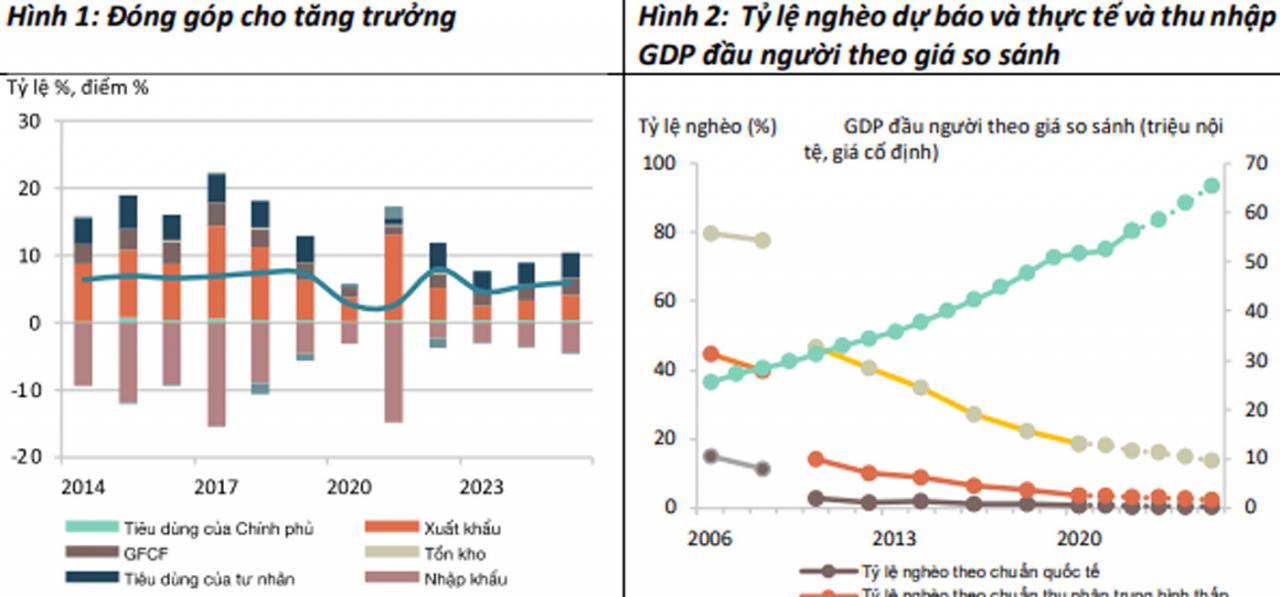

The World Bank forecasts Vietnam's economy to grow by 4.7% in 2023 and rebound to 5.4% and 6% in 2024-2025. However, the outlook is subject to a number of evolving risks.

Domestic demand is expected to remain the main driver of growth, albeit at a slower pace than last year, according to the World Bank. Average CPI inflation for the year is estimated at 3.5%, due to expected wage increases for civil servants, before easing to 3% in 2024 and 2025, assuming stable energy and commodity prices.

Vietnam's budget balance is expected to have a deficit of 0.7% of GDP in 2023 as fiscal policy remains somewhat supportive of the economy, but the Government will return to a more cautious fiscal stance in 2024, in line with the financial sector development strategy for the 2021-2030 period.

The current account is expected to continue to improve, supported by a modest recovery in exports, continued recovery in international tourist arrivals, and resilient remittances. The poverty rate (using the lower-middle-income poverty line) is forecast to decline from 3.2% in 2022 to 3% in 2023.

The above outlook is subject to a number of evolving risks.

evolving, lower-than-expected growth in developed economies and China could reduce external demand for Vietnam's exports. Further tightening of monetary policy in major and developed economies could rekindle exchange rate pressure on domestic currencies, leading to capital outflows.

Exports contribute greatly to growth. (Source: WB)

According to the WB, in the short term, fiscal policy should continue to support aggregate demand. A fully implemented investment budget, combined with steps to remove bottlenecks in public investment procedures, is a way to raise public investment to 7.1% of GDP in 2023, compared to 5.5% in 2023, thereby supporting aggregate demand.

Further monetary easing is considered appropriate, but further rate cuts will widen interest rate differentials with global markets, potentially putting pressure on the exchange rate. To mitigate rising financial risks, measures to improve banks' capital ratios and strengthen the banking supervisory framework are ways to ensure the stability and resilience of the financial sector.

According to the World Bank, in the long term, Vietnam has the ambition to become a high-income country by 2045. To achieve that goal, Vietnam needs to increase productivity by improving the fundamentals of the financial sector, addressing institutional bottlenecks in public investment to address infrastructure shortages, and creating an enabling environment for the domestic private sector to operate more effectively, in addition to addressing risks related to climate change and environmental sustainability.

Real GDP growth slowed to 3.7% in the first half of the year due to weaker external demand and weaker domestic demand. Exports fell 12% year-on-year. Consumption growth slowed to 2.7% from 6.1% in the first half of 2022 due to weaker consumer confidence and slowing real disposable income growth. Investment growth slowed to 1.1% from 3.9% in the first half of 2022 due to weaker domestic private investment, only partially offset by increased public investment. Industrial growth slowed to 1.1%.

According to the World Bank, in Vietnam, reducing policy barriers such as restrictions on foreign entry and ownership in transport, financial and business services led to a 2.9% annual increase in value added per worker in these sectors between 2008 and 2016. Removing such barriers also increased labor productivity by 3.1% in manufacturing firms using these services, with the most significant benefits for small and medium-sized private enterprises.

The combination of service reform and digitalization not only creates new opportunities but also enhances people's capacity to take advantage of these opportunities. World Bank East Asia and Pacific Chief Economist Aaditya Mattoo stressed that service reform and digitalization can create a virtuous cycle of increasing economic opportunities and human capacity, driving development in the region.

In the East Asia and Pacific region, the World Bank forecasts that growth in developing countries in the region is expected to remain high at 5% in 2023 but will ease in the second half of the year and is forecast to reach 4.5% in 2024.

China's growth in 2023 is forecast at 5.1% and in the rest of the region at 4.6%.

Comment (0)