In the trading session on July 4, Techcombank (TCB) shares of tycoon Ho Hung Anh continued to increase in price in the context of the stock market still under downward pressure for many months. This stock has recovered significantly after hitting bottom in mid-May.

Meanwhile, shares of Hoa Phat Group (HPG) of billionaire Tran Dinh Long returned to a downward trend.

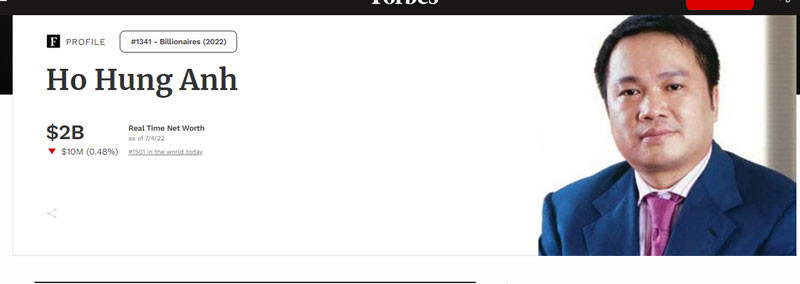

According to Forbes, as of July 4, the total assets of Mr. Ho Hung Anh, Chairman of Techcombank, reached exactly 2 billion USD. The total assets of Chairman of Hoa Phat Group, Tran Dinh Long, were 1.9 billion USD.

Mr. Ho Hung Anh's assets reached 2 billion USD on July 4.

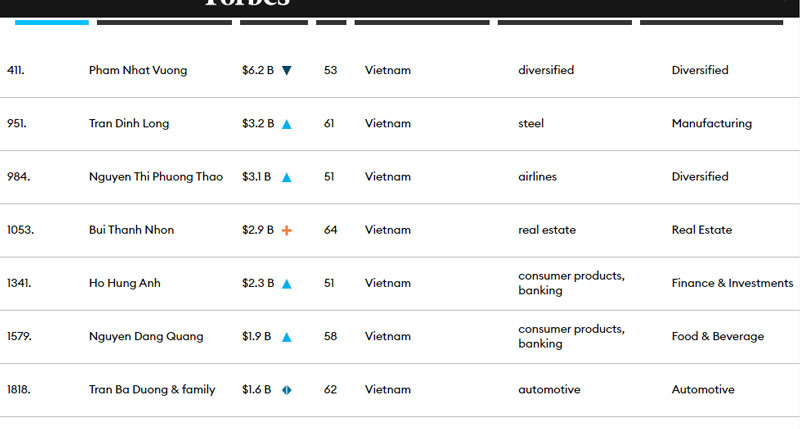

This is the first time billionaire Ho Hung Anh has surpassed billionaire Tran Dinh Long, becoming the 4th richest person in Forbes' rankings, after billionaire Pham Nhat Vuong (5.5 billion USD, as of July 4), female billionaire Nguyen Thi Phuong Thao (2.8 billion USD) and Mr. Bui Thanh Nhon (2.7 billion USD).

Mr. Nguyen Dang Quang ranked 6th with 1.7 billion USD.

Thus, Forbes' real-time rankings have changed with the fall of steel king Tran Dinh Long due to the recent sharp drop in HPG stock price, after soaring in 2021. The outlook for the steel industry is less bright.

The real-time wealth of billionaires also dropped rapidly compared to the ranking released in March.

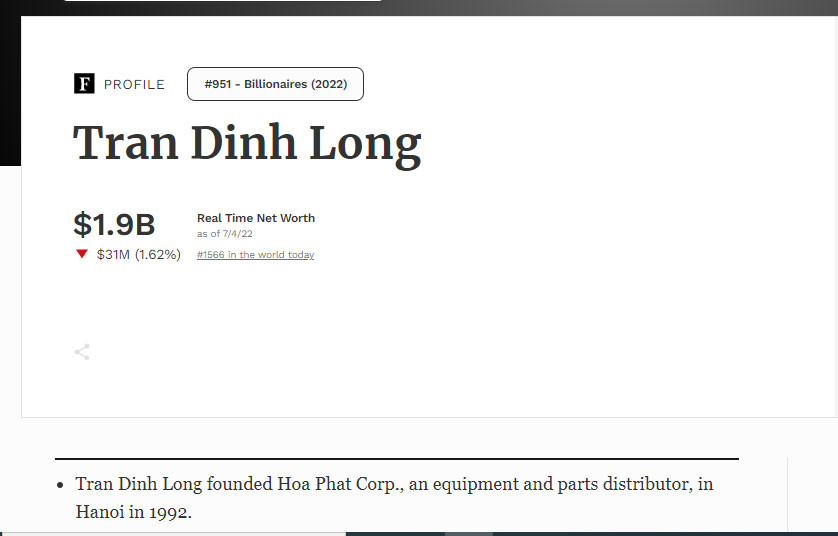

Property of Mr. Tran Dinh Long.

Specifically, billionaire Tran Dinh Long lost about 1.3 billion USD. Billionaire Pham Nhat Vuong lost 700 million USD. Billionaire Ho Hung Anh lost only 300 million USD.

The above figures are calculated by Forbes. If we consider the fluctuations in stock prices and assets converted to the number of shares held by the tycoons, Mr. Vuong lost about 2 billion USD in the first half of this year. Mr. Tran Dinh Long lost nearly 1 billion USD.

Billionaire Tran Dinh Long recorded a decrease in assets when HPG stock price fell by nearly half, from a peak of over VND43,000 (adjusted price) to the current level of VND22,000/share. HPG price fell sharply after Chairman Tran Dinh Long commented that the steel industry's outlook was not bright due to a sharp increase in input raw material prices. Meanwhile, steel prices had peaked and cooled down.

Forbes March rankings.

At the 2022 Shareholders' Meeting, Chairman Tran Dinh Long said that the results of the second, third and fourth quarters will show the business situation of the steel industry. The steel industry is in an unfavorable period. Not only is the price of coking coal increasing, logistics costs are also increasing due to the disruption of the global supply chain. All of this puts great pressure on the steel industry's profits.

After just a few months of stock price decline, Hoa Phat's total capitalization lost about 5.5 billion USD.

According to KIS Securities, Hoa Phat's gross profit margin is forecast to decrease by 4.4% from 27.4% in 2021 to 23% in 2022.

The banking industry also has a not-so-bright outlook, but profits are forecast to be positive. Yuanta Securities believes that the State Bank will loosen credit "room" in August instead of July as expected. Yuanta forecasts that the after-tax profit of parent company shareholders (net profit) of 27 listed banks in the second quarter will increase by 36% compared to the same period last year. However, compared to the previous quarter, it will decrease by 9%.

Source: https://vietnamnet.vn/vua-thep-gap-kho-dai-gia-ho-hung-anh-vuot-ty-phu-tran-dinh-long-2036459.html

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)