and commercial banks is very strict.

Therefore, how to create a legal framework to ensure that financial centers operate effectively while still ensuring macroeconomic safety is a difficult problem.

According to him, in the international financial center, traditional banking activities will not be much but will be oriented towards new banking activities, following international practices. Along with that, the management of operational safety will also be raised...

Source ANTD.VN

Source: https://baotayninh.vn/xay-dung-trung-tam-tai-chinh-tai-viet-nam-phai-lam-sao-de-nha-dau-tu-cam-thay-nhu-o-nha--a188911.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference to promote public investment growth momentum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/7d1fac1aef9d4002a09ee8fa7e0fc5c5)

Comment (0)