ANTD.VN - The World Bank (WB) said that Vietnam's GDP growth in 2023 is expected to slow to 4.7%, due to weak private consumption, a sluggish real estate market, and a sharp decline in external demand.

According to the World Bank (WB), after a strong recovery in 2022, the Vietnamese economy is now facing many domestic and external obstacles. Accordingly, the decline in global trade has affected Vietnam's exports. At the same time, domestic demand is also slowing down, which has affected economic growth.

According to the World Bank, Vietnam's GDP will grow by 3.7% in the first half of 2023. Exports will decrease by 12% year-on-year, and consumption growth will slow from 6.1% in the first half of 2022 to 2.7% in the first half of 2023. This is due to weakening consumer confidence and slowing growth in real disposable income.

|

Weak external demand slows Vietnam's economic growth |

Investment growth is expected to slow from 3.9% in the first half of 2022 to 1.1% in the first half of 2023, while industrial sector growth is expected to slow to 1.1% in the first six months of 2023 from 7.7% last year.

The World Bank assessed that the slowdown in economic growth has affected the labor market situation. According to a survey in April 2023, 60% of businesses said they had to cut their workforce by at least 5%.

However, Vietnam’s economy still has some bright spots. For example, the trade balance of goods has improved as imports have declined more sharply than exports. In addition, the deficit in the trade balance of services has narrowed as international tourists have returned. In particular, foreign direct investment (FDI) and portfolio investment flows have remained stable.

The World Bank forecasts that by the end of 2023, Vietnam's GDP could grow at 4.7%, then is forecast to recover to 5.5% in 2024 and 6.0% in 2025.

However, this growth still faces many challenges, such as lower-than-expected growth in developed economies and China's possible decline in external demand for Vietnam's exports.

In addition, further tightening of monetary policy in major and developed economies may rekindle exchange rate pressure on domestic currencies, leading to capital outflows.

Domestically, rising financial risks and vulnerabilities require close monitoring and continued innovation.

The World Bank believes that in the short term, fiscal policy should continue to support aggregate demand. In addition, continued monetary easing is considered appropriate, but continued interest rate cuts will increase interest rate differentials with global markets, potentially putting pressure on exchange rates.

"To mitigate rising financial risks, measures to raise banks' capital ratios and strengthen the banking supervisory framework are ways to ensure financial sector stability and resilience," the WB recommended.

Source link

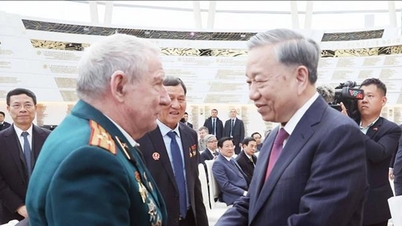

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)